When it comes to inflation, the financial crisis may be the first thing that comes to mind. Many major financial crises in history were caused by excessive inflation, and many of them were caused by war. For example, the "inflation" recorded in history textbooks during the Republic of China-the government of the Republic of China issued a large number of French currency notes to pay for the huge war expenses. In 1947, 100,000 yuan of French currency notes were issued, and the price was like a runaway horse. At that time, a professor’s salary was more than 10 million yuan, but it was not enough to buy five loaves of flour.

War consumes not only life, but also money. As early as the Northern Song Dynasty, Cai Jing, the financial minister, made a great deal of money in order to attack Xixia, and his means was to issue "pawn money".

Minister of the Northern Song Dynasty, the successor of Xining Reform

Cai Jing was a powerful minister at the end of the Northern Song Dynasty, and Song Huizong was the prime minister for five times, which experienced the whole process of the Northern Song Dynasty’s demise. Cai Jing is also a notorious treacherous court official in the history of China, and his life is recorded in the Biography of Treacherous Court Officials in Song Dynasty.

Cai Jing’s official career is full of ups and downs, and his official career cannot be separated from one person-Wang Anshi. In the second year of Xining in Song Shenzong (AD 1069), Wang Anshi began to carry out political reform, which was called Xining Political Reform in history. The aim of Wang Anshi’s political reform was to enrich Qiang Bing, which was soon realized, and the court obtained enough military materials and troops. Cai Jing’s younger brother Cai Bian is Wang Anshi’s son-in-law. During the reign of Xining, recommended by Wang Anshi, Cai Jing entered the book ceremony room to study official business. Thanks to Wang Anshi’s support, Cai Jing’s official career prospered and soared all the way. Soon, the official arrived at Zhongshu Sheren, Longtuge, and the right to know Kaifeng.

In the fourth year of Yuanfeng (AD 1081), Song Shenzong launched a large-scale war against Xixia, and Song Jun suffered a crushing defeat. Song Shenzong’s dream of making great achievements in the world was shattered, and he soon died of depression.

In the eighth year of Yuanfeng (AD 1085), Song Shenzong died, Song Zhezong ascended the throne, and the power was in the hands of Song Shenzong’s mother, Gao. Sima Guang was appointed as the prime minister and started the reform movement of Yuanyou, completely denying Wang Anshi’s political reform.

Cai Jing, as a member of Xining Party, was banished from the imperial court and became an official at the local level during the period of Yuan Yougeng. After Song Huizong took office, Xi Ning Party members were employed. At this time, Wang Anshi had already passed away, and Cai Jing became the prime minister as the successor of Xi Ning’s political reform, thus restarting the great cause of political reform.

Ten dollars in business, money law is in chaos.

In the first year of Chongning (A.D. 1102), when Cai Jing was just appointed as the vice minister, he immediately ordered the new laws of the Song Shenzong period to be re-implemented. At this time, there was a Xining Party member named Xu Tianqi, who served as a transshipment agreement in Shaanxi at that time. In order to cater to Cai Jing, he asked the court to cast ten yuan. During Wang Anshi’s political reform, he used to cast a lot of money to fold two dollars. At this time, if you cast ten dollars, the nominal value will increase by five times compared with the discount of two dollars. The intention of infringing on the interests of the people is too obvious. Cai Jing has some concerns, so he temporarily cast five dollars and tried to see its effect. In May of the second year of Chongning (AD 1103), Cai Jing ordered Shaanxi, Jiangzhou, Chizhou, Raozhou and Jianzhou to use the copper materials that were prepared to cast small flat coins in those years to cast 50 yuan. The inscription "Sheng Song Tong Bao" with a discount of five yuan is slightly heavier than that of Xiao Ping Qian. The nominal value of 50% off is two and a half times that of 20% off. The trial was successful and there was no problem. Soon after, Cai Jing ordered the casting of ten yuan in accordance with Shaanxi’s big money shape, and limited the casting line to three hundred million articles of ten copper coins and two billion articles of ten iron coins in that year. Cai Jing did this because, first, he thought that the ten-fold money was cast on the basis that the five-fold money had entered the circulation, which was only twice as big as the five-fold money and would not cause a violent market reaction; Second, it is estimated that the total amount of coins in circulation at that time was about 200 billion to 300 billion, and the amount of ten yuan in the first line accounted for a small share of the total amount of coins in circulation, which would not have much impact on the purchasing power of money; Third, there is a precedent in Song Renzong’s period to consider the discount of 10 yuan, which can refer to the ancestral casting.

