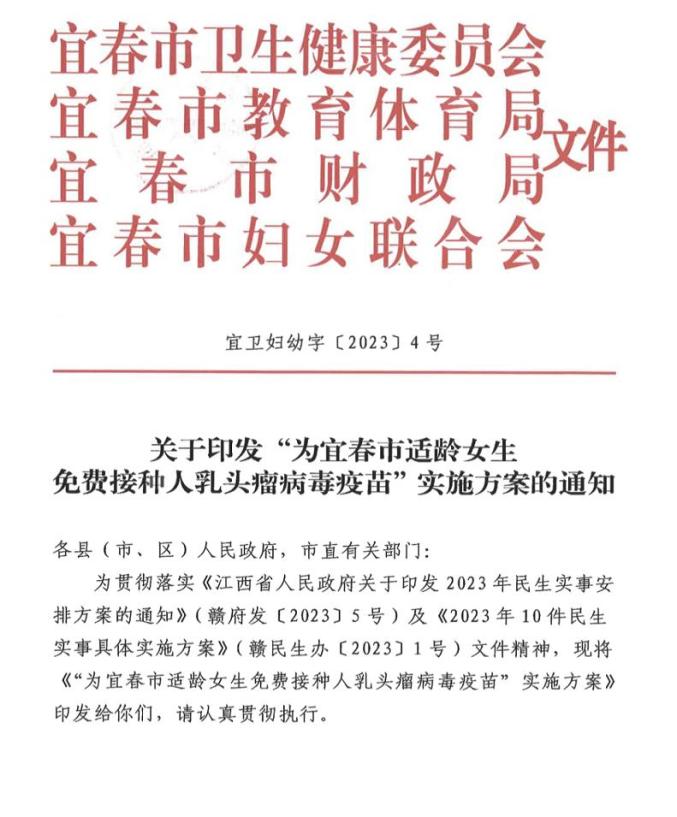

State and municipal people’s governments, provincial committees, offices, departments and bureaus:

"Yunnan Province" 14 th Five-Year Plan "for the development of traditional Chinese medicine has been agreed by the provincial people’s government and is hereby issued to you, please implement it carefully.

General Office of Yunnan Provincial People’s Government

September 2, 2022

(This piece is publicly released)

Development Plan of Traditional Chinese Medicine in Yunnan Province during the Tenth Five-Year Plan

In order to implement the decision-making arrangements of the CPC Central Committee and the State Council on the work of traditional Chinese medicine, and the strategic tasks of the provincial party committee and the provincial government on building a strong province of traditional Chinese medicine, and to clarify the overall thinking, development goals and major tasks of the development of traditional Chinese medicine in our province during the Tenth Five-Year Plan period, This plan is formulated according to Opinions of the State Council City, the Central Committee of the Communist Party of China on Promoting the Inheritance and Innovation of Traditional Chinese Medicine, Notice of General Office of the State Council on Printing and Distributing the Development Plan of Traditional Chinese Medicine in the 14th Five-Year Plan, Outline of the 14th Five-Year Plan for National Economic and Social Development in Yunnan Province and the Long-term Target in the Year 2035, Outline of Healthy Yunnan 2030, and Plan for the Development of Health Care in Yunnan Province in the 14th Five-Year Plan.

I. Planning background

During the "Thirteenth Five-Year Plan" period, the provincial party committee and the provincial government resolutely implemented the spirit of the important instructions of the Supreme Leader General Secretary on Chinese medicine work and the decision-making arrangements of the CPC Central Committee and the State Council, and made great progress in all aspects of Chinese medicine work.

Policies and measures have been continuously improved. It has successively issued the Implementation Opinions on Implementing the Strategic Plan for the Development of Traditional Chinese Medicine (2016-2030), the Implementation Opinions on Promoting the Inheritance, Innovation and Development of Traditional Chinese Medicine, and Several Measures on Accelerating the Development of Traditional Chinese Medicine, and actively promoted the revision of the Regulations on Traditional Chinese Medicine in Yunnan Province.

The service system is improving day by day. The new campus of the Provincial Hospital of Traditional Chinese Medicine was completed and put into use, the Second Affiliated Hospital of Yunnan University of Traditional Chinese Medicine was put into operation, and the state and city hospitals of traditional Chinese medicine achieved full coverage. Thirteen new county-level hospitals of traditional Chinese medicine were built, and the number of hospitals of traditional Chinese medicine in the province increased from 157 to 193, and two new hospitals of first-class Chinese medicine were added. The number of beds in TCM medical institutions increased from 25,640 to 37,752, and the number of beds in public TCM hospitals per thousand population increased from 0.46 to 0.64. The number of non-TCM medical institutions with TCM clinical departments increased from 555 to 1021, and the setting rates of "TCM clinics" in township hospitals and community health service centers reached 99.35% and 81.4% respectively.

The service capacity has been greatly improved. 19 new national and provincial regional TCM (specialist) diagnosis and treatment centers, 10 key clinical disciplines, and 133 provincial key TCM specialties. The coverage of Chinese medicine services in township hospitals, community health service centers, village clinics and community health service stations reached 99.6%, 99.4%, 89.2% and 96.6% respectively, and the number of primary medical institutions providing Chinese medicine services increased from 7,350 to 12,908. The annual number of medical consultations increased from 22.79 million to 31.47 million, and the annual number of discharged patients increased from 933,000 to 1.548 million. Chinese medicine has treated nearly 16,000 cases of AIDS patients and virus-infected people. Chinese medicine has made important contributions to the prevention and treatment of epidemic situation in COVID-19.

The quality of personnel training has improved significantly. Yunnan College of Traditional Chinese Medicine was successfully renamed as Yunnan University of Traditional Chinese Medicine, and obtained the first-class doctoral degree authorization point of traditional Chinese medicine. The talent training system of apprenticeship education and post-graduation education, which is connected with college education, has been basically completed, the incentive mechanism for talent training has been accelerated, and the measures to support the growth of Chinese medicine talents have been continuously improved. One person was selected as a "master of Chinese medicine", two people were selected as "national famous Chinese medicine practitioners", two people won the "National Outstanding Contribution Award of Chinese medicine", and 177 famous Chinese medicine practitioners and grassroots Chinese medicine practitioners in Yunnan Province were selected. More than 1,000 backbone talents with Chinese medicine characteristics have been trained, and nearly 10,000 qualified doctors have been trained in a standardized way, with more than 20% of grassroots Chinese medicine personnel. The number of practicing (assistant) doctors in Chinese medicine per thousand population increased from 0.2 to 0.4.

New achievements have been made in scientific and technological innovation. Promote the construction of clinical research bases of traditional Chinese medicine, and build 4 scientific research laboratories and 3 key research laboratories of traditional Chinese medicine. The province’s traditional Chinese medicine system has won more than 40 provincial and ministerial research projects and 11 provincial and ministerial research awards. More than 100 Chinese medicine (ethnic medicine) documents have been compiled and published, and more than 100 characteristic diagnosis and treatment technologies have been excavated.

Cultural construction is accelerating. Continue to carry out the popularization of popular science culture of "Chinese medicine in China" and the large-scale free clinic activities of "Chinese medicine serving people’s health", continuously improve the citizens’ health and cultural literacy of Chinese medicine, and continuously expand the cultural influence of Chinese medicine. Construction of "China-Myanmar Chinese Medicine Center", provincial Chinese medicine hospital was selected as the national Chinese medicine service export base. Five traditional medicine projects are listed in the list of representative projects of national intangible cultural heritage.

