In-depth report of Xiaomi Group (01810): Overseas market becomes a new engine of growth, and mobile phone ×AIoT creates an ecological moat.

Xiaomi Group is an Internet company with mobile phones, intelligent hardware and AIoT platform as its core. Starting from smart phones, Xiaomi has continuously expanded its business to all kinds of intelligent hardware, creating the world’s largest AIoT Internet of Things ecosystem. With its excellent intelligent hardware products, Xiaomi has gained a huge user traffic base. In 2021Q3, Xiaomi’s smartphone market accounted for the third place in the world, and the monthly activity of MIUI exceeded 500 million in November 2021. Based on the perfect product ecology and strong user growth, we expect Xiaomi to maintain a good growth momentum, and the EPS of 2021e/2022e/2023e is 0.80/0.88/1.04 yuan. We gave Xiaomi 2022E 21 times PE, corresponding to the target price of HK$ 23.09, and gave a buy rating for the first time.

Key points of investment

1. Grasp the rapid rise of the times, and excellent business strategies promote healthy growth.

Since its establishment in April 2010, Xiaomi has grasped the windfall dividend in the era of smart phones, and has developed into a smart phone manufacturer with the third market share in the world. In 2021Q2, its market share once surpassed Apple and jumped to the second place in the world. Xiaomi’s "triathlon" model continues to boost the company’s healthy growth through the coordinated growth of businesses: 1) the hardware ecology with smart phones as the core; 2) Internet service with MIUI as the core; 3) The new retail with the combination of online and offline represented by Xiaomi Mall Xiaomi Home.

2. Give full play to its own resource endowment and Xiaomi will enter the electric vehicle industry.

In March 2021, Xiaomi announced its entry into the electric vehicle industry. We think there are two main reasons: 1) looking for new business growth points in the future; 2) Give full play to its own advantages and improve the business ecosystem. The global smartphone market has entered the stock game, while the electric vehicle industry is in an explosive period, which is expected to become a new business growth engine of Xiaomi in the future; Electric vehicles will become an important part of Xiaomi’s hardware ecology, and its software and hardware research and development also overlap with smart phones in technology, which can make good use of Xiaomi’s technology and ecological resources.

3. "Mobile phone ×AIoT" is the core strategy to build an ecological moat.

Intelligent hardware business is the main way for companies to attract customers. Compared with traditional Internet companies, the high customer acquisition cost has achieved a "negative" customer acquisition cost. Then through the "1+4+X" hardware ecology, the user’s stickiness is greatly improved. Smartphone business in 2021Q2 exceeded expectations, and its market share surpassed that of Apple, ranking second in the world. However, in 2021Q3, affected by the supply chain, the performance of smartphones was under pressure. Xiaomi’s AIoT business has established the world’s largest AIoT Internet of Things platform through advanced layout. In 2021Q3, due to factors such as overseas shipping and logistics, the revenue of IoT and consumer products reached 20.9 billion yuan, and the growth rate slowed down. Internet services are realized by the traffic brought by hardware business, and the revenue in 2021Q3 was 7.34 billion yuan (+27% YoY), among which the advertising business grew against the trend and exceeded expectations.

Risk warning

Competition in the global smartphone market has intensified; The company’s high-end progress is less than expected; Overseas market expansion faces policy risks; The construction of offline channels is less than expected.

1. The rapidly rising upstart in science and technology has become an industry giant.

2. Build an ecological moat with the core strategy of "mobile phone ×AIoT"

3. Internet service is the core of ecological realization and profit.

4. The strategy drives the success of the enterprise, and there is much to be done in the short term.

5. Profit expectation and valuation

6. Financial statements

1. The rapidly rising upstart in science and technology has become an industry giant.

Xiaomi Group is an Internet company with mobile phone, intelligent hardware and AIoT platform as its core. With its smart phone as the core, the company has continuously expanded to all kinds of intelligent hardware, including tablet computers, notebook computers, smart bracelets and various household appliances, and built the ecosystem of Xiaomi AIoT Internet of Things platform.

Since Xiaomi was formally established in April 2010, the company has achieved amazing high-speed growth. In the third year of its establishment, its smartphone share has entered the top three in China. In the seventh year, the revenue has exceeded 100 billion yuan, and it has become the world’s largest intelligent hardware IoT platform; In the eighth year, it became the youngest enterprise in the world’s top 500, and it has been on the list for three consecutive years, and its ranking has been rising. In the second quarter of 2021, the company’s global smartphone sales surpassed Apple, and it was promoted to the second place in the world for the first time, with a global market share of 17%.

Chart 1: Milestones of Xiaomi Group

Source: Company official website, Zheshang International.

1.1. The company grew strongly in the first half of the year, and Q3 performance was constrained by the shortage of upstream supply.

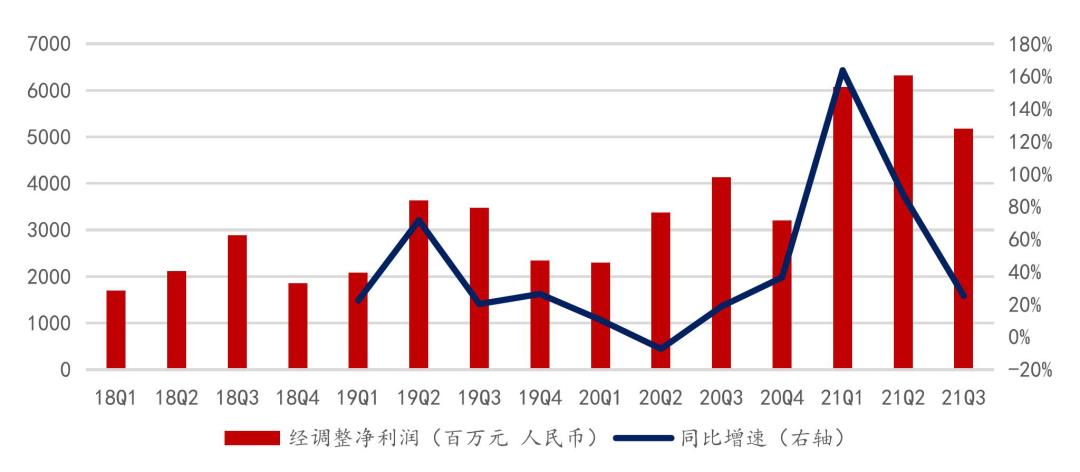

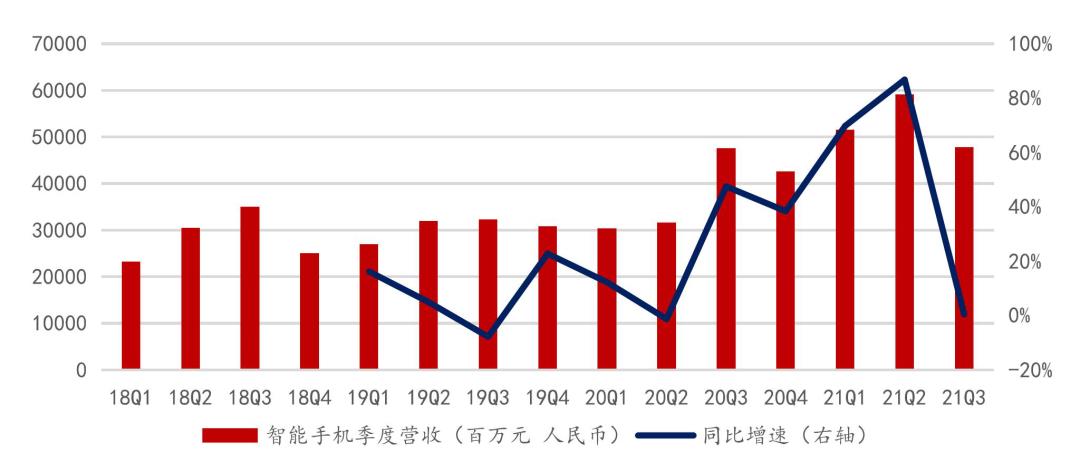

By the first half of 2021, the overall performance of Xiaomi Group’s 21H1 had a strong growth, benefiting from the substantial increase in smartphone shipments (+78% YoY) and the steady and progressive overall gross profit margin (+3 ppts YoY). The company achieved a total revenue of 164.7 billion yuan (+59.5% YoY) in 21H1, with a total profit of 16.1 billion yuan (+141.3% YoY) and an adjusted net profit of 12.4 billion yuan (+118.4% YoY). In the same period, 21Q2′ s total revenue, interim profit and adjusted net profit all reached record highs in a single quarter, reaching 87.8 billion yuan (+64.0% YoY), 8.3 billion yuan (+83.9% YoY) and 6.3 billion yuan (+87.4% YoY) respectively.

In 2021Q3, Xiaomi achieved a single-season revenue of 78.1 billion yuan (+8% YoY), with a year-on-year growth rate declining. The decline in revenue growth in 2021Q3 is mainly due to the tight supply of upstream core components, resulting in the pressure on mobile phone and intelligent hardware shipments. In 2021Q3, the shipment of smartphones was only 43.9 million units, a decrease (-5.8% YoY) compared with the same period last year. However, the overall gross profit margin of the company (18.3%) exceeded expectations, and the adjusted net profit reached 5.2 billion yuan (+25% YoY).

Chart 2: Xiaomi Group’s total quarterly revenue

Source: Company Financial Report, Zheshang International.

Chart 3: Xiaomi Group’s quarterly adjusted net profit

Source: Company Financial Report, Zheshang International.

1.2. Xiaomi Group’s products and businesses are diversified, and the "triathlon" grows together.

Xiaomi Group has diversified its products and businesses through its own business and investment layout. Up to 21H1, the company has invested in more than 330 eco-chain companies, and has built the world’s largest consumer AIoT Internet of Things platform, combining smart phones and Internet services, weaving a diversified product business structure.

1) The hardware ecosystem starts from the core smart phone, and the products extend to the peripheral products of the mobile phone (including headphones, mobile power supplies, routers and stereos, etc.), and then further involve all kinds of intelligent hardware (including water purifiers, rice cookers, balance cars and air purifiers, etc.), and finally even extend to all kinds of household consumables (including towels, toothbrushes, ornaments and clothing, etc.).

2) The product ecology of the Internet mainly takes MIUI operating system installed on Xiaomi mobile phone and various hardware as the entrance, and expands the company’s products and business to various Internet value-added services such as advertising, games and financial technology. In addition, it also includes e-commerce platforms independent of the MIUI system.

Chart 4: Xiaomi’s diversified business matrix

Source: Notes on Xiaomi Ecological Chain Battlefield, Zheshang International.

