Do you understand the rumored "selling assets at a high price" correctly?

Author Liu Yan

Editor Xin Ling

Toutu. com

After a wave of unrest, Gao Wei fell into a storm of public opinion again.

First, it was rumored that the consumer group was "indiscriminately laying off employees". After Gao Yan’s urgent rumor, it was rumored that some of its projects were "frequently looking for buyers", "selling a lot of assets" and "looking for a takeover man" … and then the market conveyed various speculations.

In response to the so-called "selling assets" in the market, Gao Yan responded to the entrepreneurial state and said: "International markets such as Coller Capital and TR Capital are all mature players in the S market. S-transactions are more often about the continuation of assets than the simple sale of assets. In the simplest way, the seller who sells the share is not a VC/PE institution, but a share transfer between LPs. Before and after the asset package transaction, the GP share remains unchanged. That is to say, the so-called’ high-selling assets’, in essence, the share transfer between high-selling LP is not high-selling assets.

At the same time, according to the entrepreneurial state, Gao Yan is also setting up a special S fund team. Gao Wei said: "S trading has two meanings for Gao Wei. On the one hand, it can serve our LP and help the existing LP to better grasp the exit rhythm. At the same time, we are also very optimistic about the investment opportunities in the S market. For the long-term optimistic areas, we can either invest in new shares or intervene in the S fund. We believe that S trading, as a new tool, has great market potential and promotes venture capital. "

Let’s not comment on the deep-seated reasons behind Gao Ling’s trading in S, but from the feedback of the market, do we really know S funds?

The answer may not be.

As far as the incident itself is concerned, "Gao Yi sets up S fund team" has been misunderstood by the market as "Gao Yi sells assets". The so-called "high-selling assets" in the market is actually the share transfer between high-selling "LP", which can make the old LP get liquidity and withdraw early, but high-selling is still the holder of assets, and its share of assets remains unchanged.

When Gao Ying set up the S fund, it appeared as a buyer in the S transaction, and they would buy fund shares, investment portfolios or investment commitments from other investors.

We can see that Gao Ling, as an important weather vane, has begun to focus on the hidden opportunities in S trading.

The fundamental reason why the market has misunderstood Gao Ling’s fund is that many people confuse the concepts of S fund and S trading, and think that S fund is only an exclusive game dominated by LP, and GP with operational problems will passively participate. Even most GPs deliberately stay away from the S fund, which seems to have the label of "disposal of non-performing assets", for the sake of brand protection.

In fact, S trading is a good tool to help GP "make money". More and more foreign GPs take the initiative to use S trading as a tool to solve the problems of raising funds, withdrawing, optimizing LP structure, asset management, adjusting investment strategy and withdrawing cash.