Multi-format integration development. The planting area of Chinese herbal medicines ranks first in the country, and the comprehensive output value of Chinese herbal medicine industry exceeds 100 billion yuan. Completed the fourth national survey of Chinese medicine resources, supported the construction of two seed and seedling breeding bases of Chinese medicine, identified 103 "designated pharmaceutical parks", and built a healthy tourism base of Chinese medicine represented by Kunming Xinglin Grand View Garden and Tengchong "Medicine Palace".

With the constant change of people’s health concept and profound changes of healthy lifestyle, Chinese medicine has many advantages and conditions in the construction of healthy Yunnan. Traditional Chinese medicine (TCM) has played an active and unique role in the prevention and control of epidemic situation in COVID-19, and its role in health care, old-age care, rehabilitation and health care has been increasingly recognized by the broad masses of the people. However, the problem of unbalanced development of traditional Chinese medicine in our province is still outstanding, the service system still needs to be further improved, the infrastructure construction of medical institutions is generally lagging behind, the service ability and level of traditional Chinese medicine are generally low, the total amount of talents is insufficient and the high-level talents are scarce, the synergy between Chinese and Western medicine is insufficient, and the ability to participate in public health emergencies is insufficient. The total scale and quality of the traditional Chinese medicine industry are small, and the governance system that follows the laws of traditional Chinese medicine needs to be improved urgently. It is urgent to speed up the filling of shortcomings, change the development mode, and accelerate the innovation and development of traditional Chinese medicine.

Second, the overall requirements

(A) the guiding ideology

Guided by the Supreme Leader’s Socialism with Chinese characteristics Thought in the New Era, fully implement the spirit of the 19th National Congress of the Communist Party of China and the previous plenary sessions of the 19th National Congress, thoroughly implement the important exposition of the Supreme Leader’s General Secretary on Chinese medicine work and inspect the spirit of Yunnan’s important speech, closely focus on the major decision-making arrangements of the CPC Central Committee and the State Council on accelerating the development of Chinese medicine and the work requirements of the provincial party committee and government, base on the new development stage, implement the new development concept, serve and integrate into the new development pattern, and promote high-quality development; Adhere to the people-centered, pay equal attention to Chinese and Western medicine, inherit the essence, keep the integrity and innovate, focus on improving the development level of Chinese medicine, focus on improving the management system and policy mechanism of Chinese medicine, and aim at improving and safeguarding people’s health, further expand the field of Chinese medicine services, promote the coordination of Chinese and Western medicine, and promote the revitalization and development of Chinese medicine as a whole, making new contributions to the construction of healthy Yunnan and ensuring people’s health.

(2) Basic principles

Adhere to the overall leadership of the party. Adhere to the Party’s health and wellness policy in the new era, improve the system and mechanism for the development of Chinese medicine under the leadership of the Party, promote the modernization of the governance system and governance capacity of Chinese medicine, and provide a fundamental political guarantee for the high-quality development of Chinese medicine.

Adhere to the people as the center. Adhere to the development of Chinese medicine for the people, and the achievements of Chinese medicine development will benefit the people. With the goal of safeguarding people’s health and enjoying Chinese medicine health services for everyone, we will provide people with multi-level, diversified and high-quality Chinese medicine health services.

Adhere to the law of development. Follow the characteristics and development law of traditional Chinese medicine, follow the original thinking of syndrome differentiation and treatment, inherit the essence, be upright and innovative, combine the original thinking of traditional Chinese medicine with modern science and technology, deeply explore the essence of traditional Chinese medicine, and promote the creative transformation and innovative development of traditional Chinese medicine.

Insist on deepening reform and innovation. Identify the key links that restrict the development of Chinese medicine, further reform and improve the development system and mechanism of Chinese medicine around the goal of high-quality development, refine and improve the development measures of Chinese medicine, and promote the coordinated development of the "six-in-one" of medical care, health care, education, scientific research, industry and culture of Chinese medicine, and continuously improve the development level of Chinese medicine.

Adhere to overall planning and coordination. Coordinate the coordinated development of Chinese and western medicine with the concept of great health, adhere to equal emphasis on Chinese and western medicine, enhance the ability of integrating Chinese and western medicine, and promote complementary advantages. Take all aspects of the development of traditional Chinese medicine into consideration, and constantly enhance the integrity and systematicness of the development of traditional Chinese medicine.

Adhere to government leadership. Strengthen the responsibilities of the government in the planning, policy, investment and supervision of traditional Chinese medicine, and actively create a good policy environment and development conditions for the inheritance and innovation of traditional Chinese medicine. Actively play the role of the market, encourage and mobilize social forces to support and promote the development of Chinese medicine.

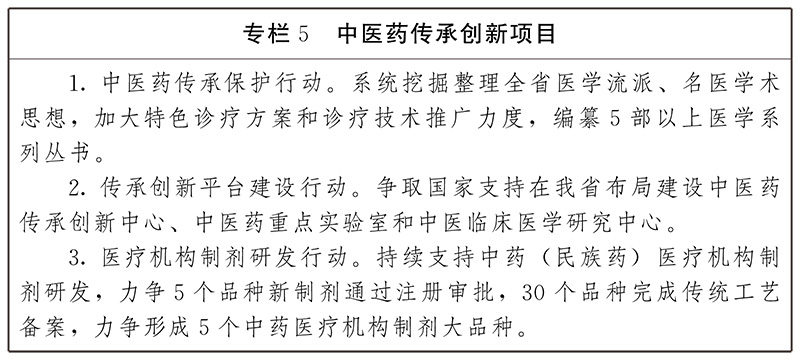

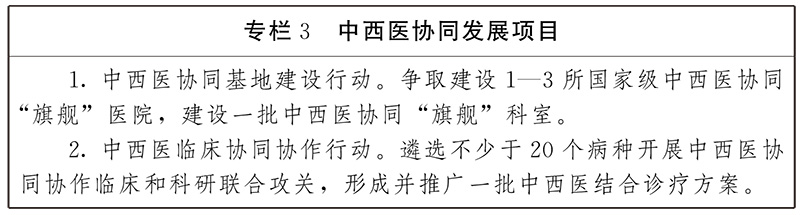

(3) Development goals

By 2025, the system and mechanism for the high-quality development of Chinese medicine will be further improved, the policies and systems for the development of Chinese medicine will be further improved, the service capacity of Chinese medicine will be significantly improved, and the development of Chinese medicine industry will achieve positive results, and the important supporting role of Chinese medicine in the construction of healthy Yunnan will be further highlighted.

-The Chinese medicine service system has been improved. Basically, a Chinese medicine service system with provincial Chinese medicine medical institutions as the leader, Chinese medicine departments of state, city and county Chinese medicine hospitals and other medical institutions as the backbone, grass-roots medical and health institutions as the foundation, and social Chinese medicine as the supplement, integrating preventive health care, disease treatment and rehabilitation, will be established.