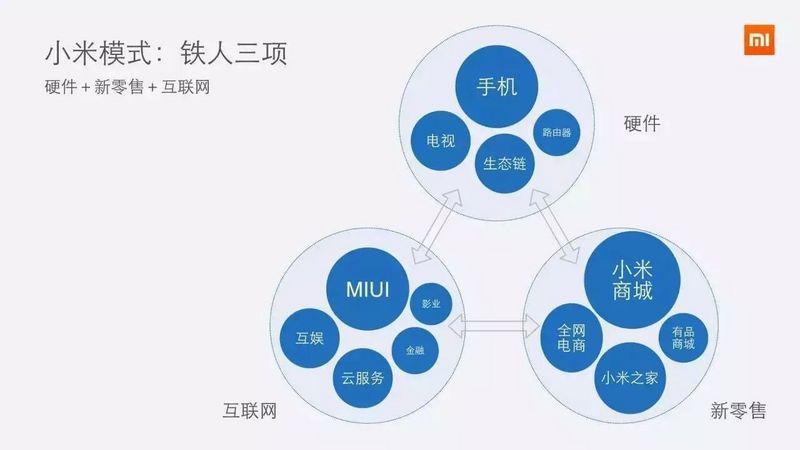

By combing and integrating Xiaomi’s business lines, we can divide it into three categories: 1) hardware ecology with smart phones as the core; 2) Internet service with MIUI as the core; 3) The new retail with the combination of online and offline represented by Xiaomi Mall Xiaomi Home.

These three categories are also defined by the company as the "triathlon" business model: using highly cost-effective hardware equipment to get customer drainage and guide traffic to Xiaomi’s Internet service; Internet services realize traffic realization by providing various Internet value-added services to hardware users; New retail plays the role of a catalyst for drainage efficiency, and realizes the development and retention of user traffic through the development of online and offline retail channels.

Chart 5: Xiaomi’s triathlon business model

Source: Prospectus, Zheshang International

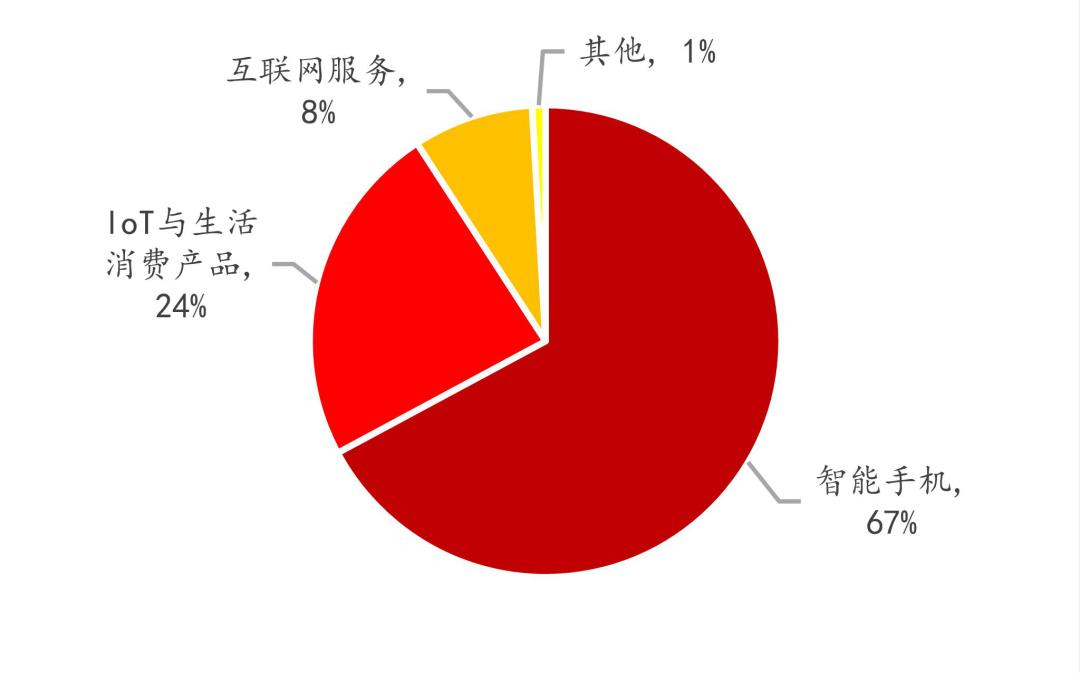

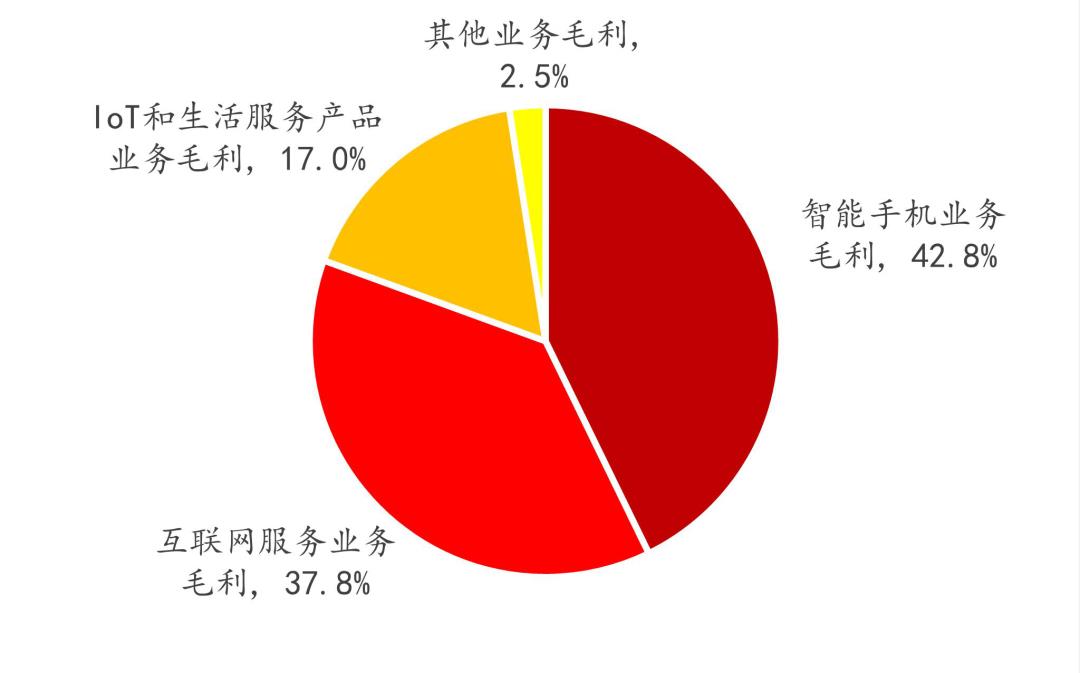

The business model of "triathlon" hardware ecological drainage Internet service realization can also be seen from the company’s profit structure. In the total revenue structure of Xiaomi in 2021Q3, the total revenue of smartphones, loT and consumer products accounted for 88%, while the total gross profit only accounted for 60% of the company’s total gross profit level; On the other hand, the revenue from Internet services only accounts for 9% of the total revenue, but it contributes nearly 38% of the company’s gross profit. This profit structure intuitively reflects the company’s low gross profit margin level in hardware business, which is also in line with Xiaomi’s long-standing cost-effective route and the commitment that the comprehensive net profit margin of hardware business does not exceed 5%, and the user traffic is obtained by price exchange.

Xiaomi has positioned itself as an internet company rather than a hardware company, and its efficiency is extremely high compared with that of ordinary internet companies by means of hardware ecological drainage. At a time when Internet traffic resources are precious and the cost of obtaining customers is rising, attracting traffic through the cost-effective hardware ecology not only makes profits while draining, but also greatly strengthens the user’s stickiness.

Chart 6: Proportion of Xiaomi’s business income to total income in 6:2021Q3

Source: Company Financial Report, Zheshang International.

Chart 7: Gross profit ratio of Xiaomi’s businesses to total gross profit in 7:2021Q3

Source: Company Financial Report, Zheshang International.

However, Xiaomi does not stop at the price/performance ratio. After occupying the target customers who pay attention to the price/performance ratio and price sensitivity, in order to expand the target customer market and enhance the brand positioning of Xiaomi, the company started its own high-end road.

In 2019, the company announced that Redmi Redmi series mobile phones will be independent as a brand new brand, continuing the past cost-effective strategy, focusing on the thousand yuan machine market, and the brand label of "extreme cost-effective" is deeply rooted in the hearts of the people; The Xiaomi brand is positioned in the middle and high end, focusing on the price range of 2,000 yuan to 3,000 yuan or more, and positioning different customer groups through different series to expand the market scale and realize the overall high-end and differentiation. For example, the Mix series, the Civi series and the G series, etc.

Among them, the Civi series released in the second half of 2021 accounted for more than 60% of the new users of Xiaomi by 2021Q3, and the female users accounted for more than half, which well penetrated into the customers who prefer fashion; Gaming mobile phones contribute to the internet business by covering the corresponding population, and their users’ game income is three to four times that of mobile phones at the same price segment.

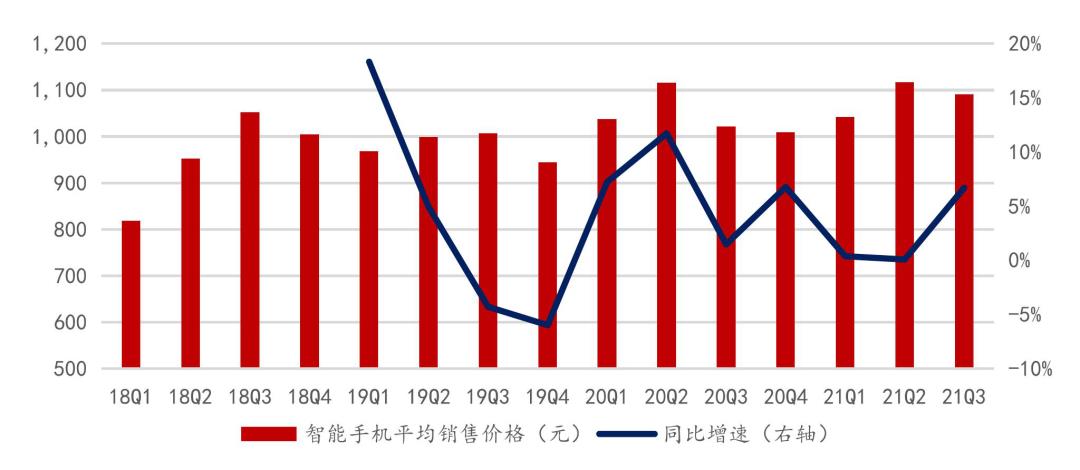

Xiaomi’s high-end strategy has been steadily advanced. In the first three quarters of 2021, Xiaomi shipped nearly 18 million smartphones priced at 3,000 yuan in the mainland and 300 euros or more overseas, accounting for more than 12% of the total global shipments. In addition to the domestic market, Xiaomi is also promoting the high-end overseas market. In 2021Q3, Xiaomi’s overseas smartphone shipments with a price of 300 euros and above increased by over 180% year-on-year. Benefiting from the increase in the proportion of high-end mobile phone shipments, the average selling price (ASP) of the company’s smart phones has stabilized above 1000 in the past two years.

Chart 8: Average selling price of Xiaomi smartphone

Source: Company Financial Report, Zheshang International.

Chart 9: Xiaomi Smartphone Product Matrix

Source: Company official website, Zheshang International.