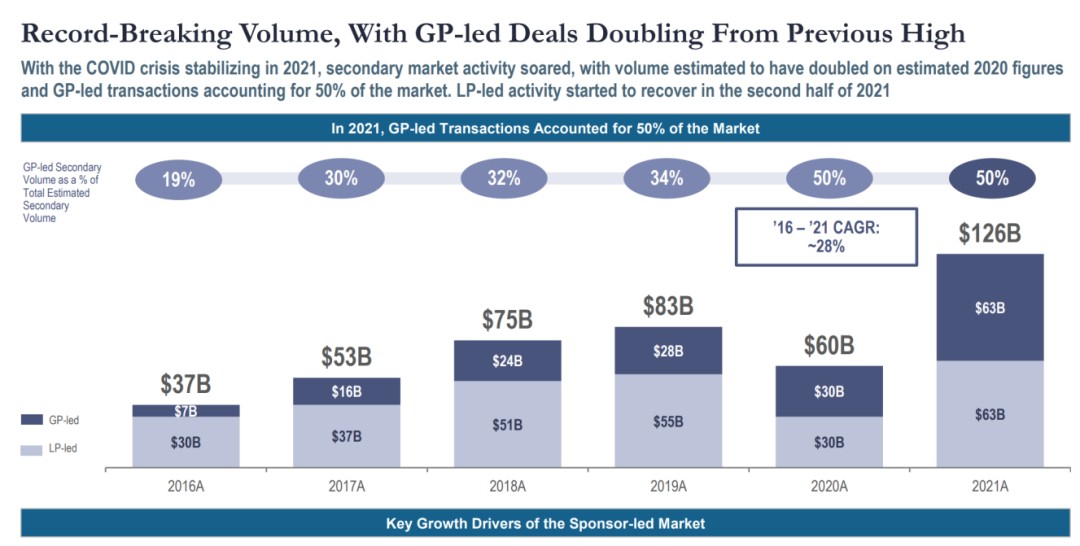

After more than 20 years’ development, this innovative financial instrument has entered a milestone development abroad. The landmark event is that in 2021, the GP-led S transaction exceeded the LP-led transaction scale for the first time, and it showed a sustained growth trend. According to the latest data of Jefferies in the United States, the transaction volume dominated by GP has increased from 35 billion dollars in 2020 to 68 billion dollars in 2021, accounting for more than half of the transaction volume in the S market, among which, the continuation fund (a model in S trading) accounts for the majority. This survey is also verified by Lazard’s data.

Foreign GP-led transactions surpassed LP-led transactions for the first time, accounting for half of the total trading volume in the S market (Source: Lazard).

However, in China, the vast majority of China GPs don’t realize the intrinsic value of S-trading. In most cases, GPs passively participate in S-trading when LP needs to withdraw, and the GP institutions that actively initiate trading are rare. As far as quantity is concerned, there are only a few domestic GP-led trading cases, such as IDG Capital, Kunzhong Capital, Huagai Capital-Shenzhen Venture Capital, Junlian Capital, Xiangfeng Fund and Puzzle Capital.

As a professional buyer, S fund managers generally believe that the risk coefficient of GP-led S trading is higher than that of LP-led S trading, but the return on investment is also significantly higher. This has also become one of the important reasons why the big buyers of foreign mature S funds represented by Kohler Capital actively participate in GP-led transactions.

What is GP-led s trading? When will it become mainstream in China? How can VC/PE managers use it to create more value?

S fund has been known to most GPs. As the market tends to be hot, 2020 is also called the first year of China S Fund. However, many people’s first impression of S fund still stays at the level of "taker" of non-performing assets.

Tracing back to 30 years ago, when S Fund was born abroad, it also had the derogatory color of "disposal of non-performing assets".

"In the beginning, S funds were only used when there were major problems in American funds. At that time, some big GPs would try to avoid having relations with S funds, so as not to be labeled as’ bad’. Now, more and more GPs are actively looking for S funds to cooperate, in order to create more income. At present, the awareness of S funds in the China market in the early stage of development is at most a neutral concept. " Yang Zhan, director of Kohler’s capital investment and general manager of Kohler (Beijing) Private Equity Fund Management Co., Ltd. introduced.

"The fund expires to find the next LP, just as it is common for a girl to find an object when she is older." Executive CEO Li Miao made an image metaphor. She believes that it is absolutely unnecessary for GP to avoid the normal behavior of selling assets or transferring shares.

"Generally, it is very good that 20% of the assets of US dollar funds can be withdrawn through IPO, and a large number of other assets need to be withdrawn through mergers and acquisitions, transfer, repurchase and liquidation." As an early group of S fund practitioners in China, Li Mingming, managing director of Xingnahe Capital, told Entrepreneurship.

"The market has a certain misunderstanding of the S fund. The S fund will not simply buy bad assets, but can look at the underlying assets through cycles and outlets and invest in valuable asset packages. And in general, the return on investment of S funds is higher than that of parent funds, even higher than that of some PE/VC funds, and J curve can be avoided to some extent. " Li Mingming thinks.

"In China, many VC/PE institutions and even the media often confuse the concept of S fund with S transaction, which leads many GPs to wonder whether they should find S fund to receive assets or do S fund, and even narrowly think that only S fund can help GP." Li Miao said.

The main difference between S fund and S transaction is that S fund is one of many participants in S transaction and a part of S market. S fund is a Secondary Fund, which specializes in investing in the private equity secondary market.

For example, there are Kohler Capital and TR Capital abroad, and there are Gefei S Fund, Nuelle S Fund, SIIC Shengshi S Fund (jointly established by Shengshi Investment and SIIC Group) and Shenzhen Venture Capital S Fund in China, which act as buyers in S transactions.