-the service capacity of Chinese medicine has been significantly improved. Promote the promotion of Chinese medicine medical institutions to meet the standards and expand the quality medical resources of Chinese medicine. Deeply implement the "three strategies" of traditional Chinese medicine, and cultivate "famous doctors, famous subjects and famous medicines" with certain influence. We will promote the implementation of the health promotion project for the prevention of diseases in traditional Chinese medicine and the improvement project for the rehabilitation service capacity of traditional Chinese medicine, increase the cooperation between Chinese and Western medicine, improve the treatment level of major diseases with the combination of Chinese and Western medicine, and enhance the public health emergency response capacity of traditional Chinese medicine.

-continuous optimization of the contingent of Chinese medicine talents. Implement the national talent training project with Chinese medicine characteristics, and establish and improve the talent training system at the provincial, prefecture and county levels. Reform the training mode of Chinese medicine talents, increase the training of Chinese medicine talents, further optimize the structure of Chinese medicine talents, continuously improve the quality of grassroots Chinese medicine talents, and enrich the total number of Chinese medicine talents. Strengthen the cultivation of ethnic medicine talents and give full play to their role.

-the scientific research level of traditional Chinese medicine has been significantly improved. Further promote the research and inheritance of Yunnan local characteristic TCM academic schools, strengthen the protection and excavation of ethnic medicine ancient books, and form and popularize a number of local schools’ academic ideas, diagnosis and treatment experience and characteristic technologies. We will promote the establishment of a scientific and technological innovation system that combines the use of Chinese medicine in Industry-University-Research, promote breakthroughs in Chinese medicine theory and diagnosis and treatment technology, and promote the transformation of scientific research results of Chinese medicine.

-Integrated development of Chinese medicine industry. Strengthen the protection and utilization of Chinese herbal medicine resources and promote the standardized cultivation of authentic Chinese herbal medicines. Develop Chinese medicine health service industry, improve the supply level of Chinese medicine health service, and promote the integration and development of Chinese medicine multi-formats.

-Chinese medicine culture has been further developed. The popularization of Chinese medicine culture and health education have been carried out in depth, and the level of citizens’ Chinese medicine health culture literacy has been further improved. High-quality Chinese medicine has been integrated into the "Belt and Road" construction, foreign exchanges and cooperation of Chinese medicine have been continuously expanded, and the influence of Yunnan Chinese medicine has been further expanded.

![ZBF78[ internal ]-9.jpg](http://www.4000082948.cn/wp-content/uploads/2023/12/PwR92NAi.jpg)

III. Main tasks

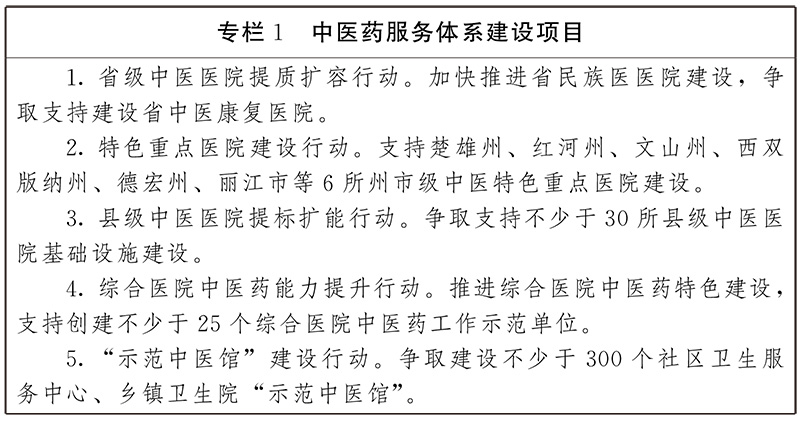

(A) to speed up the improvement of Chinese medicine service system.

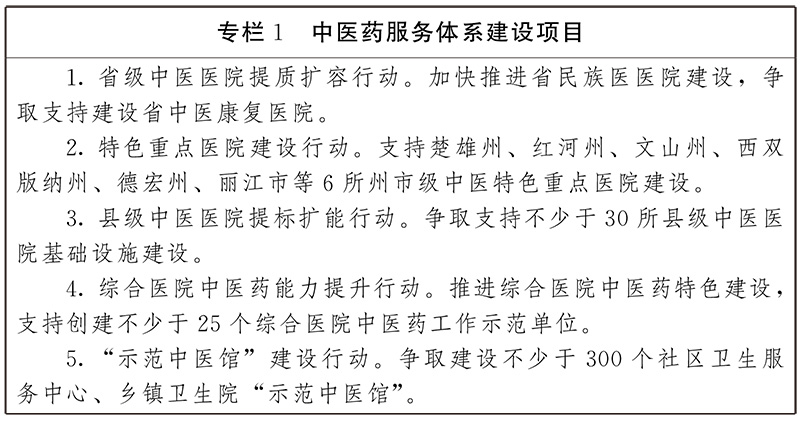

1. Be a strong leader. Promote the upgrading and expansion of provincial Chinese medicine hospitals, support provincial Chinese medicine hospitals to build high-level Chinese medicine hospitals and Chinese medicine medical care centers that radiate South Asia and Southeast Asia, build provincial ethnic medicine hospitals based on provincial Chinese medicine hospitals, and strengthen the leading and exemplary role of provincial Chinese medicine medical groups. Support the Second Affiliated Hospital of Yunnan University of Traditional Chinese Medicine to build a provincial rehabilitation hospital of traditional Chinese medicine, and actively create a third-class first-class hospital of integrated traditional Chinese and western medicine.

2. Be a big backbone. Strengthen the construction of state, city and county-level Chinese medicine hospitals, promote the construction of key hospitals with Chinese medicine characteristics, promote the implementation of a number of county-level Chinese medicine hospitals to raise standards and expand capacity, fill in the shortcomings of infrastructure construction of Chinese medicine medical institutions, and improve the conditions for Chinese medicine medical institutions to run medical services. Support qualified counties, cities and districts to build a number of county-run Chinese medicine medical institutions. Support qualified Chinese medicine hospitals to take the lead in setting up medical complexes and county medical communities, and support the construction of Chinese medicine specialist alliances. Support medical institutions at all levels to build a famous yiguang and a Chinese Medicine Hall.

3. Tamp the base. Implement the "Fourteenth Five-Year Plan" action plan of the grass-roots Chinese medicine service capacity improvement project. Promote the full coverage of community health service centers and Chinese medicine clinics in township hospitals, support 15% of community health service centers and Chinese medicine clinics in township hospitals to carry out service connotation construction, and support 10% of community health service stations and village clinics to build "Chinese medicine pavilions". Encourage qualified Chinese medicine clinics to form a team of family doctors to carry out contract services. 100% of community health service centers and township hospitals can standardize 6 categories and more than 10 appropriate technologies of Chinese medicine, and 100% of community health service stations and more than 80% of village clinics can standardize 4 categories and more than 6 appropriate technologies of Chinese medicine.

4. Improve others. Strengthen the construction of clinical departments of traditional Chinese medicine and Chinese pharmacy in general hospitals, specialized hospitals and maternal and child health hospitals, support the establishment of gynecology and pediatrics of traditional Chinese medicine in maternal and child health hospitals, and organize the establishment of demonstration units of traditional Chinese medicine work in general hospitals. Support social forces to set up Chinese medicine medical institutions, and encourage qualified Chinese medicine professionals and technicians, especially famous old Chinese medicine practitioners, to set up Chinese medicine clinics. By 2025, more than 95% of public general hospitals will set up clinical departments of traditional Chinese medicine and meet the Basic Standards for Clinical Departments of Traditional Chinese Medicine in General Hospitals, and the proportion of third-level and second-level maternal and child health hospitals setting up clinical departments of traditional Chinese medicine will reach 80% and 70% respectively.