As early as the first year of Kangding, Song Renzong (AD 1040), Song Jun attacked Xixia, and Shaanxi was short of military supplies, so the imperial court was invited to cast large copper coins in parallel with small flat coins, and one copper coin was used as ten. Since then, ten iron coins have been made, which led to the theft of casting by the people, so the money law was in chaos. After frequent adjustments to the money law, the court gradually calmed down the chaos of the money law. Cai Jing used the shape of Shaanxi’s big money to cast it as ten money, in order to borrow the ancestral system and obtain the legitimacy of currency reform.

Discount five yuan for the inscription "Sheng Song Tong Bao" and ten yuan for the inscription "Chong Ning Chong Bao". From the unearthed cultural relics, the number of "Shengsong Tongbao" with a discount of five yuan is very small, because the casting line soon changed to "Chongning Chongbao" with a discount of ten yuan. At that time, more casting was "Chongning Heavy Treasure".

In the Northern Song Dynasty, the word "fold" was often used to express the amount of virtual money. During the period of Song Huizong, the pawn money was originally called "ten-fold money". In October of the second year of Chongning (AD 1103), Song Huizong ordered that "ten-fold money" be renamed as "ten-fold money". The end of the Chronicle of the Emperor and Song Dynasty as a Mirror contains: "The imperial edict is changed into two, and the ten is combined as two and ten." Lu You’s "Old Story of the Family" also contains: "At the beginning, Xi Ning cast two yuan, so Chongning Daquan began to be called’ 10′, but the group castrated that Huizong was the tenth son of Shenzong, and’ 10′ was not a good name, so it was called as 10, so it was ordered to cloud." It can be seen that Song Huizong should call the money "10% off" in the early years; After the imperial edict of Chongning for two years, the money should be called "pawn ten money". However, there are many confusions in the literature records.

After the imperial court minted ten yuan, the people stole it and the money law was in chaos. In order to prohibit the people from stealing castings, the court issued several bans. However, the lure of huge profits still makes the phenomenon of casting theft very serious, and many people do not hesitate to try their own laws. In the fourth year of Chongning (A.D. 1105), Shangshu said: "I heard that the southeast roads were stolen and cast as ten dollars, and the boat was cast in the rivers and seas. When I was an official, I didn’t care about my heart, and I indulged in evil." People steal ten coins, melt small money into copper, and cast it into big money, so they can get several times of profits. In order to avoid the arrest of the government, this illegal activity has developed to ships on rivers and seas.

Fang La Uprising, United with Jin and destroyed Liao, finally became a swan song.

A small sum of money has helped the people for a long time, and the ancient people have prospered the army, but the tin reward has not continued, or one is a hundred, or one is a thousand. This right is appropriate at the right time. How can it be done on a peaceful day? When ten drums are cast, there are several times of interest. Although it is cut every day, it is unstoppable.

In the third year of Daguan (A.D. 1109), Taiwan remonstrators spoke in succession about Cai Jing’s sins. Therefore, Cai Jing lost his post as prime minister for the second time and presided over the compilation of A Record of Zhe Zong. However, three years later, Cai Jing was in power again.

In May of the second year of Zhenghe (AD 1112), Cai Jing was appointed as Prime Minister for the third time. Unexpectedly, in November of the following year, He Zhizhong became the left servant of Shangshu, and also served as the assistant minister and became the prime minister. Song Huizong made Cai Jing a prince, a surname, and a duke of Lu. Cai Jing lost his post as prime minister for the third time.

In April of the sixth year of Zhenghe (AD 1116), He Zhizhong became an official. Lin Lingsu, a Taoist priest, told Song Huizong that Song Huizong was the eldest son of God, the king of God’s clouds and jade, and came down to be emperor. Cai Jing, an immortal of Zuo Yuan, came down to assist Song Huizong in governing the world. Song Huizong was convinced of this, claiming to be the "leader of Daojun Emperor" and ordering Cai Jing to take charge of the affairs of Zhongshu, Menxia and Shangshu provinces.

This is Cai Jing’s fourth term as prime minister. In June of the second year of Xuanhe (AD 1120), Cai Jing was removed from the post of prime minister for the fourth time.

At this point, Cai Jing is seventy-four years old. Cai Jing was removed from the post of Prime Minister this time, nominally because of his old age, but actually because of his opposition to the Northern Expedition of Liao. The person who succeeded the post of prime minister, whose name was Wang Fu, was a troublemaker. Wang Fu served as prime minister for four years, and the Northern Song Dynasty was constantly in trouble. First, Fang La uprising, and then United Jin to destroy Liao.