1.3. Xiaomi officially entered the smart electric vehicle industry.

Xiaomi’s business extension does not stop at the moment. In March this year, Xiaomi Group announced that Xiaomi’s smart car business was officially established and officially entered the electric vehicle industry. And plans to set up a wholly-owned subsidiary, with Lei Jun as the CEO of smart car business. The initial investment is 10 billion yuan, and the estimated investment in the next 10 years will reach 100 billion yuan.

In September this year, Xiaomi Automobile was officially registered with a capital injection of 10 billion yuan, with Lei Jun as the legal representative, and the first automobile manufacturing factory settled in Yizhuang, Beijing. The company said on the investor’s day in October that all processes of the electric vehicle business far exceeded expectations, and it is expected that Xiaomi Automobile will be officially mass-produced in the first half of 2024.

1.3.1. Why should we enter the electric vehicle industry?

Regarding why Xiaomi wants to enter the electric vehicle industry, we think it can be explained from two aspects: 1) looking for new business growth points in the future; 2) Give full play to its own advantages and improve the business ecosystem.

1) Looking for new business growth points in the future.

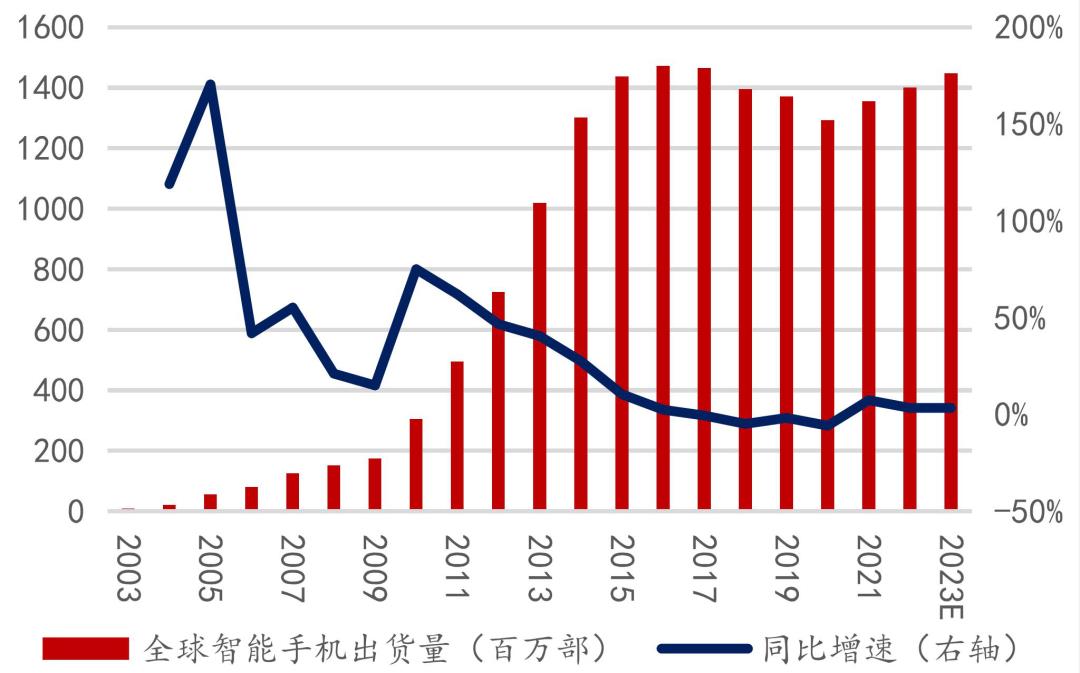

The global smart phone market has entered the stock game, while the smart electric vehicle industry is in an explosive period. According to IDC data, global smartphone shipments have recorded negative growth for four consecutive years since reaching a high point in 2016. Driven by the strong recovery in several emerging markets, shipments rebounded (+4.8% YoY) in 2021, and the compound annual growth rate in the next two years is expected to be only about 3%-4%.

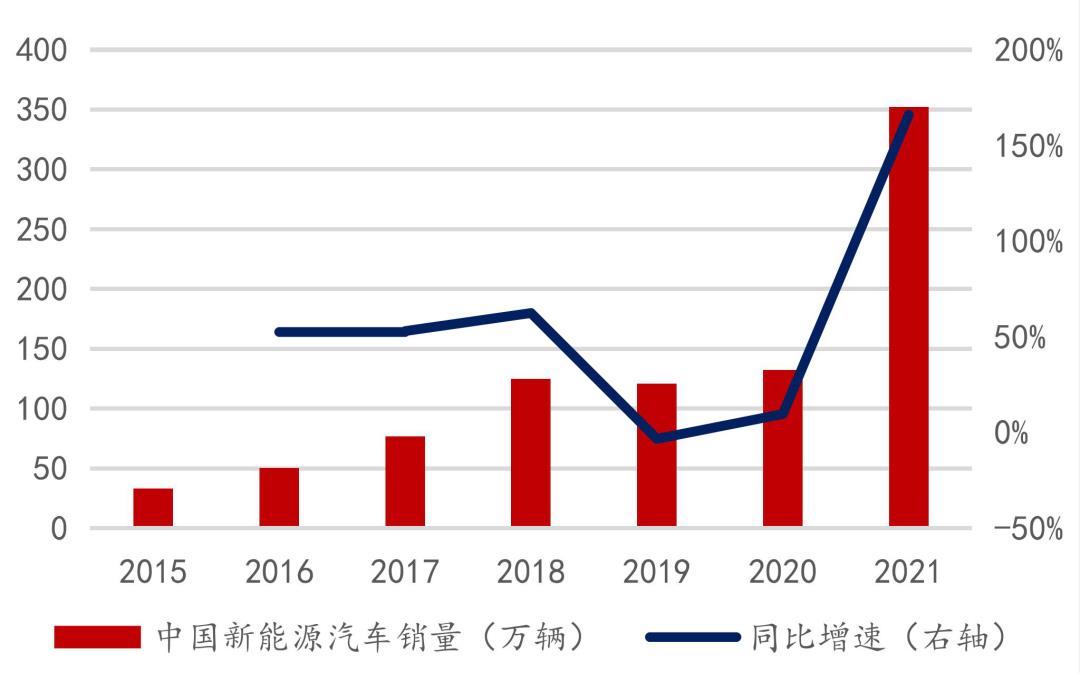

However, the smart electric vehicle industry is another scene. After experiencing the decline of the automobile industry in 2019 and 2020, the new energy automobile industry ushered in an outbreak this year. According to the statistics of China Automobile Association, the sales volume of new energy vehicles in China in 2021 exceeded 3.52 million, a year-on-year increase of more than 160%, far exceeding industry expectations. And this achievement was completed under the circumstance that the automobile industry was generally "lack of core" this year. In addition, the market penetration rate of new energy vehicles in China will be 13.4% in 2021, and according to "New Energy Vehicle Industry Plan 2021-2035" issued by the State Council, the sales penetration rate of new energy vehicles in China will reach at least 20% by 2025, and the market space to be tapped is huge.

In addition, we compare the market size of smart phones and new energy vehicles, and we can find that the difference between the two markets is more obvious. According to Gartner’s calculation, in 2019, the size of China’s automobile and automobile aftermarket is about 10 times that of the mobile phone market. The smart electric vehicle business is expected to become a new performance growth point of the company in the future.

Chart 10: Global smartphone shipments

Source: IDC, Zheshang International

Chart 11: Sales of New Energy Vehicles in China

Source: China Automobile Association, Zheshang International.

2) Give full play to its own advantages and improve the business ecosystem.

Under the wave of intelligent electric vehicles, the automobile industry is transforming from machinery industry to information industry and consumer electronics industry. More than half of the bill of materials of the whole vehicle is electronic parts, and this proportion will be higher and higher, and the research and development costs will also focus on electronic parts in the future. As the global leader in smart phones and IoT intelligent hardware, Xiaomi has its inherent advantages in software and hardware ecology, supply chain resources and sales channels.

Based on the "1+4+X" IoT category strategy, Xiaomi has built the world’s largest intelligent hardware IoT platform. In "1+4+X", "1" refers to mobile phones, "4" refers to televisions, smart speakers, routers and notebooks, and "X" refers to various IoT products provided by eco-chain enterprises and cooperative enterprises. As the intelligent single product with the highest single value, the intelligent electric vehicle is expected to become a new important part of the IoT strategy, realize ecological synergy with other intelligent hardware, and give play to Xiaomi’s huge ecological user resource advantages.

Smart phones and smart cars have a certain overlap in communication, software and architecture, which is conducive to Xiaomi’s advantages in intelligent software and hardware accumulated over the years. In terms of software, for example, Xiao Ai’s students enter the car human-computer interaction system, MIUI’s in-vehicle service, etc., in terms of hardware, Xiaomi can give full play to the supply chain management advantages of intelligent hardware for many years, including supplier resources such as foundry companies and chip manufacturers. Considering the current shortage of automotive software technicians in the talent market, Xiaomi’s mobile phone department is also conducting regular technical exchanges with the automotive team, and even directly exporting software technicians to the automotive team.

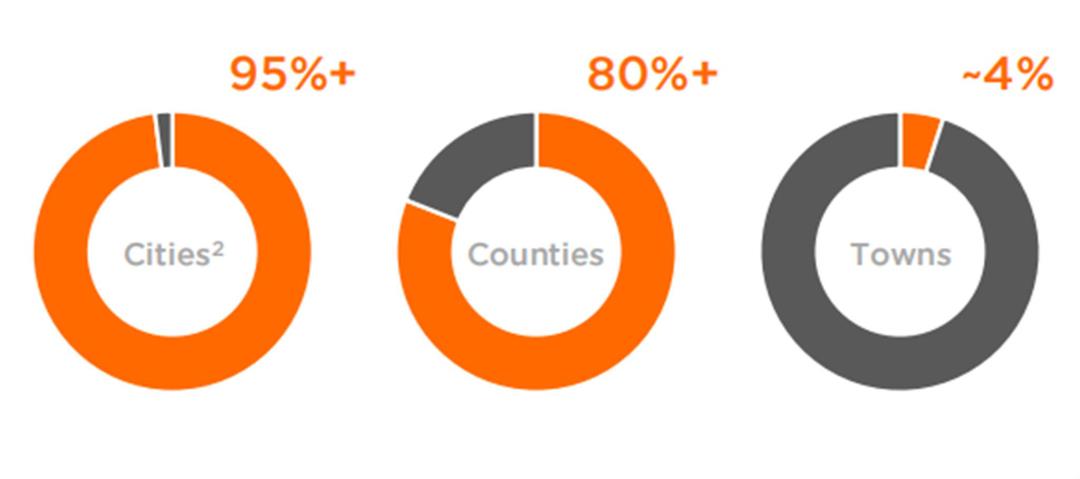

The advantage of Xiaomi’s sales channel will be an important guarantee for the development of its smart electric vehicle business. Xiaomi Home will become an important scene for users to experience Xiaomi Automobile and assume an important role in the sales and service of Xiaomi Automobile. By October 2021, the number of Xiaomi Home’s stores had reached 10,000 (only 3,200 by the end of 2020), covering 95% of cities, 80% of counties and 4% of towns, and it is planned to reach 30,000 in the next three years. It is worth mentioning that in the future, in addition to the rapid spread of Xiaomi House in quantity, its high leveling effect is far superior to that of domestic peers.