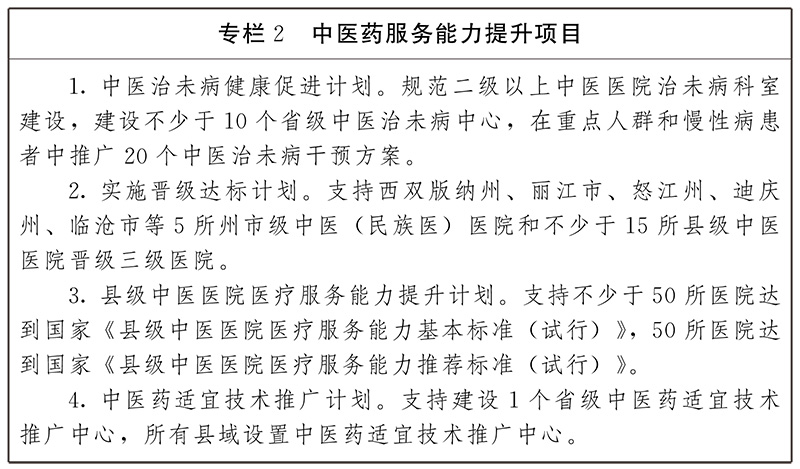

(2) Focus on improving the service capacity of Chinese medicine.

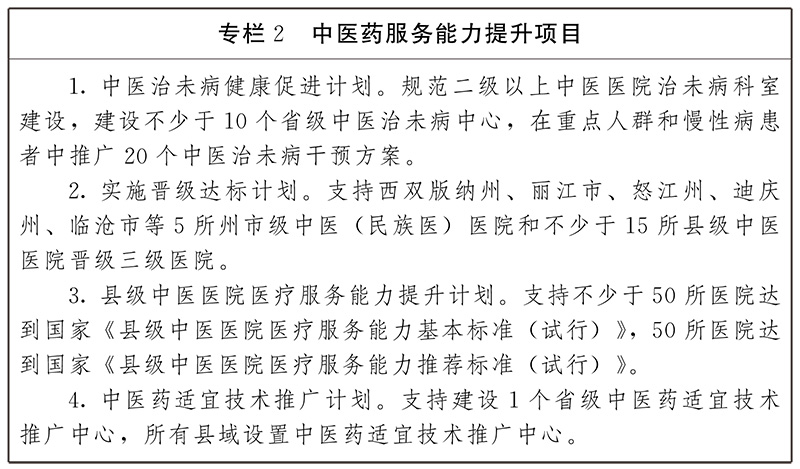

1. Give full play to the unique role of Chinese medicine in health services.

Strengthen the ability of disease prevention. We will carry out special actions to promote the health of traditional Chinese medicine, set up preventive departments in traditional Chinese medicine hospitals and qualified general hospitals, specialized hospitals and maternal and child health care centers, standardize the preventive services of traditional Chinese medicine such as health consultation and evaluation, intervention and conditioning, and follow-up management, and popularize the concepts and methods of preventive treatment of traditional Chinese medicine. Continue to strengthen the prevention and treatment of cancer with integrated traditional Chinese and western medicine, and explore the construction of a cancer prevention and treatment network with traditional Chinese medicine. In the national basic public health service projects, we will enrich the content of Chinese medicine prevention and treatment, encourage family doctors to provide Chinese medicine contract services, continue to carry out Chinese medicine health management for key groups such as children aged 0-36 months and elderly people over 65 years old, and gradually improve the coverage rate. We will carry out pilot projects for the prevention and treatment of myopia, scoliosis and obesity in children and adolescents, and promote the application of appropriate technologies of Chinese medicine in children’s health care and women’s postpartum rehabilitation.

Enhance the ability of disease diagnosis and treatment. Promote the promotion of Chinese medicine hospitals to meet the standards. More than 80% of state-level Chinese medicine hospitals meet the standards of third-class first-class Chinese medicine hospitals, more than 90% of county-level Chinese medicine hospitals meet the standards of second-class first-class Chinese medicine hospitals, and no less than 15 county-level Chinese medicine hospitals meet the standards of third-class Chinese medicine hospitals. More than 90% of the county-level Chinese medicine hospitals have reached the national basic standards and more than 50% have reached the recommended standards. We will implement the project of cultivating the characteristics and advantages of traditional Chinese medicine, and strengthen the specialties of traditional Chinese medicine such as bone injury, anorectal, pediatrics, skin, gynecology, acupuncture, massage, tumor, cardiovascular and cerebrovascular diseases, lung diseases, spleen and stomach diseases, nephropathy and peripheral vascular diseases. Strengthen the training of TCM knowledge and skills of nursing staff, and support the pilot project of TCM nursing outpatient service. By 2025, five provincial-level clinical medical centers of traditional Chinese medicine and no less than 30 sub-centers of cities and prefectures will be built, 20 provincial-level clinical key disciplines of traditional Chinese medicine and no less than 300 specialties of traditional Chinese medicine will be supported, and no less than 40 diagnosis and treatment schemes for dominant diseases of traditional Chinese medicine will be promoted.

Strengthen the characteristic rehabilitation ability. The rehabilitation (medicine) department has been strengthened in Chinese medicine hospitals above the second level. All rehabilitation hospitals have traditional rehabilitation treatment rooms, and other medical institutions providing rehabilitation services are generally able to provide Chinese medicine services. Explore the rehabilitation service model that is conducive to giving full play to the advantages of traditional Chinese medicine, promote the integration of traditional Chinese medicine, traditional Chinese sports and modern rehabilitation technology, develop rehabilitation medicine with Chinese characteristics, and promote the research and development of rehabilitation instruments for traditional Chinese medicine. For cardiovascular and cerebrovascular diseases, diabetes, pneumoconiosis, cerebral palsy and other chronic diseases and disabilities, we will formulate and promote TCM rehabilitation programs to promote TCM rehabilitation technology into communities, families and institutions. By 2025, no less than 75% of the second-level Chinese medicine hospitals and 85% of the third-level Chinese medicine hospitals will set up rehabilitation departments, and no less than four provincial-level Chinese medicine rehabilitation demonstration bases will be built.

2. Improve the public health emergency capacity of traditional Chinese medicine.

Establish and improve the working mechanism of integrating Chinese medicine into infectious disease prevention and public health emergency response. Accelerate the establishment of a clinical treatment system of infectious diseases in traditional Chinese medicine, and accelerate the construction of a national base for the prevention and treatment of diseases in traditional Chinese medicine and emergency medical rescue based on the provincial hospital of traditional Chinese medicine. Relying on institutions of higher learning and enterprises to establish a basic research and industrial innovation platform for the prevention and treatment of epidemics in traditional Chinese medicine. Promote the establishment of fever clinics in tertiary public Chinese medicine hospitals and qualified secondary Chinese medicine hospitals, and strengthen the construction of weak departments such as infectious diseases, critical care medicine (emergency department) and pulmonary diseases, and convertible infectious diseases and intensive care units in Chinese medicine hospitals.