Although Cai Jing has resigned, his policy of collecting money has gradually produced serious consequences. According to Cai Jing’s policy of accumulating wealth, officials at all levels plundered the people’s wealth, and the people couldn’t live any longer, raising flags in succession to rebel.

Fang La raised his arms and responded everywhere, and many private tea dealers and salt dealers defected to Fang La. Within a few days, the rebel army grew to one hundred thousand people. With troops, Fang La began to attack the city, and the insurgents were invincible, robbing rich rooms and killing officials everywhere. In December, the rebels occupied Muzhou (now Chun ‘an County, Zhejiang Province) and Shezhou (now Shexian County, Anhui Province), and conquered Hangzhou, the southeast town of the Northern Song Dynasty. At this point, the number of the uprising people is close to one million, and the four sides are shocked.

In order to whitewash the peace, Prime Minister Wang Fu concealed the truth. In the imperial history, Chen Guoting believed that Wang Nai’s concealment of military intelligence was the main reason for the spread of the uprising. In his recital to Song Huizong, he said: "To Cai Jing, the man who was the coach, and Wang Fu, the man who raised the coach, if these two men are taken down for questioning, then the coach will be even."

When Song Huizong heard the news, he immediately wrote a letter to himself, ordered the abolition of Hua Shigang, cancelled the artificial bureau, exempted the public and private debts in the uprising area, and refused to accept land tax for three years.

The Fang La Uprising was brutally suppressed, and the court spent a lot of money. The financial situation of the Northern Song Dynasty was even more tense, and the life of the people was even more difficult.

In the first year of Zhenghe (AD 1111), Tong Guan went to Liao. There was a Han official named Ma Zhi in Liao country who was dissatisfied with Liao dynasty. When Ma Zhi met Tong Guan, he presented Tong Guan with the plan of uniting the gold to destroy Liao. In the fifth year of Zhenghe (AD 1115), Ma Zhi fled to the Song Dynasty, met Song Huizong, and once again put forward the idea of uniting Jin to destroy Liao.

At this time, the state of Jin became stronger and stronger, while the state of Liao gradually declined. Liao country is no longer a concern, but Jin country has become the main threat of Song Dynasty. Therefore, many scholars in the Northern Song Dynasty opposed the alliance of Jin and Liao. However, sixteen prefectures was in the hands of Liao State, which made the northern border of Song Dynasty have no danger to defend. Recovering sixteen prefectures is the greatest wish of the Song Dynasty for a long time. At this time, the decline of Liao’s national strength seemed to be the best time for the Northern Song Dynasty to recover sixteen prefectures. Faced with such a huge temptation, Song Huizong couldn’t resist, and finally accepted Ma Zhi’s idea of destroying Liao with gold, and gave Ma Zhi the royal Zhao surname. Ma Zhi was renamed Zhao Liangsi.

In the first month of the fifth year of Zhenghe (AD 1115), Akuta proclaimed himself emperor, with the title of Daikin. In September, Jin Jun captured Huanglongfu (now Nong ‘an County, Jilin Province), a military town in Liao, and Emperor Tianzuo of Liao led 700,000 troops to counterattack Huanglongfu. As a result, the Liao army was defeated.

In March of the second year of Xuanhe (A.D. 1120), Zhao Liangsi met Akuta from Dengzhou (now Penglai City, Shandong Province), and the two sides reached an agreement: Jin Jun attacked Liaozhongjing (now Ningcheng County, Inner Mongolia Autonomous Region), and Song Jun attacked Liaoning Nanjing, also known as Yanjing (now Beijing); After Song Jun captured Yanjing, Yanjing and the prefectures under its control belonged to the Song Dynasty, which transferred 500,000 pieces of silver silk originally given to the Liao Dynasty to the rulers. This agreement is known in history as "Song, Jin, Xuan and Maritime Alliance". With the Covenant, 8 Jin Army began to attack Liao without any worries, while Song Jun was transferred to suppress the Fang La uprising.

In the first month of the fourth year of Xuanhe (AD 1122), 8 Jin Army broke through Liaozhongjing; In March, the Jin army attacked western Liaoning. At this point, Liao Wujing has lost four, and only Yanjing exists. Emperor Tianzuo of Liao fled to Jiashan (now Wuchuan County, Inner Mongolia Autonomous Region), and Jin Jun concentrated his forces on pursuit, so he had no time to take care of Yanjing. At this point, Tong Guan has wiped out the Fang La uprising. Therefore, Song Huizong appointed Tong Guan as the Xuanfu envoy of Hebei and Hedong, and Cai You, the eldest son of Cai Jing, as the deputy envoy, and became the general commander of Zhongshi Daodu, leading an army of 150,000, attacking Yanjing and launching the Battle of Yanshan.