Chart 12: Number of Xiaomi’s stores in Chinese mainland.

Source: Company Announcement, Zheshang International.

Chart 13: The store coverage of Xiaomi in Chinese mainland.

Source: Company Announcement, Zheshang International.

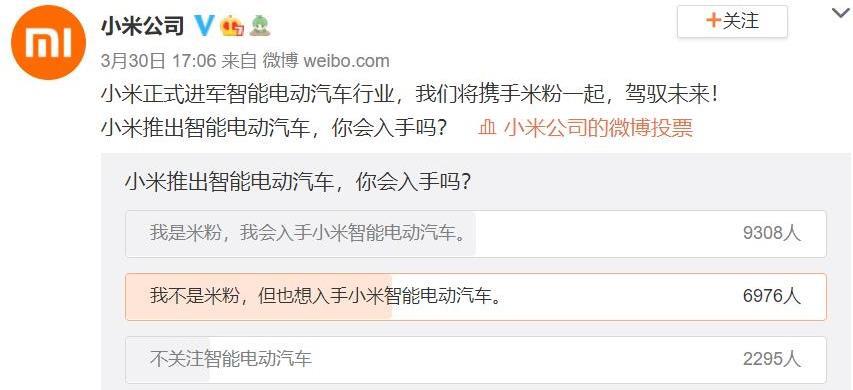

Consumer recognition of Xiaomi’s entry into the smart electric vehicle industry is also the basic disk for future business development. Before the official announcement of building the car, Xiaomi launched a poll in Weibo, and nearly 87% of the users who participated in the poll expressed their willingness to buy.

Chart 14: User Survey of Xiaomi Smart Electric Vehicle in Weibo

Source: Sina Weibo, Zheshang International.

2. Build an ecological moat with the core strategy of "mobile phone ×AIoT"

2.1. "Mobile phone ×AIoT" is Xiaomi’s strategic highland.

We mentioned above that in Xiaomi’s triathlon model, hardware business is regarded as the main way for the company to attract customers. Xiaomi promises that the comprehensive net profit rate of hardware business will not exceed 5%. Although the hardware profit level is lower than that of traditional hardware enterprises, such a strategy has unique advantages from the perspective of the company’s own positioning of Internet enterprises.

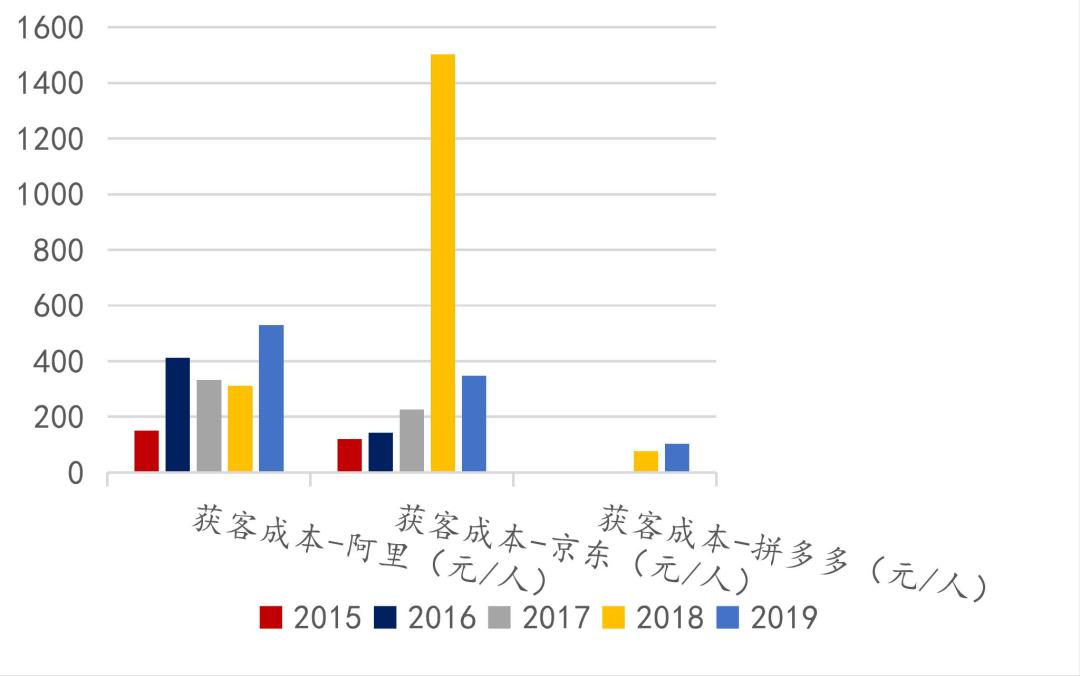

At present, Internet users in China have entered the era of stock competition, and the customer acquisition cost of Internet companies is increasing year by year. Taking the e-commerce industry with fierce competition in China as an example, we can see that the penetration rate of online shopping users has gradually peaked in recent years, and the growth of the number of online shopping users is under pressure. In addition, there are more and more newcomers in the industry, which has led to the increase in customer acquisition costs of major Internet e-commerce platforms year by year. Xiaomi’s model is another way. Relying on its cost-effective hardware, it not only attracts a lot of user traffic, but also achieves a "negative" customer acquisition cost, and then greatly improves user stickiness through its "1+4+X" hardware ecosystem. As an ecological strategy of Xiaomi’s hardware, "mobile phone ×AIoT" will be the core strategy of Xiaomi in the next decade, and its importance is equivalent to that of WeChat to Tencent.

Chart 15: The customer acquisition cost of major e-commerce platforms is increasing year by year.

Source: Iresearch, Zheshang International

Chart 16: The penetration rate of online shopping users has gradually peaked.

Source: Wind, Zheshang International

From the evolution of Xiaomi’s hardware ecological strategy, we can see the company’s vision of its hardware ecology in the future. From "All in IoT" in 2018 to "mobile phone+AIOT" in 2019, and then to "mobile phone ×AIoT" in 2020. We can see from these two strategic changes: 1) the strategic complementarity between smartphone as the core and AIoT; 2) Eco-chemical reaction from "mobile phone plus AIoT" to "mobile phone with AIoT". That is to say, with smart phones as the core, we will continue to make efforts to form a hardware ecosystem with AIoT, and with a variety of hardware devices and a massive user base, we will realize further data precipitation and ecological chain development, which in turn will feed back the virtuous circle of smart phones and AIoT services and take the lead in the future Internet of Everything era. At present, Xiaomi’s "mobile phone ×AIoT" strategy has achieved remarkable results, and it still maintains a strong growth momentum.

2.2. Smartphone business 21H1 exceeded expectations, and the upstream supply of Q3 was under pressure.

Xiaomi’s smartphone business revenue in 2021H1 reached RMB 110.6 billion (+78.5% YoY), and the strong growth of revenue was mainly due to the substantial increase of Xiaomi’s mobile phone shipments in the first half of the year (+77.9% YoY). Especially in 21Q2, the company’s smartphone revenue and global mobile phone shipments reached record highs, reaching 59.09 billion yuan (+86.8% YoY) and 52.9 million units (+86.9% YoY). According to Canalys data, with the global mobile phone shipments of 21Q2, the company’s global smartphone market share reached 16.7%, surpassing Apple’s first promotion to the second place in the world; The market share in the domestic smartphone market ranked third, rising to 16.8%(+6.5 ppts YoY).

In 2021Q3, due to the shortage of upstream core components, the global shipment of Xiaomi smartphones dropped from a high level to 43.9 million units (-5.8% YoY). Affected by this, Xiaomi’s smartphone business revenue in 2021Q3 only increased by 0.5% year-on-year to 47.8 billion yuan. In the same period, with the strong sales of iphone 13 series, Apple replaced Xiaomi and returned to the second place in the global smartphone market. In the domestic market, the surge of glory shipments in 2021Q3 also made Xiaomi’s market share in China drop to the fourth place. Although the shortage of upstream supply is difficult to completely improve in the short term, we still believe that the shipment of Xiaomi smartphone 2021Q4 is expected to pick up with the help of domestic and international promotion activities in the fourth quarter.

Chart 17: Quarterly Revenue of Xiaomi’s Smartphone Business

Source: Company Financial Report, Zheshang International.

Chart 18: Global shipments of Xiaomi smartphones

Source: Company Financial Report, Zheshang International.

2.2.1. Xiaomi’s globalization strategy has achieved remarkable results.

With the negative growth of domestic smartphone shipments year by year, it is inevitable for Xiaomi to accelerate the pace of globalization. We counted the changes of domestic mobile phone shipments from 2012 to 2020, and found that domestic mobile phone shipments reached a high point in 2013, and the annual shipments in 2014 shrank by nearly 22% year-on-year. After a slight rebound in 2015 and 2016, domestic mobile phone shipments have maintained a decreasing trend year by year. Xiaomi reached the top of the domestic smart phone market in 2014Q2, and started globalization in the same year, which just echoed the trend change of the domestic mobile phone market at the time point.

Chart 19: Domestic Mobile Phone Shipments

Source: Wind, Zheshang International

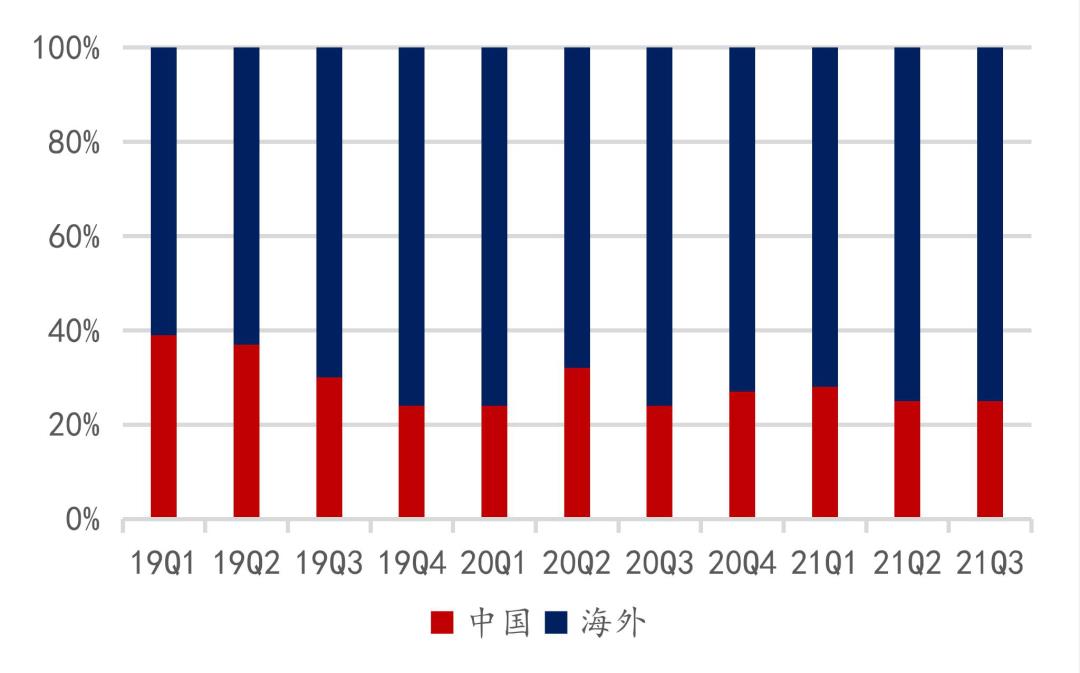

At present, the globalization of the company has achieved remarkable results. The company’s 21H1 revenue in overseas markets reached 81 billion yuan, maintaining a strong growth (+65.9% YoY), accounting for 49.2% of the total revenue. Among them, 21Q2′ s overseas income reached a record high, reaching 43.6 billion yuan (+81.6% YoY), accounting for 49.7% of the total income (+1.05 ppts qoq). According to Canalys data, in 2021Q2, Xiaomi ranked in the top five in 65 markets around the world, among which it ranked first in 22 markets. Moreover, 10 of them ranked first for the first time, showing the strong growth of Xiaomi in overseas markets.