We will build a scientific research support platform for Chinese medicine to deal with public health emergencies, strengthen the research on the treatment of major infectious diseases with Chinese medicine, and increase the research and development of new drugs and preparations for medical institutions to prevent and treat major infectious diseases with Chinese medicine. Strengthen the construction of experts in emergency treatment of traditional Chinese medicine, formulate and improve a number of TCM prevention and treatment plans for major infectious diseases, and strengthen the reserve of emergency materials, medicines, equipment, facilities, technology and human resources of traditional Chinese medicine. Encourage exploring the establishment of Chinese medicine departments in disease prevention and control institutions, equipped with a team of Chinese medicine experts.

3. Develop minority medicine.

Strengthen the construction of key specialties of Dai, Tibetan, Yi and other ethnic medicine, and build no less than 10 specialties of ethnic medicine. Formulate the diagnosis and treatment plan for dominant diseases of Dai, Tibetan, Yi and other ethnic medicine, and carry out clinical efficacy evaluation and drug use characteristics research. Strengthen the rescue, collection, collation and research of ancient documents of ethnic and folk Chinese medicine, classic prescriptions, oral instruction and other medical materials, and screen and popularize a number of characteristic diagnosis and treatment technologies of ethnic medicine. Compile the catalogue of Yunnan minority medical classics, techniques and prescriptions, screen and form a batch of single prescriptions for ethnic medicine and popularize them.

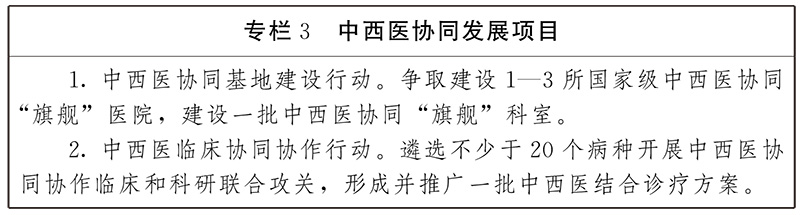

4. Promote the coordinated development of Chinese and Western medicine.

Improve the cooperative mechanism of Chinese and western medicine. Support the construction of provincial integrated traditional Chinese and western medicine hospitals and further enhance their service capabilities. Promote the "mechanism, team, measures and effective" medical model of integrated traditional Chinese and western medicine in general hospitals, promote general hospitals, specialist hospitals and maternal and child health centers to standardize the establishment of a multidisciplinary consultation system of integrated traditional Chinese and western medicine, and formulate and implement the "appropriate Chinese medicine is suitable for Chinese medicine, and appropriate western medicine is suitable for western medicine" diagnosis and treatment plan. Incorporate indicators such as the proportion of TCM diagnosis and treatment into the grade evaluation and performance appraisal of medical institutions such as general hospitals, specialist hospitals and maternal and child health hospitals.

Enhance the cooperative ability of Chinese and western medicine. Strive for state support, relying on comprehensive hospitals, specialized hospitals, infectious diseases hospitals, maternal and child health care hospitals and integrated traditional Chinese and western medicine hospitals with strong comprehensive strength to build a "flagship" hospital and "flagship" department for the coordination of traditional Chinese and western medicine. Establish a multidisciplinary team of Chinese and Western medicine cooperation and a clinical research platform of Chinese and Western medicine to improve the ability and level of Chinese and Western medicine collaborative medical services. Focusing on major and difficult diseases such as tumor, cardiovascular and cerebrovascular diseases, diabetes, AIDS and senile dementia, as well as antibiotic resistance and emerging major infectious diseases, we have carried out joint research of Chinese and Western medicine and formed a number of treatment programs with obvious curative effects.

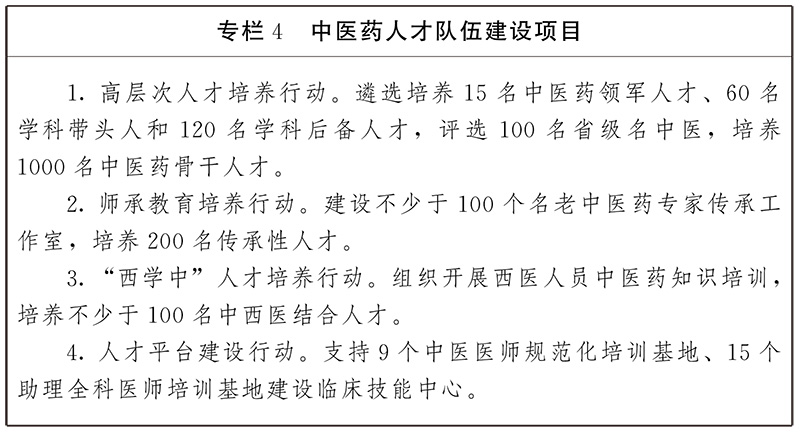

(3) Continue to lay a solid foundation for Chinese medicine talents.

1. Strengthen college education. Reform the education of TCM colleges and universities, strengthen the construction of TCM disciplines and specialties, and strengthen the training of TCM thinking and clinical skills. Adjust and optimize the professional curriculum, establish the system of early follow-up with teachers and early clinical learning, and make the teacher-follow education run through the whole process of clinical practice teaching. Strengthen the cooperation between doctors and teachers, and strengthen the clinical teaching function of traditional Chinese medicine in affiliated hospitals of colleges and universities. The course of traditional Chinese medicine will be included in the compulsory course of clinical medicine, so as to improve the knowledge and skills of clinical physicians. Support the exploration and development of the nine-year Chinese medicine talent training model. Support Yunnan University of Traditional Chinese Medicine to apply for the degree authorization point of Chinese medicine related disciplines. Strive to build 4 national and 10 provincial first-class undergraduate majors in traditional Chinese medicine and 2 national and 5 provincial demonstration centers for clinical teaching and training of traditional Chinese medicine. We will build a number of standardized training bases for Chinese medicine practitioners and assistant general practitioners. Students majoring in clinical medicine who are studying for a degree in traditional Chinese medicine can participate in the qualification examination of doctors of integrated traditional Chinese and western medicine and standardized training of Chinese medicine residents according to state regulations. Support and promote the compilation of national planning textbooks for Dai medicine and Yi medicine.

2. Cultivate characteristic talents. Organize the implementation of special training programs for innovative talents of traditional Chinese medicine, earnestly grasp the training programs for Chinese medicine talents such as Qihuang scholars, young Qihuang scholars, national excellent clinical talents of traditional Chinese medicine, and nursing backbones of traditional Chinese medicine, and increase the training of provincial-level high-level talents of traditional Chinese medicine and clinical backbones of traditional Chinese medicine. Carry out the activities of "reading classics, understanding classics and using classics" to improve the ability and level of clinical classic application of Chinese medicine doctors. Vigorously promote vocational education and skills training of traditional Chinese medicine, and accelerate the training of technical and skilled personnel such as Chinese herbal medicine planting, Chinese herbal medicine processing and Chinese herbal medicine health service. Strengthen the construction of innovative team of Chinese medicine talents and support the development of interdisciplinary integration.

3. Promote mentoring education. Establish a multi-level education system for traditional Chinese medicine teachers at the provincial, city and county levels, vigorously carry out the inheritance of academic experience of famous and old Chinese medicine experts, establish a number of famous and old Chinese medicine experts’ inheritance studios based on Chinese medicine masters, national famous Chinese medicine practitioners and provincial famous Chinese medicine practitioners, and support the construction of grassroots famous and old Chinese medicine experts’ inheritance studios. Support Chinese medicine hospitals to set up positions of Chinese medicine (specialty) doctors, and promote the inheritance and development of national and folk characteristic technologies.