The national strength was weak, the Chaogang was corrupted, and the war broke out again, and another eunuch of Song Huizong, Li Yan, caused a great disaster to Song Huizong. Li Yan checked the fields in the northwest, confiscated more than 34,300 hectares of land of the people, and killed more than 1,000 people with sticks, resulting in countless bankrupts. As a result, people in JD.COM and Hebei rebelled, making it more difficult for the court to stabilize the situation.

Cai Jing has lost his position as prime minister because of his opposition to uniting Jin to destroy Liao. There was a covenant between Song and Liao, which lasted for a hundred years. At this time, the war ends together, and the future was unpredictable. Cai You, the son, went to fight against Liao, and Cai Jing was sad and gave a poem to his son:

The lazy man is not free in body and mind, and the letter is sent with tears.

A hundred years of faith and oath should be deeply read, and the three-volt sign should be combined with less rest.

Seeing the standard like yesterday’s dream, I feel deeply worried.

It’s full of breeze in the clothing hall, and I’ll come back early and get drunk.

With the ups and downs of Cai Jing’s official career, the amount of pawn money in circulation is also increasing, and inflation is intensifying. The price of rice has risen to about 400 to 1,500 per stone, which is about three to five times higher than the price of 100 to 300 per stone in the early Northern Song Dynasty. The price of silk rose to about 2,000 Wen per horse, which was about twice as high as that of about 1,000 Wen per horse in the early Northern Song Dynasty. Serious inflation has made people’s lives increasingly difficult, and the voice of opposition to Cai Jing in the DPRK is growing. When the nomads from the army attacked Taiyuan and nearly forced the capital, and Song Huizong gave Song Qinzong a Zen position, Taixue invited the imperial court to kill Cai Jing to thank the world.

After Song Qinzong ascended the throne, he demoted Cai Jing once and then, and a few months later he demoted Cai Jing to Hainan Island for resettlement. However, Cai Jing failed to reach Hainan Island and fell ill and died halfway to Changsha. A few months after Cai Jing’s death, the nomads from the army invaded Kaifeng and took Song Huizong and Song Qinzong to the north. As a result, the Northern Song Dynasty perished, and the circulation of ten coins finally came to an end.