In 2021Q3, the proportion of Xiaomi’s overseas income continued to increase, and the proportion of Xiaomi’s total income increased to 52.4%. Affected by the decline in global smartphone shipments, Xiaomi’s smartphone market share has declined in some parts of the world. In 2021Q3, Xiaomi ranked first in 11 countries and regions around the world, and ranked in the top five in 59 countries and regions around the world. In some overseas countries and regions, the carrier channel is the mainstream of mobile phone sales. In 2021Q3, the shipment of Xiaomi smartphones in overseas carrier channels exceeded 6.8 million units, a year-on-year increase of over 130% (excluding the Indian market).

It is worth mentioning that as the first stop for Xiaomi to go to sea in 2014, the success of the Indian market can be said to be the epitome of Xiaomi’s success in overseas markets. In 2017Q4, it only took Xiaomi more than three years in India to achieve the first shipment in the Indian smartphone market, with a market share of 26.8%. Since then, as of 2021Q3, Xiaomi has maintained the first market share in the Indian smartphone market for 16 consecutive quarters.

With the continuous expansion of Xiaomi in overseas markets, the company aims to hit the throne with the largest global market share in the next five years.

Chart 20: Regional proportion of Xiaomi smartphone shipments

Source: Company Financial Report, Zheshang International.

Chart 21: Regional Structure of Xiaomi Group’s Total Revenue

Source: Company Financial Report, Zheshang International.

2.3. AIoT builds the era of Internet of Everything, and Xiaomi has taken the lead.

Xiaomi’s AIoT is the artificial intelligence Internet of Things, which is the technical integration of AI (artificial intelligence) and IoT (Internet of Things). We believe that the essence of AIoT is a data-based ecosystem. The IoT of the Internet of Everything promotes the development of AI through its huge data precipitation, which in turn realizes a smarter IoT Internet of Everything and realizes a virtuous circle.

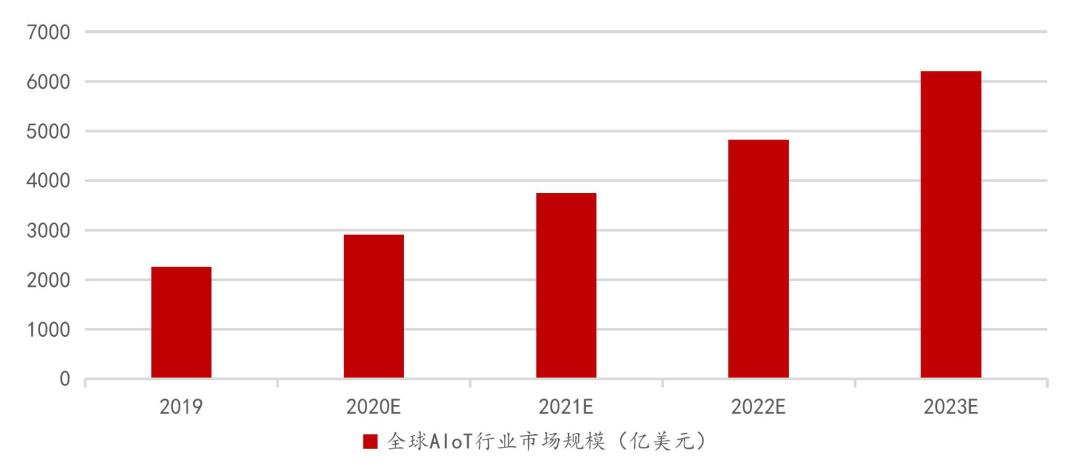

The AIoT industry is currently in a period of rapid development. According to the data of IoT Analytics, the global market size of the AIoT industry is expected to reach a compound growth rate of 29% from 2020 to 2023. In view of the huge market scale and sustained strong growth momentum of the AIoT industry, new players are constantly pouring in, especially mobile phone manufacturers with Internet of Things portals, which have launched their own IoT strategies, such as Huawei’s "1+8+N" strategy, the IoT open ecological alliance established by vivo through Jovi IOT, and OPPO’s "Building a Three-Circle Model".

Chart 22: Global AIoT Industry Market Size

Source: IoT Analytics, Zheshang International

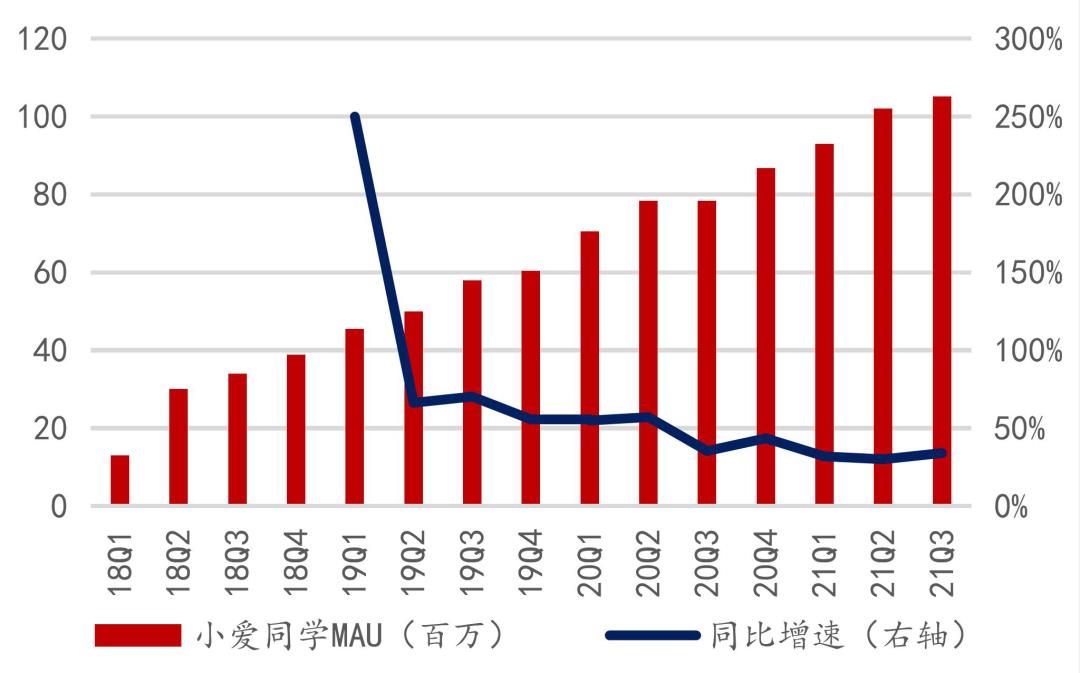

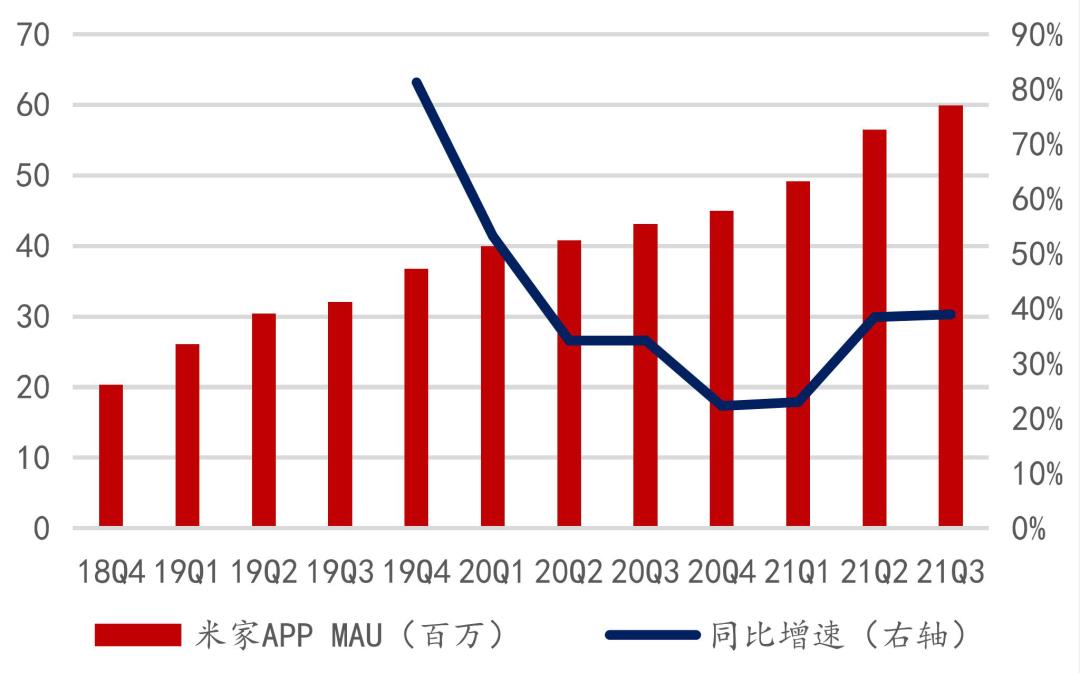

Xiaomi, as the early layout of the AIoT track, has already taken the absolute lead. Since the layout began in 2013, it has built the world’s largest consumer AIoT Internet of Things platform company. By the end of Q3, 2021, the number of IoT devices connected by Xiaomi has exceeded 400 million, and it can still maintain a high growth rate of 33% year-on-year, among which the number of users with five or more devices is as high as 8 million, with a year-on-year growth rate of 43%. In addition, in 2021Q3, the monthly users of Xiaoai classmate and Mijia APP reached 110 million and 60 million respectively, up by 34% and 39% respectively.

Chart 23: Connection number of Xiaomi IoT devices

Source: Company Financial Report, Zheshang International.

Chart 24: Number of users with 5 or more devices

Source: Company Financial Report, Zheshang International.

Chart 25: Xiao Ai classmate MAU

Source: Company Financial Report, Zheshang International.

Chart 26: Mijia APP MAU

Source: Company Financial Report, Zheshang International.