4. Promote the cultivation of "Western learning" talents. Establish and improve the training and assessment system for western medicine personnel to learn Chinese medicine knowledge. Implement the "western learning" talent training project, build a high-level talent team of integrated traditional Chinese and western medicine, and enhance the clinical treatment ability of integrated traditional Chinese and western medicine for major infectious diseases and major difficult diseases. Professionals of integrated traditional Chinese and western medicine are allowed to participate in standardized training of clinical general practitioners.

5. Strengthen the training of Chinese medicine talents at the grassroots level. Strengthen the construction of teachers with appropriate technical training and the training of Chinese medicine clinical technical backbone in primary medical institutions and free medical students majoring in Chinese medicine in rural areas, and continue to do a good job in standardized training, job transfer training and assistant general practitioner training for general practitioners of Chinese medicine. Vigorously promote the "1155" training experience of appropriate technology of traditional Chinese medicine, that is, rural medical personnel are familiar with not less than 100 Chinese medicine soup songs (prescriptions), familiar with the efficacy of not less than 100 kinds of Chinese medicine pieces, can identify not less than 50 local common Chinese herbal medicines, and master and use not less than 5 appropriate technologies. Train not less than 10000 rural doctors.

(4) Continuously promote the inheritance and innovation of traditional Chinese medicine.

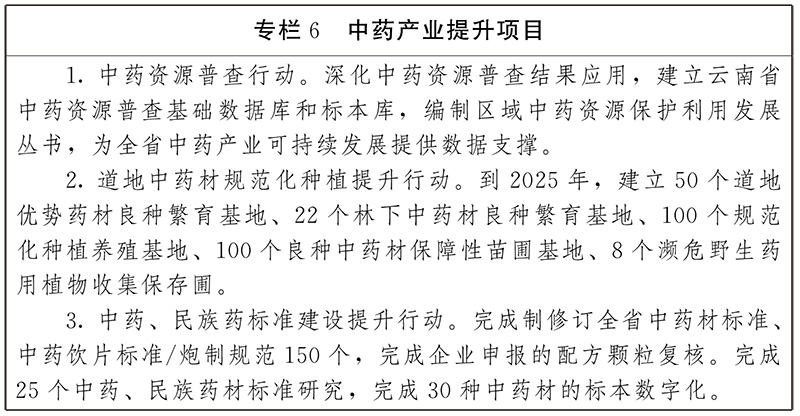

1. Strengthen the inheritance and protection of traditional Chinese medicine. Strengthen the rescue, collection, collation, research, popularization and application of medical materials such as ancient Chinese medicine documents, classic prescriptions and oral instruction. Strengthen the cultural popularization of academic schools of traditional Chinese medicine, systematically excavate and sort out the academic ideas, diagnosis and treatment experience and characteristic technologies of local schools, and promote the formation of a medical system with Yunnan characteristics in southern Yunnan. Promote more Chinese medicine projects to be included in the list of representative projects of intangible cultural heritage.

2. Strengthen tackling key problems in key areas. Increase the support for scientific and technological innovation of traditional Chinese medicine in the provincial science and technology plan. Deepen the research on the medical theory of southern Yunnan, the theory of Yunnan’s unique ethnic medicine and the mechanism of Yunnan’s authentic Chinese herbal medicines, and carry out the diagnosis and treatment law and clinical research on the prevention and treatment of major, refractory and emerging local infectious diseases with traditional Chinese medicine. Support medical institutions to carry out research on famous and experienced prescriptions of famous and old Chinese medicine experts, and promote the transformation of preparations to medical institutions. Strengthen the capacity building of evidence-based medicine of traditional Chinese medicine, build an evidence system that combines traditional Chinese medicine theory, human experience and clinical trials, and study and explain the mechanism of traditional Chinese medicine.

3. Build a platform for inheritance and innovation. Strive for state support in the layout and construction of traditional Chinese medicine inheritance and innovation center, key laboratory of traditional Chinese medicine and clinical research center of traditional Chinese medicine in our province. Promote the provincial institute of traditional Chinese medicine to enhance the ability of scientific research and innovation, strengthen the clinical technology research and drug research and development of traditional Chinese medicine, and strive to make breakthroughs in research and development, production and popularization. Support Chinese medical institutions to strengthen cooperation and share resources with enterprises, scientific research institutions and institutions of higher learning.

4. Promote the transformation of scientific research achievements. Relying on high-level research institutions, institutions of higher learning, medical institutions and Chinese medicine innovation enterprises, we will intensify the research on Chinese medicine and the transformation of scientific and technological achievements, and support the research and development of advanced equipment and new Chinese medicine. Carry out clinical research and basic research on dominant diseases of traditional Chinese medicine, research on traditional Chinese medicine and its industrialization technology, and strive to form a number of independent intellectual property rights and accelerate the transformation of achievements. Promote the secondary development of preparations of traditional Chinese medicine (ethnic medicine) in medical institutions and improve the technical standards, and gradually expand the scope of dispensing and use in medical institutions.

(5) Promote the high-quality development of the Chinese medicine industry.

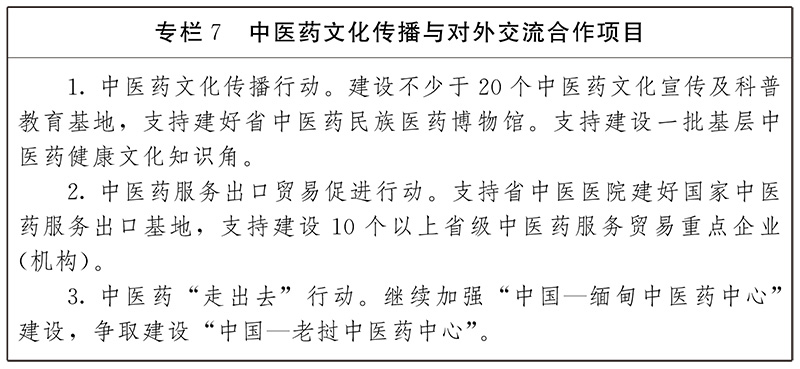

1 to strengthen the protection, development and utilization of traditional Chinese medicine resources. Strengthen the protection of rare and endangered wild medicinal plants, and support the artificial breeding of rare and endangered Chinese herbal medicines and the development and utilization of substitutes. Make full use of the data of the fourth national survey of traditional Chinese medicine resources in Yunnan Province, and establish the basic database and specimen database of the survey of traditional Chinese medicine resources in Yunnan Province. Carry out the work of applying for geographical indication agricultural product registration, product protection and trademark registration for authentic varieties of Chinese herbal medicines, the origin of edible and medicinal material resources and the main producing areas.

2. Promote the cultivation of authentic medicinal materials. Focusing on the "Top Ten Famous Medicinal Materials" such as Panax notoginseng, Paris polyphylla var. yunnanensis, Erigeron breviscapus, Dendrobium candidum, Amomum villosum, Gastrodia elata, Poria cocos, Angelica yunnanensis, Aucklandia yunnanensis, Gentiana yunnanensis, we will carry out the research and application of improved varieties breeding, propagation and variety cultivation techniques of Chinese medicinal materials, and promote a number of green production technologies and planting models aimed at steadily improving the quality of Chinese medicinal materials. Promote the standardized cultivation of authentic Chinese herbal medicines and promote the development of Chinese herbal medicine industry under the forest. Cultivate and strengthen the "one county, one industry" demonstration counties and characteristic counties of Chinese medicinal materials, cultivate a number of strong agricultural towns dominated by Chinese medicinal materials, and build our province into a national production base of high-quality authentic medicinal materials.