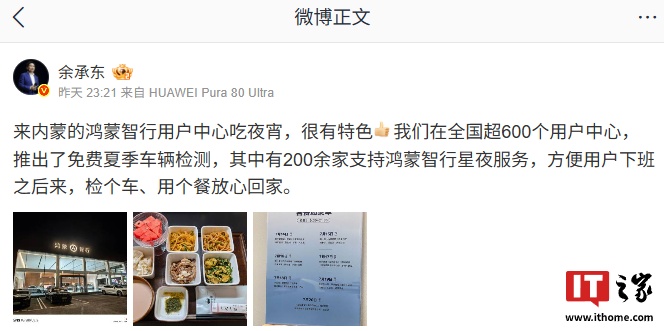

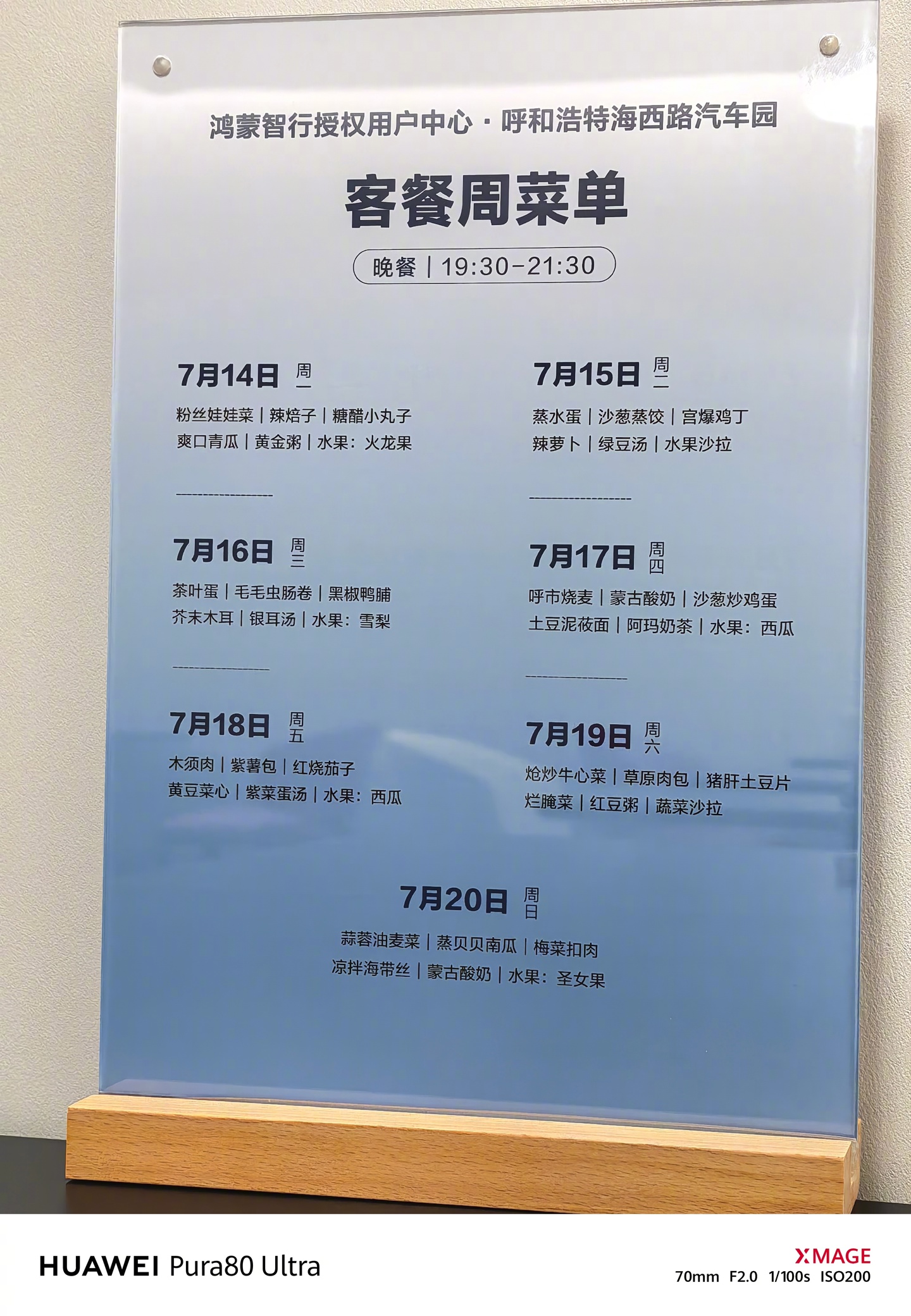

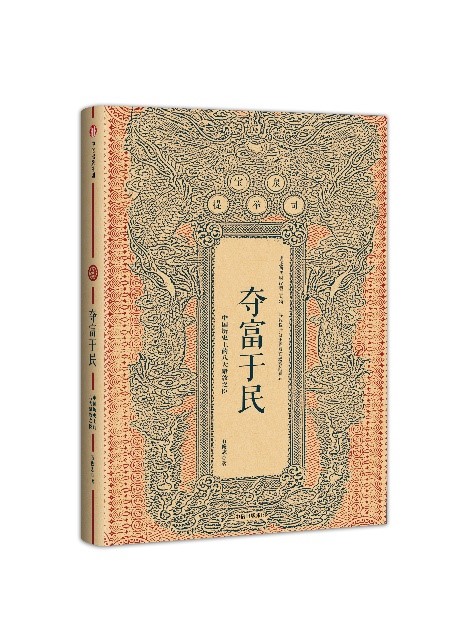

(This article is excerpted from "Taking Wealth from the People: Eight Great Ministers in the History of China")

By Shi Junzhi

Seize the wealth from the people

CITIC Publishing House published in September.

About the author: Shi Junzhi, Ph.D. in History from Beijing Normal University, J.D. from China Renmin University, Ph.D. in Economics from Tsinghua University, and a scholar in the history of monetary law in China. Researcher, Institute of Finance, China Academy of Social Sciences, General Manager of National Trust Company Limited.

He has held senior management positions in the International Business Department of China Bank Head Office, China Bank London Branch, China Merchants Bank Head Office, Orient Asset Management Company and Bohai Bank Head Office, and has 25 years of financial practice and management experience. He is the executive director of China Institute of International Finance, tutor and part-time professor for master students of Central University of Finance and Economics, tutor and part-time professor for master students of graduate department of China People’s Bank, tutor and part-time professor for master students of Hunan University Law School, and member of the editorial board of Translation of Financial Works of China Financial Publishing House.