Benefiting from the hot sales of various IoT products, the company’s IoT and Consumer Products Division 2021H1 achieved revenue of 39 billion yuan (+38% YoY), of which Q2 reached 20.74 billion yuan (+36% YoY). It is worth mentioning that Xiaomi’s IoT business has grown strongly overseas. In 2021Q2, the revenue of overseas IoT and consumer products increased by 93.8% year-on-year, and the growth rate was significantly higher than the domestic market. Among them, electric scooters, smart bracelets and other categories have become popular explosions in overseas markets. In 2021Q3, affected by panel price increase and overseas shipping logistics, the business growth rate slowed down to 15.5% year-on-year, and the revenue was 20.9 billion yuan. The company expects that the problem will be alleviated in 2022 and has confidence in restoring the previous strong growth momentum.

Chart 27: Quarterly Revenue of Xiaomi IoT and Life Service Products Business

Source: Company Financial Report, Zheshang International.

As an important eco-portal hardware, Xiaomi TV, Xiaoai speaker, Xiaomi notebook and Xiaomi router are all in an important position in the industry.

According to the statistics of Aowei Cloud, by the end of 2021Q3, the shipments of Xiaomi TV in Chinese mainland ranked first for 11 consecutive quarters, and the global smart TV shipments ranked in the top five. In terms of smart speakers, according to IDC data, the domestic smart speaker industry is highly concentrated. In 2020, the industry Top3 accounted for nearly 96% of the total, and Xiaomi ranked in the top three, with a market share of 27%.

As the core of intelligent hardware data transmission, router plays an important role in Xiaomi’s AIoT ecology. In 2020, the global shipment of Xiaomi router exceeded 15 million units, and in 2020Q4, it was the second in Chinese mainland, with a market share of 20.6%. In 2021, the sales volume of Xiaomi router exceeded 20 million. In addition, according to ZDC’s statistical survey, in 2021, the brand attention of Xiaomi router in the domestic wireless router market was second only to Huawei and TP-LINK, ranking third in the industry.

In addition to the basic functions of the router, Xiaomi constantly strengthens the position of the router as the data transmission hub of intelligent hardware. By developing various new functions related to Xiaomi’s intelligent devices, it enhances the synergy effect of Xiaomi’s AIoT ecology, the user experience of hardware devices and the user’s stickiness to the ecology. For example, the router with the function of "Xiaomi carefree connection" is equipped with an independent AIoT antenna. With Mijia APP, you can automatically find Xiaomi intelligent hardware devices that are not connected to the network. You can configure the network with one button without entering a password or complicated settings, which greatly reduces the learning cost of configuring Xiaomi AIoT ecology, and it is easy for the elderly and children at home to operate. There is also the "WiFi encryption synchronization" function of the router. After the router modifies the WiFi password, it will synchronize the new password to all Xiaomi smart devices, and the devices will automatically connect to the router with the new password without resetting the distribution network one by one. This is a great improvement in the user experience at the moment when there are more and more types of Xiaomi AIoT ecological hardware devices.

Chart 28: Xiaomi carefree company

Source: Xiaomi Mall, Zheshang International.

Chart 29: WiFi encryption synchronization

Source: Xiaomi Mall, Zheshang International.

Compared with the saturation of the global smart phone market and the uncertain smart electric vehicles, we believe that Xiaomi AIoT will be an important driving force for the future growth of Xiaomi’s performance. According to the company’s estimation, the volume of the company’s overseas IoT market is expected to reach three to four times that of the China market in the future. At present, the revenue of the company’s AIoT business accounts for about 25%-30%. With the further development of the AIoT business overseas, its revenue share is expected to increase in the future. This also echoes Lei Jun’s prediction that "in the next decade, the proportion of IoT business of Xiaomi Company is expected to reach 40%-50%" at the Xiaomi IPO meeting in 2018. In addition, the gross profit margin of the company’s overseas IoT business is higher than that of China, which is conducive to promoting the overall gross profit margin of the company.

2.3.1. "Bamboo Forest" effect breeds AIoT ecology.

Xiaomi has built the world’s largest AIoT platform ecosystem, and its current number of device connections and monthly users of software can still maintain a strong growth of at least 30%, which is inseparable from Xiaomi’s continuous investment and cultivation in the AIoT ecological chain. Its investment and cooperation mode with the "millet ecological chain" enterprises is also talked about, which is called "bamboo forest effect".

In Xiaomi’s official work "Notes on Xiaomi Ecological Chain Battlefield", it is mentioned that the "evergreen foundation" of traditional enterprises is more like a century-old pine tree, which not only needs years of accumulation, but may be uprooted once it encounters strong winds and waves; In the rapidly changing Internet era, just a few years may determine the fate of a company, just like a bamboo, its life cycle is very short. However, bamboo is transformed into a bamboo forest by the way of "ecological chain". Although the life cycle of each bamboo is not long, this bamboo forest is constantly growing through continuous incubation and renewal iteration.

When Xiaomi built its own ecological chain, it followed this thinking. Through the mode of investment and cooperation, a large number of intelligent hardware companies entered the "Xiaomi Ecological Chain" and quickly occupied their respective sub-segments by making explosions. By the end of 2021Q2, Xiaomi had invested in more than 330 companies, among which many early eco-chain enterprises had become the industry leaders and listed on the capital market, such as Huami Technology, which focuses on smart wearable devices, Yunmi Technology, which is the manufacturing and research of small household appliances, and No.9 robot of robot products.

Specific to the mode of cooperation and incubation with eco-chain enterprises, Xiaomi generally shares in eco-chain enterprises through the investment principle of "holding shares but not holding shares", regards the investment enterprises as "brother companies", conducts business in a cooperative way, and helps eco-chain enterprises to create explosives and quickly occupy their respective sub-tracks through Xiaomi’s own advantages in supply chain, products and brand channels.

1) in the supply chainWith its advantages in sales volume, Xiaomi has a strong bargaining power in the supply chain, which may help eco-chain companies reduce procurement costs in terms of common parts;

2) In terms of productsXiaomi will deeply participate in the early product definition and design to ensure the overall harmony of the tonality of the ecological chain products. Some intelligent hardware products can also access the Xiaomi smart home ecology through Mijia APP;

3) In terms of brand channelsThe products of eco-chain enterprises can not only save a lot of brand marketing expenses with the help of Xiaomi’s brand advantages, but also enter various sales channels of Xiaomi. Online channels include Xiaomi official website, Xiaomi Youpin and third-party e-commerce platforms, while offline channels include Xiaomi Home with over 10,000 households.

In recent years, with the continuous growth of eco-chain enterprises, some excellent enterprises, such as Roborock, have been listed on the capital market. In order to strengthen the control of their own supply chain and get rid of the cost-effective positioning of products from Xiaomi, some eco-chain companies that have successfully grown or even listed have begun to appear the voice of "going to Xiaomi".

However, considering that Xiaomi invested in shares as a "brother company" from the very beginning, and Xiaomi is still an important shareholder, we believe that "de-Xiaomi" is only a move towards high-end branding in the later development process, and the continuous integration with Xiaomi’s AIoT ecology will continue, and Xiaomi will also benefit from the investment income brought by the long-term growth of eco-chain companies. In this process, eco-chain enterprises have met consumers’ demand for high-end intelligent hardware and completed the high-end of their own brands, which in turn is conducive to Xiaomi’s gradual getting rid of the label of "cost performance" and boosting the high-end of Xiaomi in terms of ecology and channels.

3. Internet service is the core of ecological realization and profit.

As mentioned in Xiaomi’s triathlon model above, Xiaomi’s Internet service business undertakes the huge traffic brought by "hardware+new retail", and provides various Internet value-added services such as user advertisements, games and financial technology with MIUI operating system as the carrier.

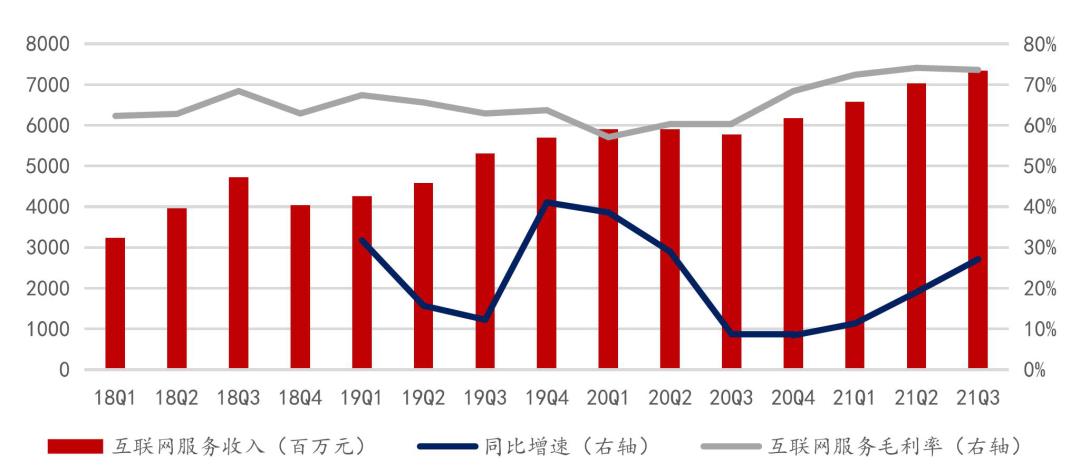

The reason why the Internet service business is the core of Xiaomi’s ecological realization and profitability is that although the income of the Internet service business is relatively small compared with other business segments, it benefits from the high gross profit level of the Internet service business, and its gross profit level plays a very important role in the overall gross profit of the company, which has improved the profitability of the whole company. Taking the latest 2021Q3 performance as an example, the company’s Internet service business revenue only accounts for 9.4% of the total revenue, while gross profit accounts for 37.8% of the company’s total gross profit. This is due to the fact that the gross profit margin of the Internet service sector far exceeds that of other sectors. The gross profit margin of the Internet service sector is as high as 74%, while the gross profit margins of smartphones, IoT and life service products and other sectors are only 13%, 12% and 18%. The lower hardware gross profit margin is also in line with the positioning of cost-effective drainage.

Chart 30: Revenue proportion of each business segment in 2021Q3

Source: Company Financial Report, Zheshang International.

Chart 31: Gross profit ratio of each business segment in 2021Q3

Source: Company Financial Report, Zheshang International.

Internet service business is an important point in Xiaomi’s recent performance. With the continuous growth of the number of MIUI users at home and abroad, the revenue of Xiaomi Internet service in 2021Q3 reached 7.34 billion yuan, a substantial increase of 27% year-on-year and a continuous increase of 4% quarter-on-quarter. The revenue of the segment kept hitting record highs in the first three quarters of 2021. Among them, overseas revenue reached a new high, with a year-on-year growth of over 110% in 2021Q3, accounting for nearly 20% of the sector revenue. In addition, with the strong growth of Xiaomi’s advertising business against the trend, the structural changes in Internet service revenue have made its gross profit margin stand at a new level of more than 70% this year.

Chart 32: Quarterly Revenue of Xiaomi’s Internet Service

Source: Company Financial Report, Zheshang International.