3. Improve the development level of Chinese medicine industry. Improve the standard system of Chinese herbal medicine planting and breeding, warehousing, logistics, and primary processing specifications. Encourage the industrialization, commercialization and moderate scale development of Chinese herbal medicines. Promote the upgrading of Chinese medicine pharmaceutical technology, promote the standardization and modernization of Chinese medicine production technology, and encourage production enterprises to gradually realize intelligent manufacturing. Promote the construction of a number of industrial parks with distinctive advantages, mainly Chinese herbal medicines, and promote the development of industrial clusters. Promote the brand development of traditional Chinese medicine produced in Yunnan, and cultivate large varieties and exclusive varieties of Chinese patent medicine. Strengthen the quality and safety risk assessment and risk monitoring of Chinese herbal medicines, establish and improve the third-party quality monitoring system, and promote the construction of traceability systems in production, processing and circulation. Improve the local standard system of Chinese herbal medicines and Chinese herbal pieces, and improve the processing level and product quality of Chinese herbal pieces. Continue to promote the construction of the inheritance base of traditional Chinese medicine processing technology.

4. Strengthen the safety and quality supervision of traditional Chinese medicine. Highlight the "four strictest" requirements of the most stringent standards, the strictest supervision, the most severe punishment and the most serious accountability, explore the establishment of a traceability system for the whole process of production, circulation and use of Chinese herbal medicines, Chinese herbal pieces and Chinese patent medicines, establish and improve the whole chain drug safety supervision mechanism, carry out special actions on drug quality and safety, and severely crack down on illegal activities. Strengthen the management of instructions and labels of traditional Chinese medicine to improve the guiding effect of instructions for clinical use.

5. Establish and improve the circulation system of Chinese herbal medicines. Establish a circulation system of Chinese herbal medicines integrating cultivation, primary processing, packaging, storage, transportation and sales. Promote the development of "internet plus Logistics", build modern intelligent logistics, and carry out door-to-door service of Chinese herbal medicine distribution. Create a Chinese herbal medicine trading center facing southwest and radiating South Asia and Southeast Asia.

(six) innovative development of Chinese medicine health service industry.

1. Develop TCM health care services. Standardize the behavior of TCM health care services, and promote the standardized development of TCM health management services such as identification and evaluation of TCM health status, consultation and guidance, and health intervention. Enrich the connotation of TCM health care service, popularize TCM health care methods and traditional Chinese health care campaigns such as Tai Ji Chuan, Baduanjin and Wuqinxi, and promote the formation of a health service model combining physical education with medicine. Strengthen the supervision of TCM health care institutions, improve the quality of employees, improve the management level and service quality, and promote the healthy development of TCM health care services.

2. Develop Chinese medicine health care service for the aged. Support qualified Chinese medicine hospitals to carry out community and home Chinese medicine health care services. Promote Chinese medicine hospitals above the second level to strengthen the construction of geriatrics, and carry out traditional Chinese medicine prevention and rehabilitation care for senile diseases and chronic diseases. Encourage and support social capital to participate in traditional Chinese medicine health care services, and provide continuous, personalized and integrated traditional Chinese medicine care services for the elderly. Promote the construction of a demonstration base combining traditional Chinese medicine with medical care.

3. Develop healthy tourism of traditional Chinese medicine. Give full play to the unique advantages of Yunnan traditional Chinese medicine, ethnic medicine and folk medicine and the resource advantages of cultural tourism, promote the deep integration of traditional Chinese medicine health service and cultural tourism industry, introduce leading enterprises, launch a number of health products, promote the development of comprehensive traditional Chinese medicine health tourism services with the theme of traditional Chinese medicine cultural communication and health experience, and integrate traditional Chinese medicine medical treatment, health care, medicated diet, tourism and leisure, and promote the construction of a number of health tourism bases with outstanding traditional Chinese medicine characteristics, forming a number of experiences and wide participation.

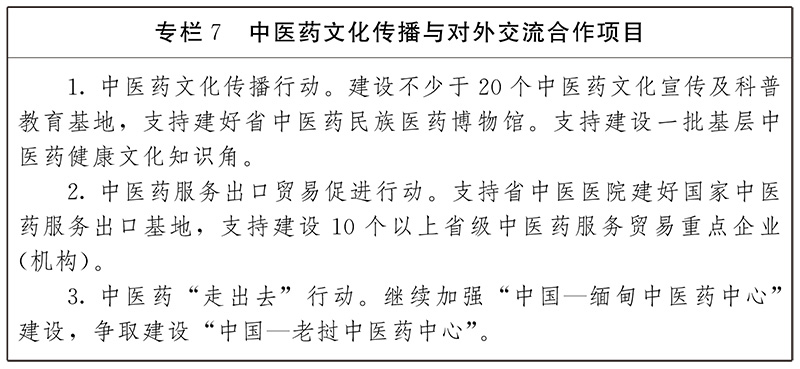

(seven) to promote the development of Chinese medicine culture and foreign exchanges and cooperation.

1. Vigorously promote Chinese medicine culture. Implement the action of spreading Chinese medicine culture, and continue to carry out large-scale popular science publicity activities such as "Chinese Medicine Publicity Day" and "Chinese Medicine China Tour" to promote Chinese medicine culture into rural areas, communities, schools and enterprises. Support the construction of Chinese medicine culture publicity and education bases in Chinese medicine medical institutions, scientific research institutes and Chinese medicine enterprises above the second level. Support the establishment of the provincial museum of traditional Chinese medicine and ethnic medicine, and encourage social forces to build a museum of traditional Chinese medicine (ethnic medicine). Promote the creation of a knowledge corner of Chinese medicine health culture.

2. Strengthen the propaganda team of Chinese medicine culture. The establishment of teachers and students in medical colleges and universities, medical institutions, Chinese medicine personnel as the main body of traditional Chinese medicine culture popularization team, strengthen the construction of provincial traditional Chinese medicine culture popularization expert team. Explore the establishment of Chinese medicine culture publicity and training system, strengthen the training of grassroots Chinese medicine culture propagandists, and basically establish a Chinese medicine culture propaganda team that is suitable for the development of Chinese medicine.

3. Promote the open development of Chinese medicine. Encourage and support Chinese medicine education, medical institutions and Chinese medicine enterprises to "go global". Vigorously develop Chinese medicine service trade, build a national Chinese medicine service export base with high quality, and support the construction of provincial key enterprises (institutions) in Chinese medicine service trade. Support the establishment of 1-2 overseas Chinese medicine centers.

(eight) comprehensively deepen the reform of traditional Chinese medicine.