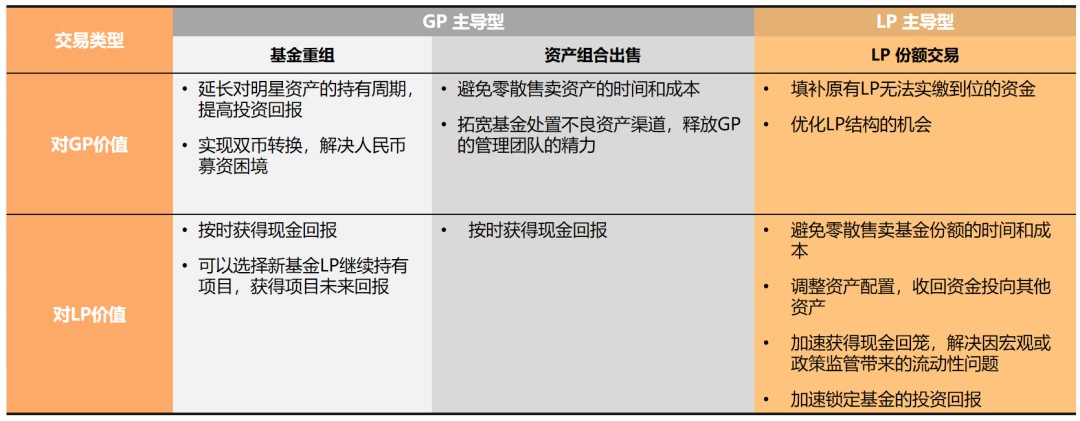

S transaction refers to the Secondary Transaction of private equity, which is commonly divided into two types: LP-led and GP-led.

Among various transaction types, GP and LP have achieved different requirements (source: Executive Middle School).

Most GPs in China are familiar with the LP-dominated trading mode, and most of them are the share transfer between LPs due to liquidity considerations. Because it is difficult to bring increment to the management scale of VC/PE funds, GPs generally have no driving force to actively cooperate with S trading links such as full adjustment and industrial and commercial changes.

What VC/PE in China ignores is that GP-led S transaction usually refers to a transaction in which GP takes the initiative to transfer one or more assets or fund shares to a new fund, and the new fund will continue to be managed by the existing GP or related parties. It is generally divided into various types, such as continuing fund, fund reorganization, late trading and tied trading.

After removing the misunderstanding of S-transaction and S-fund, we further analyze the value of GP-led S-transaction to VC/PE institutional managers.

For GP, what other "money-making" opportunities are implied in S trading?

Generally speaking, passive pressure and active interests are enough to drive more and more China GPs to actively participate in the private equity secondary market. This is Li Miao’s view.

As far as income is concerned, she learned that the income of investment institutions participating in S trading is considerable. "The first income from investing in S shares comes from discount income, but more income comes from the later appreciation of assets. We are familiar with S funds and financial institutions that have participated in the S market since 2021. "

For example, a fund restructuring transaction led by Kunzhong Capital, as the seller, created a 25% DPI for RMB funds. In addition, some investors revealed that the investment return performance of individual market-oriented S funds in China is better than that of mature foreign markets, and they are enjoying the early dividends in China’s S market.

However, the market dividend of S fund for LP share discount transfer will not last forever. "After a wave of market dividends in the downturn of the secondary market in 2018, the share of S in COVID-19 will be rapidly ignited in 2020, because the share of S can accelerate the cash return, reduce the risk of blind pools, and the discount rate will increase the return on income." As a parent fund practitioner for many years, Li Mingming, managing director of Xingnahe Capital, said.

After communicating with her peers, she basically reached a general consensus that the small LP share discount transfer has actually entered a relatively fierce level in China, and the "missing" behavior of buying and selling shares at low prices between LPs is difficult to last for a long time. In contrast, the complex S trading led by GP will gradually become a new trend.

"In the past two or three years, foreign GP-led transactions have gradually increased, and now it has accounted for half of S transactions, of which single assets have more transactions. The reason is not only related to the expiration of many foreign funds, but also because S trading has become one of the important exit paths for foreign M&A funds. Through S trading, M&A funds can retain assets for a longer period of time in order to obtain higher returns. " Kohler Capital Yang Zhan analyzes the differences between China and foreign countries.