From the perspective of the relationship between quantity and price of Internet services, the strong growth of Internet services is mainly attributed to the strong growth of the number of MIUI users. Corresponding to the strong growth of smartphone shipments since 2020Q3, the number of monthly accounts of MIUI has also rebounded in the same period. By 2021Q3, the number of monthly active users of MIUI reached 486 million (+32% YoY), a record high. And on November 22, 2021, MIUI’s global monthly activity exceeded 500 million, which became another important milestone for Xiaomi.

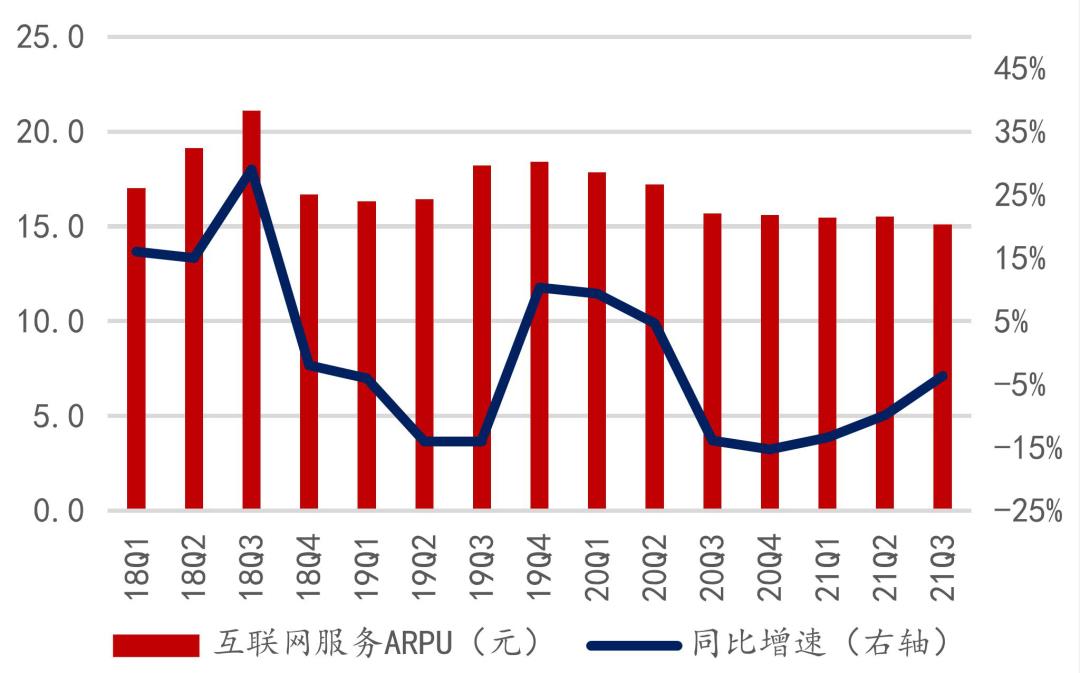

In contrast, the ARPU of Internet services in 2021Q3 decreased slightly by 4% year-on-year to 15.1 yuan. Mainly due to the rapid increase in the proportion of Xiaomi’s overseas business, the growth of overseas MIUI users is strong. However, the ARPU of overseas markets is still significantly smaller than that of domestic users, so the change of user structure leads to a decline in the overall ARPU. However, with the continuous deepening of Xiaomi in overseas markets in the future, we believe that the overall ARPU is expected to pick up in the future.

Chart 33: Number of monthly active accounts of MIUI

Source: Company Financial Report, Zheshang International.

Chart 34: ARPU of Internet Service Quarterly

Source: Company Financial Report, Zheshang International.

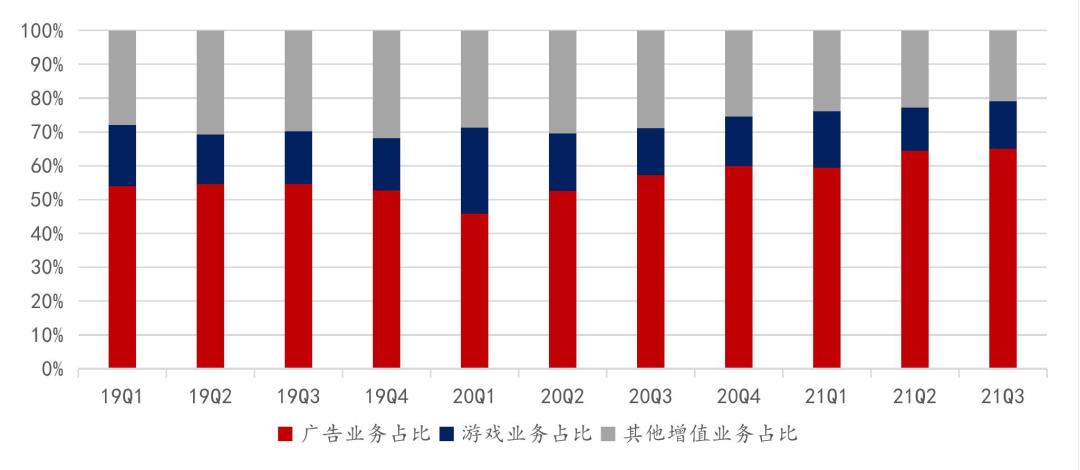

Dismantle Xiaomi’s Internet service business, which is mainly divided into three parts: advertising revenue, game revenue and other value-added service revenue (mainly composed of Internet finance and the income of the product e-commerce platform). Internet service revenue is mainly contributed by advertising business. In 2021Q3, advertising business realized revenue of 4.8 billion yuan, accounting for nearly 65%, while the revenue from games and other value-added services accounted for 14% and 21% respectively.

Chart 35: Revenue Ratio of Internet Services

Source: Company Financial Report, Zheshang International.

1) Advertising businessAdvertising business includes effect and brand advertising, search advertising and pre-installed advertising. As the business with the largest proportion of revenue in Internet services, relying on the huge hardware ecosystem, Xiaomi firmly grasps the traffic portal. Massive user data and complete ecology make advertising marketing more scene-oriented, intelligent and accurate, and its gross profit margin is as high as 80%. In the context of weak macro consumption and the stall of Internet advertising business of giants such as Ali Tencent, Xiaomi’s advertising business continued to maintain strong growth in 2021. In Q3 2021, Xiaomi’s advertising revenue was 4.8 billion yuan, a record high, with a strong year-on-year growth of 45%. The increasing proportion of advertising revenue has also raised the gross profit margin level of the entire Internet service sector.

2) Game businessGame business income mainly comes from mobile game distribution channels and svip system of Xiaomi Game Center. In 2021Q3, the revenue of Xiaomi’s game business increased by 25% year-on-year to 1 billion yuan, mainly due to the excellent performance of fine new games and the higher average game revenue per user brought by the growth of high-end mobile phones and game mobile phone users. According to the company’s disclosure, the average game revenue of high-end and gaming mobile phone users reached 4 times and 5 times of the average level respectively. With the steady progress of Xiaomi’s high-end mobile phone strategy, the game business revenue is expected to usher in further growth.

3) Other value-added servicesOther value-added services are mainly composed of Internet finance and quality e-commerce platforms. In 2021Q3, the revenue was 1.6 billion yuan, a slight decrease of 4.3% year-on-year. Mainly because the company continues to actively control the scale of financial technology business and strengthen its risk control capabilities. In terms of products, Xiaomi launched a new consumer brand "Daily Elements" around daily life scenes in 2020Q2, and launched the UP paid membership system in November to continuously improve users’ online consumption experience.

4. The strategy drives the success of the enterprise, and there is much to be done in the short term.

To sum up, we think Xiaomi is an excellent enterprise driven by strategy. From the macro-advanced layout of the high-quality potential track (betting on the smart phone track at the beginning of its establishment, laying out the loT industry one step ahead in 2013, and announcing its entry into new energy vehicles in 2021); Strategic planning of the company’s ecology (including the core strategy of "mobile phone ×AIoT", the category strategy of "1+4+X" and the "bamboo forest strategy" in investment) from the enterprise level; From microcosmic concrete to the "explosive product strategy" of products, the methodology is summarized from the aspects of products, design and marketing, which makes "explosive products" reproducible.

Although the performance of Xiaomi in 2021Q3 is under pressure due to various short-term factors such as supply chain and logistics, we are still strongly optimistic about the company’s long-term development in the future. We can see that although the temporary growth of hardware shipments is under pressure, the number of users in Xiaomi Ecology (such as the number of MIUI users, the number of students living in Xiaoai and the number of people living in Mijia APP) still maintains a fairly steady and rapid growth, which can show the stickiness of Xiaomi Ecology to users, and the unexpected growth of Internet services as the core of profit is a good proof of this view. In the future, with the further expansion of Internet service business overseas and the improvement of overseas ARPU level, the Internet service sector will usher in further growth, which is expected to further highlight Xiaomi’s Internet enterprise attributes and consolidate its valuation foundation.

However, it is undeniable that the engine of Xiaomi Ecology is still at the hardware level, and the product strength of mobile phone products will still be the focus of the company itself and market investors in the future. At the moment when products in the industry are homogeneous, we think that product strength can be summarized as follows: 1) product differentiation and quality, 2) excellent brand influence and 3) complete hardware ecology. These points can also be used for investors to focus on when observing the performance of Xiaomi market for a long time.

1) product differentiation and quality.In terms of differentiation, Xiaomi’s mobile phone technology is abundant. In the past, the first generation of Mix led the industry’s comprehensive screen boom. In 2021, Mix4 equipped with an off-screen camera earned the public’s attention. In terms of quality, we believe that it is important to "make no mistakes". In the development of domestic mobile phones, there are many precedents that failed because of defects in design, quality and performance. With the continuous growth of mobile phone shipments, Xiaomi is expected to further enhance its voice in the supply chain and is expected to do better in design and quality control.

2) Excellent brand influenceBrand is not only the label of product characteristics for users (such as Xiaomi’s "cost performance"), but also an important consideration for users to find value recognition and their own social labels. Xiaomi’s cost-effective label in the past has won most people’s love, but the dual-brand and high-end strategy in the future is an important point of view. We have seen that Xiaomi mobile phone has now stabilized the mid-to high-end market and further launched an offensive to the higher price segment.

3) Complete hardware ecologyA complete hardware ecosystem not only gives users a complete user experience through the interconnection between hardware, but also greatly enhances the user’s stickiness. Xiaomi has the largest AIoT hardware ecosystem in the world, which is undoubtedly an important strength of Xiaomi, and the subsequent polishing in experience will be the focus.