1. Establish an evaluation system that conforms to the characteristics of traditional Chinese medicine. Establish and improve a scientific and reasonable evaluation system for Chinese medical institutions, characteristic talents, clinical efficacy and scientific research achievements. Regularly carry out the performance appraisal of tertiary and secondary public Chinese medicine hospitals, and increase the application of the assessment results. Deepen the reform of the title system of health professional and technical personnel, improve the evaluation criteria for the title of Chinese medicine talents, establish an evaluation and incentive mechanism for outstanding Chinese medicine talents and a selection system for famous Chinese medicine practitioners at the provincial, prefecture and county levels. Chinese medicine talents and medical ethics are the main evaluation criteria for Chinese medicine talents, and "being able to see a doctor and being optimistic about the disease" is the main evaluation content for the selection of Chinese medicine doctors and famous Chinese medicine practitioners at all levels. In the selection of health professional and technical personnel, explore the separate and independent evaluation of Chinese medicine talents. Study and optimize the evaluation system of clinical curative effect of traditional Chinese medicine, and explore and formulate evaluation indicators that conform to the laws of traditional Chinese medicine. Highlight the characteristics and development needs of traditional Chinese medicine, and explore the establishment of a collaborative management mechanism for scientific research of traditional Chinese medicine between science and technology departments and health departments. The establishment and evaluation of scientific research projects of traditional Chinese medicine are listed separately and peer review is adopted.

2. Establish and improve the modern hospital management system. Establish a modern hospital management system that reflects the characteristics of Chinese medicine hospitals, and fully implement and implement the president responsibility system under the leadership of the party Committee. Strengthen the construction of hospital traditional Chinese medicine connotation service and improve the level of medical service. Improve the operation management system, promote the scientific, standardized and refined hospital management, and strive to achieve "three changes and three improvements". Strengthen the ability of medical technology innovation, expand the innovative medical service model, and promote the high-quality development of public Chinese medicine hospitals. Reform the personnel management system, improve the salary distribution system, and implement the national "two permits" requirements. Strengthen the management of TCM medical quality, build 7 TCM quality control centers for bone injury, anorectum and gynecology based on TCM clinical medical centers and regional TCM (specialist) diagnosis and treatment centers, newly select and build no less than 5 TCM quality control centers, gradually improve the quality control network system at the provincial, prefecture and county levels, build a professional quality control talent team, and implement dynamic management of medical quality. Strengthen the construction of hospital infection prevention and control system in traditional Chinese medicine hospitals and build a solid foundation for hospital infection prevention and control. Establish and improve a long-term mechanism to protect, care for and care for medical personnel, strengthen communication between doctors and patients, and build a harmonious doctor-patient relationship.

3. Implement the Chinese medicine price and medical insurance policy. We will improve the dynamic price adjustment mechanism of Chinese medicine medical services, and promote the implementation of the independent pricing policy for Chinese medicine decoction pieces and prepared Chinese medicine preparations processed and used by public medical institutions. To promote the reform of medical insurance payment methods, general Chinese medicine diagnosis and treatment projects can continue to pay by project, and explore the implementation of Chinese medicine diseases to pay by disease score.

4. Optimize the preparation review and approval of Chinese medicine medical institutions. Establish and improve the relevant systems of emergency review and approval, conditional approval and internal adjustment and use of preparations in Chinese medicine medical institutions. For qualified Chinese medicine preparations recommended by science and technology, health and other departments, Chinese medicine preparations that are used for the prevention and treatment of major diseases, are urgently needed in clinic and are in short supply, or belong to children’s medication are given priority for review and approval. To explore the technical requirements of preparation evaluation and filing in Chinese medicine medical institutions by combining Chinese medicine theory, human experience and clinical trials. Support the research and development of preparations in traditional Chinese medicine medical institutions, and formulate and improve technical guidelines for the filing of preparations in ethnic medicine medical institutions.

(nine) to strengthen the development of traditional Chinese medicine support.

Strengthen information support. Relying on the provincial national health information platform, the provincial Chinese medicine data center will be built. Promote the standardized access of Chinese medicine medical institutions at all levels to the provincial national health information platform. Carry out grading evaluation of the application level of electronic medical record system. Accelerate the construction of Internet hospitals for traditional Chinese medicine. Vigorously develop new medical service models such as telemedicine, mobile medical care and smart medical care of traditional Chinese medicine, and provide convenient services such as online appointment for diagnosis and treatment, waiting reminder, pricing payment, diagnosis and treatment report inquiry, and drug distribution.

Strengthen the rule of law in traditional Chinese medicine. We will further promote the implementation of the People’s Republic of China (PRC) Law on Traditional Chinese Medicine, promote the promulgation of the Regulations on Traditional Chinese Medicine in Yunnan Province, and encourage and support ethnic minority areas to formulate and promulgate local regulations on the development of ethnic medicine. We will promote the implementation of the relevant supporting policies of People’s Republic of China (PRC) Traditional Chinese Medicine Law, and strengthen the examination and registration of the qualifications of doctors with expertise in Chinese medicine and the management of the filing system of Chinese medicine clinics. Strengthen the supervision and law enforcement of traditional Chinese medicine, strengthen personnel training, and comprehensively improve the supervision ability and level of traditional Chinese medicine.

Fourth, safeguard measures

(1) Strengthen organizational leadership. Establish and improve the joint meeting system of Chinese medicine departments at the provincial, prefecture and county levels, strengthen the overall coordination of Chinese medicine work, and regard Chinese medicine work as an important part of implementing economic and social development plans in various places. Establish and improve the management system of traditional Chinese medicine, clarify the institutions that undertake the management functions of traditional Chinese medicine at the provincial, prefecture and county levels, enrich the work force of the management department of traditional Chinese medicine, implement the work responsibilities, and form a linkage pattern of traditional Chinese medicine.

(2) Strengthen the safeguard mechanism. Establish and improve a multi-input mechanism for the development of traditional Chinese medicine led by the government and with the participation of social forces, and gradually establish an input guarantee system that is suitable for the development of traditional Chinese medicine. Governments at all levels actively support the development of Chinese medicine through the existing funding channels. Governments at or above the county level should include the development funds of Chinese medicine into the fiscal budget at the corresponding level, implement the government’s main responsibility for running public Chinese medicine hospitals, implement investment policies such as capital construction, equipment purchase, development of key specialties, and personnel training, give play to the incentive role of medical insurance in the development of Chinese medicine, and create a better policy environment for the development of Chinese medicine.

(three) to carry out monitoring and evaluation. Establish and improve the monitoring and evaluation mechanism of traditional Chinese medicine to adapt to the inheritance, innovation and development of traditional Chinese medicine, organize dynamic evaluation of the implementation of the plan, find and solve problems in the implementation of the plan in time, and improve the scientificity and timeliness of monitoring and evaluation. Carry out mid-term and final evaluation of planning, strengthen the binding nature of planning implementation, and ensure the smooth completion of various objectives and tasks.

(4) Pay attention to publicity and guidance. Vigorously promote the "People’s Republic of China (PRC) Chinese Medicine Law", "People’s Republic of China (PRC) Physician Law" and other laws and regulations and the principles and policies for the development of health and Chinese medicine. Strengthen the positive publicity of advanced models of traditional Chinese medicine and improve the level of public opinion guidance. Give full play to the role of social organizations, actively promote the development effect, scientific value and health concept of traditional Chinese medicine, and form a strong atmosphere of government-led, departmental coordination and joint support of the whole society for the development of traditional Chinese medicine.

![ZBF78[ internal ]-9.jpg](http://www.4000082948.cn/wp-content/uploads/2023/12/PwR92NAi.jpg)