Many people said that the two core pain points of fund-raising and withdrawal will force China GP to find more exit ways, and S-trading will gradually become an important supplement to various exit channels such as IPO, M&A and liquidation. This trend is basically consistent with the mature American market of private equity.

Although the multi-level capital markets such as Beijing Stock Exchange, Growth Enterprise Market registration system and science and technology innovation board can broaden the exit channels, the pressure of fund exit is still great, and a large number of funds are entering the liquidation period one after another, and the demand for fund late trading is great. "Looking back at the VC/PE industry in China, it experienced rapid development from 2015 to 2017, during which a large number of market-oriented funds were established with a term of 5-7 years. Now many funds have reached the liquidation period, and LP urgently needs liquidity. In addition, there are many funds that take money from the financial funds with a term of 10 years, and they have also come to the exit period one after another, and the enthusiasm of state-owned assets to participate in S-share trading is getting higher and higher. The stock market of domestic S transactions is very large, with a scale of more than 13 trillion yuan. " Huang Zhenlei, deputy general manager of Beijing Equity Exchange Center, told Entrepreneurship.

Why are "second-hand share" trading opportunities more active in the stock market era?

Kohler Capital Yang Zhan made an image metaphor: "The Beijing real estate market has entered the stock market, and the second-hand housing transactions are active, accounting for the vast majority of the total transaction volume, which is a bit like the reason that the private equity secondary market in China will gradually enter the stock market; The real estate market in Xiong’ an is just the opposite. The real estate development time is delayed in Beijing, and it is still in the era of first-hand housing transactions, and there will be no large-scale second-hand housing transactions for the time being. "

Yang Zhan is optimistic about the market potential of a large number of second-hand shares in China market. Kohler Capital, where he works, is the buyer of the private equity secondary market with the largest investment team in the world, and its investment strategy will also focus on the GP-led market.

Huang Zhenlei of Beijing Equity Exchange Center revealed to Entrepreneurship: "As the first pilot of S share transfer in China, the transaction volume of Beijing Equity Exchange Center has shown a substantial growth trend in the last two years. Last year, the transaction volume reached 1 billion, and it is expected to break through 10 billion yuan this year."

Then analyze the pressure of GP fundraising. Factors such as new asset management regulations, tight financial funds, and financial difficulties of listed companies lead to difficulties in LP’s capital contribution. The situation that LP’s subscribed capital contribution is not in place, LP requires DPI, and fund raising increases the pressure on GP to raise funds.

What is the root cause of the difficulty in raising funds for GP?

Li Miao has different perspectives: "Compared with other asset classes, private equity funds have a long cycle and high uncertainty of investment returns. The core reason is a serious shortage of liquidity. An illiquid asset is lifeless, and S trading can just solve the liquidity problem of private equity funds. Money is the smartest and will flow to assets that can generate returns, so now we can see that a larger amount of funds have entered the private equity secondary market. "

"Despite the existence of market demand and GP pain points, on the whole, the enthusiasm of domestic GPs to actively participate in S trading needs to be improved. Although they are interested in S trading, there are not many real participants. Compared with overseas developed markets, S trading in China market is still in the early stage, and the market space is very large. " Huang Zhenlei of Beijing Equity Exchange Center said.

Judging from the proportion of capital contribution, the main sellers in China S market may be finance, central enterprises, state-owned enterprises and financial institutions, but the buyer’s strength needs to be cultivated, the types of intermediary institutions need to be enriched, and the pricing mechanism for financial state-owned shares needs to be further improved. Judging from the transactions completed by Beijing Equity Exchange Center, although there are occasional packaged asset transactions and GP restructuring, the trading mode is relatively simple, and GP-coordinated LP share trading is still the mainstream.

"A core point is that when the assets invested by GP are really poor, it is not S trading that can solve the problems of withdrawal and fundraising, and the cart before the horse cannot be put". Li Miao reminds some players who want to participate in the transaction.

"Foreign fund managers and investors will use S trading as a tool to adjust their existing portfolios, just like buying stocks to adjust positions." Kohler Capital Yang Zhan said that the frequency of domestic players using S tools is obviously not high.

In addition, according to the observation of many domestic people, a new phenomenon has begun to appear in the China market. When some GPs encounter difficulties in fund-raising, they begin to use S trading tools and promise to sell some assets of new LP or past fund shares at low prices in exchange for the possibility of LP contributing to the new fund, so as to achieve the purpose of fund-raising. This practice of "tying up assets" belongs to bundled transactions.

"Although there are similar binding modes abroad, the thinking logic and original intention are different." Kohler Capital Yang Zhan reminds domestic players.

According to Li Miao, some FA will use Mingchi Continuation Fund when raising funds for GP. "this method is more suitable for new funds or GP that has just come out to raise funds and is being institutionalized. S tool can help GP create DPI performance. In addition, a single old stock and asset package transaction can also be used as a value exchange to create DPI for GP. With DPI, GP will make it easier for the new LP to see its historical performance and raise funds more conveniently. "

In fact, continuing fund and fund reorganization have become a new way of playing individual head GP in China in recent two years. "Asset restructuring seeks to withdraw, and generally packages a number of assets to speed up the withdrawal of funds and release more management energy of GP. It can also adjust investment strategies, turn to other track investments, and even actively optimize the LP structure and absorb institutionalized LP. In addition, you can also make a single project fund share transfer. " Huang Zhenlei of Beijing Equity Exchange Center said.

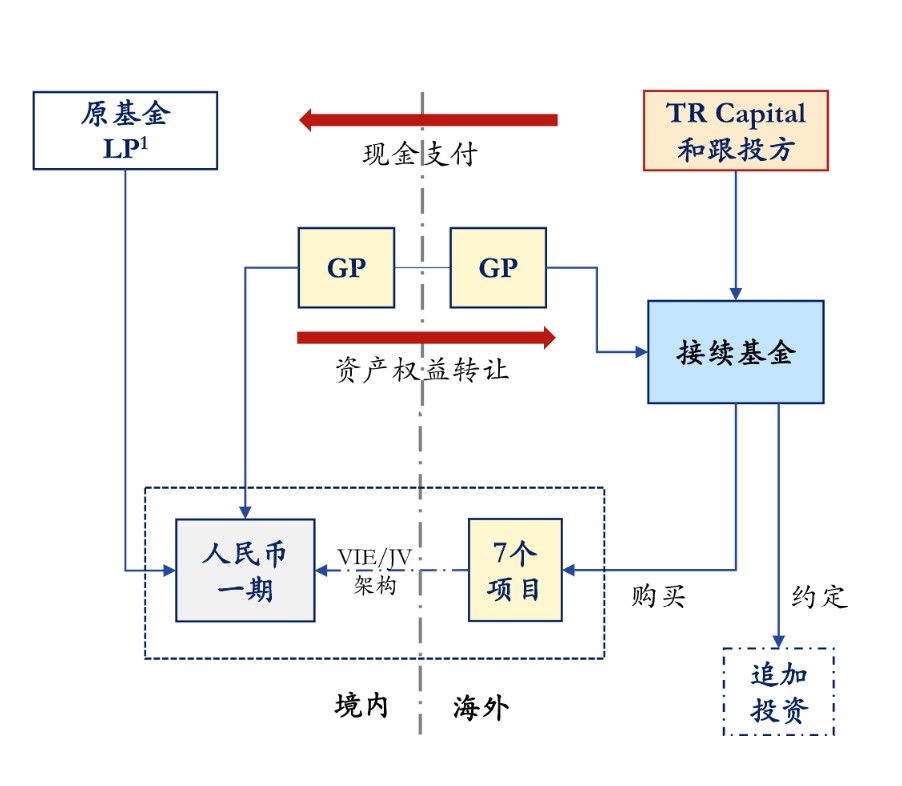

In China, the fund restructuring transaction known as the first RMB-to-US dollar fund in China is dominated by Kunzhong Capital.

In 2020, Kunzhong Capital packaged and sold seven projects to overseas entities set up by TR CAPITAL, creating a 25% DPI for RMB funds, and the transaction involved about 100 million US dollars. Through this S transaction, Kunzhong Capital completed the withdrawal of some RMB assets, and at the same time realized the raising of the first US dollar fund of Kunzhong Capital. Also completed the RMB-to-US-dollar fund restructuring transaction is Unconfused Capital, with the transaction scale exceeding 100 million US dollars. It can be seen that the GP-led S transaction can realize dual-currency conversion and solve the fundraising problem smoothly.

Kunzhong Capital Dollar Fund Reorganization Transaction Chart (Source: Guangchen Consultant "Ten Thousand Folds Must Be East")

Guangchen Consultant stated in "Ten Thousand Folds Must Go East" that Kunzhong Capital achieved a win-win situation among the three parties through this transaction. First of all, the original LP achieved considerable DPI through this transaction, which improved the overall cash performance of the fund in 2016; Secondly, the new LP has obtained the potential appreciation space of assets in the future; Thirdly, RMB LP helped GP upgrade to a dual-currency GP with more brand influence, paving the way for GP to enter the US dollar fund market for future financing.

In September, 2020, IDG led the completion of the S-fund restructuring transaction with NAV (Net Fund Share) exceeding USD 600 million, which became the largest publicly disclosed S-fund transaction in the history of China at that time.

This typical GP-led S-trade has injected a shot in the arm into the S-market. In the transaction, IDG packaged the portfolio of one of its RMB funds that has not been withdrawn into US dollar funds, involving more than 10 projects, and the buyer was a consortium led by Harbour Vest, an international parent fund management agency.

According to the observation of Entrepreneurship, the S transaction led by IDG capital is relatively active. At the beginning of this year, the largest single paid-in "QFLP+S" fund was established in Wuxi, which is also the first cross-border S fund of IDG to complete the payment.

Let’s look at the first publicly available large-scale RMB GP-led fund share restructuring transaction in China, with Huagai Capital as the leading party and Shenzhen Venture Capital S Fund participating as CO-GP.

The scale of this S fund is 800 million yuan. As the first RMB-structured reorganization and continuation fund in China, Huagai Capital has packaged many star projects such as Fuhong Hanlin. Through this continuation fund, Huagai Capital further enlarges the value of the portfolio, prolongs the holding period of star assets, and thus improves the return on investment.

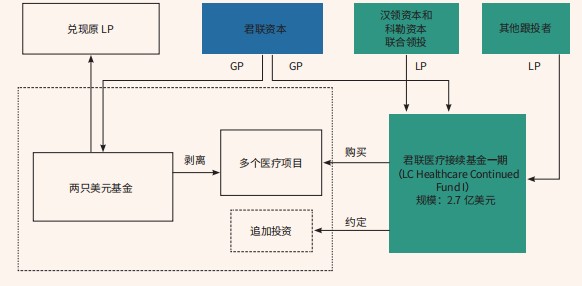

In addition, Junlian Capital also completed a typical GP-led medical continuation fund transaction in 2021, with a transaction scale of US$ 270 million. Among them, one of the important buyers of the transaction is Kohler Capital. Prior to this, in February 2020, Junlian also completed a $200 million continuation fund transaction.

Junlian Capital’s $270 million medical and health continuation fund transaction chart (Source: Zhongzhong)

Vilen, managing director of Xingnahe Capital, suggested that GP should have strong resource control ability, and it is best to find a professional intermediary or professional buyer to cooperate. Generally, GP may find it difficult to copy the existing gameplay of other GPs.

As one of the earliest S-trading practitioners in China, vilen thinks that the current S-market in China may not be as lively as most people feel. After all, the S-market in China is in its early stage, and the professionalism of the buyers and sellers involved in the transaction is extremely high. "S-trading is highly complex, the trading process is complex, the water is deep and there are many pits, so participants need to be cautious, otherwise there will be many potential risks."

Finally, many senior people said that there will be special trading opportunities and market dividends when the secondary market is depressed. 2022 is undoubtedly a good opportunity for S fund buyers to buy excellent assets, but it is not necessarily a good time for GP to sell assets.

If you are right"s trading topic"Interested, welcome to add the author’s WeChat communication (ID: ID:i20130214).

This article is original for the entrepreneurial state and may not be reproduced without authorization, otherwise the entrepreneurial state will reserve the right to pursue legal responsibility against it. If you need to reprint or have any questions, please contact editor@cyzone.cn.