5. Profit expectation and valuation

5.1. Profit expectation

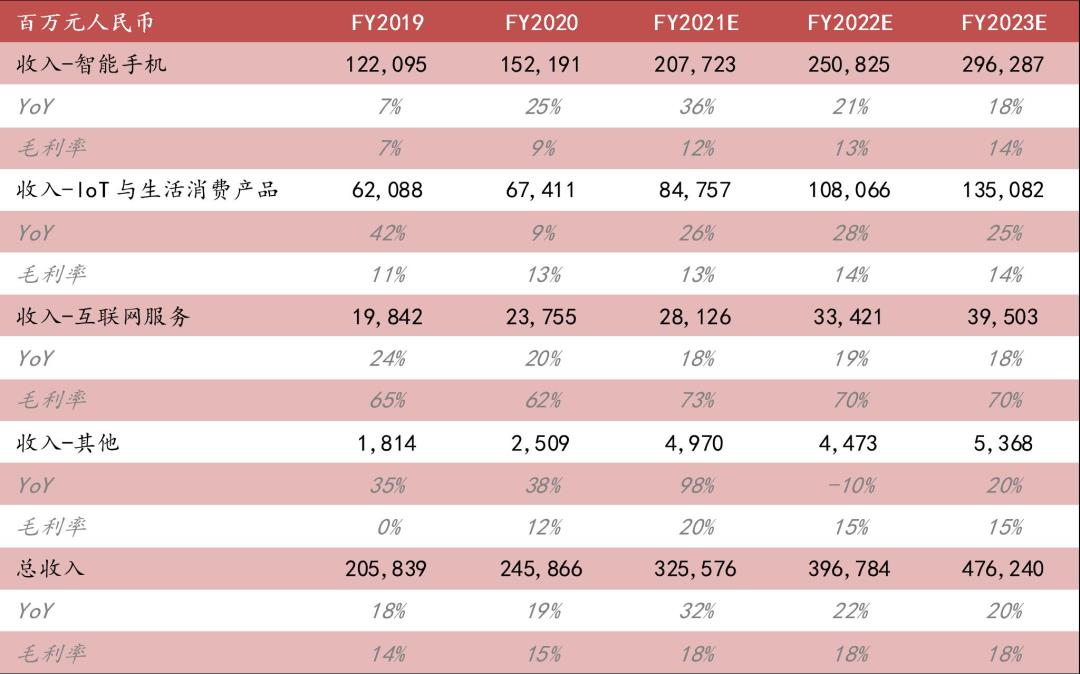

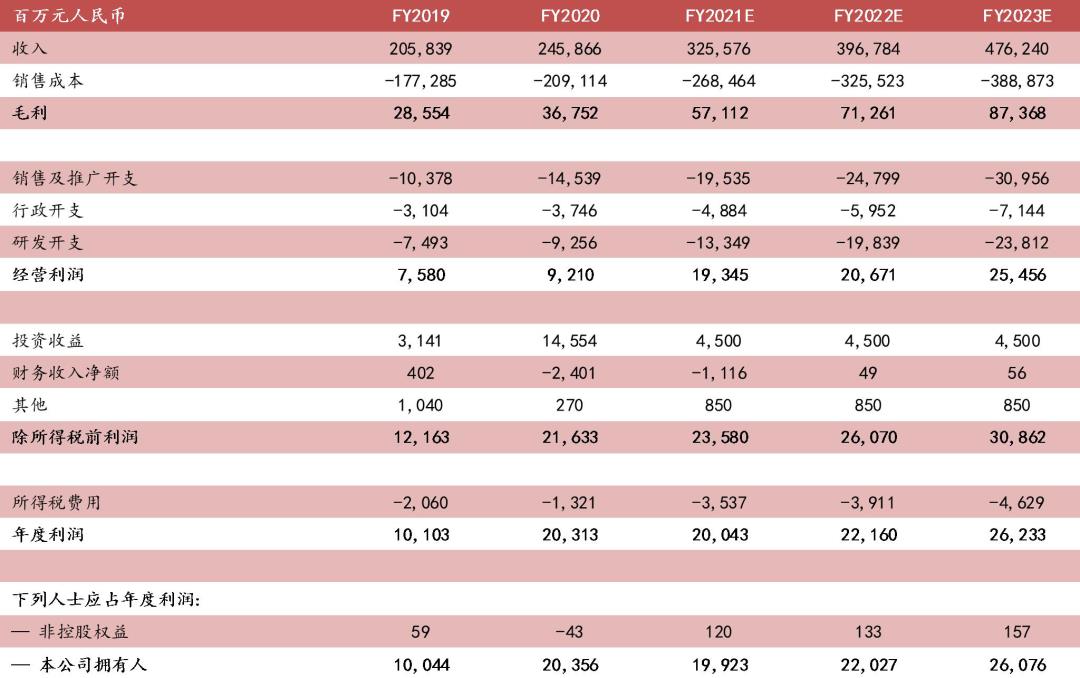

We predict that the revenue of Xiaomi Group in the next three years (2021E, 2022E and 2023E) will increase by 32%, 22% and 20% respectively, reaching RMB 325.6 billion, RMB 396.8 billion and RMB 476.2 billion. The company’s 2021Q3 results have been announced. Combined with the strong performance growth in the first half of this year, we expect the annual revenue growth in 2021 to be as high as 32% year-on-year. In the next two years, combined with many uncertain factors such as epidemic situation, supply chain and market competition, and taking into account Xiaomi’s future high-end promotion and potential in overseas markets, we believe that the overall revenue growth level of the company will decline in 2022 and 2023, but it can still maintain steady revenue growth.

Chart 36: Xiaomi’s revenue is expected to maintain rapid growth in the next three years.

Source: Company Financial Report, Zheshang International Forecast.

In terms of business segments, it is estimated that the overall revenue structure of the company in 2021E/2022E/2023E will not change much compared with that in 2020. Among them, the smart phone business will still be the main source of the company’s revenue (estimated to account for 64%/63%/62% respectively). With the rapid growth of loT and consumer products business, the revenue share of smart phone business is expected to decrease slightly.

1) Smart phone business: We predict that in 2021E/2022E/2023E, the smartphone business will achieve revenue of 2077/2508/2963 billion yuan respectively, with year-on-year growth rates of 36%/21%/18% respectively. In the future, the growth of smartphone shipments and the promotion of ASP will still be the main driving forces for revenue growth. Shipments will benefit from the high growth in the first half of 2021, and the growth rate will slow down in the next two years under uncertain factors such as upstream supply pressure, epidemic situation and market competition; We expect ASP to continue to grow steadily under Xiaomi’s high-end strategy, and it is expected to continue to raise the gross profit margin of the sector.

2)loT and consumer products: We estimate that the revenue of LOT and consumer products business in 2021e/2022e/2023e will reach 848/1081/135.1 billion yuan respectively, with a year-on-year growth rate of 26%/28%/25% respectively. It is expected that the hardware products of Xiaomi AIoT will continue to be under the pressure of upstream supply shortage and overseas logistics in the early 2022, but considering the huge overseas market and the good user stickiness of Xiaomi’s ecology, we expect the sector to maintain steady and rapid growth in the future.

3) Internet servicesInternet business is expected to remain the most important profit point of the company. We expect that the revenue of 2021E/2022E/2023E loT and consumer products business will reach 281/33.4/39.5 billion yuan respectively, with year-on-year growth rates of 18%/19%/18% respectively, and the gross profit margin will remain above 70%. Although the company’s advertising business has performed strongly in recent performance, considering the overall macroeconomic downturn in China, we expect the growth rate of the company’s advertising business to slow down in 2022. Combined with the recovery of the game business, the gross profit margin level may fall back, but the overall sector revenue will still maintain a steady growth of around 20%.

4) Others: We estimate that other income in 2021E/2022E/2023E will be 5/45/54 billion yuan, with year-on-year growth rates of 98%/-10%/20% respectively. Other income of the company increased by 194% in 2021Q3, mainly due to the sale of office buildings and materials, and it is expected that there will still be similar one-time income in 2021Q4. Therefore, considering the high base of the previous year, it is expected that the plate revenue will decline in 2022.

Chart 37: The revenue scale forecast of Xiaomi’s business segments in the next three years.

Source: Company Financial Report, Zheshang International Forecast.

Regarding the company’s 2021E/2022E/2023E expenses, we expect that the company’s sales expense ratio will continue to increase slightly in the future, in line with the company’s high-end and new product marketing; In terms of administrative expenses, we expect that the expense ratio will basically maintain the current level; In terms of R&D expenses, it is expected that the company will continue to increase R&D investment in the future, and the R&D expense ratio will rise steadily in the future.

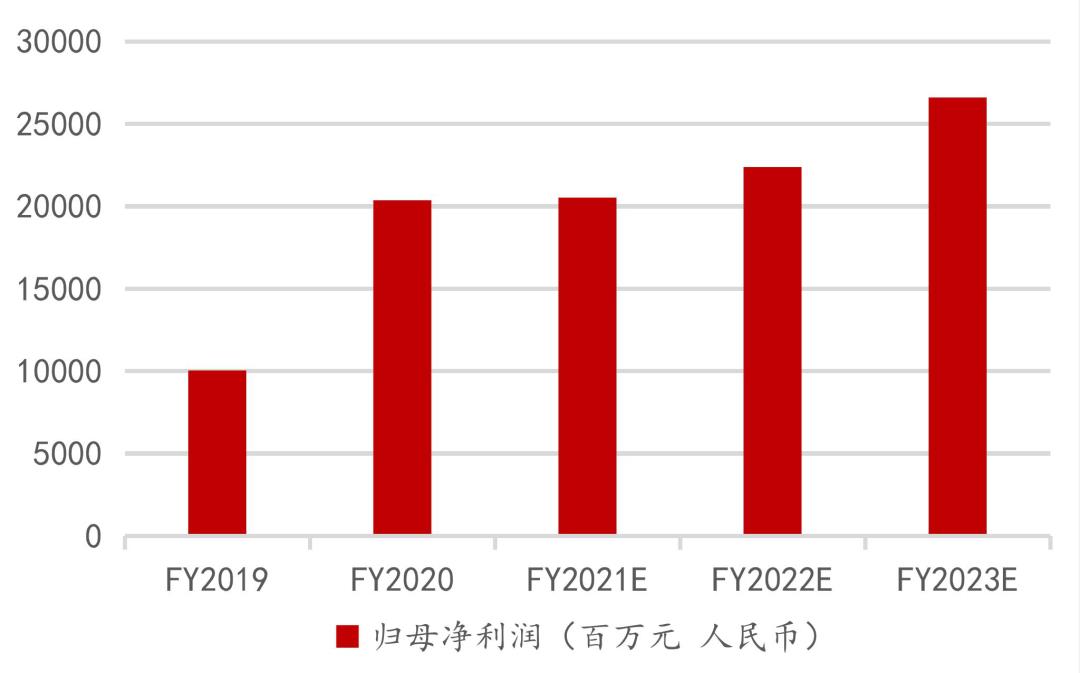

To sum up, we predict that the net profit of the company in 2021E/2022E/2023E will reach 206/225/268 million yuan respectively, and the EPS of the corresponding company in 2021E/2022E/2023E will reach 0.80/0.88/1.04 yuan.

Chart 38: Expense Rate Level of Xiaomi Group

Source: Company Financial Report, Zheshang International Forecast.

Chart 39: Net profit level of Xiaomi Group’s homecoming

Source: Company Financial Report, Zheshang International Forecast.

5.2. Valuation and investment suggestions

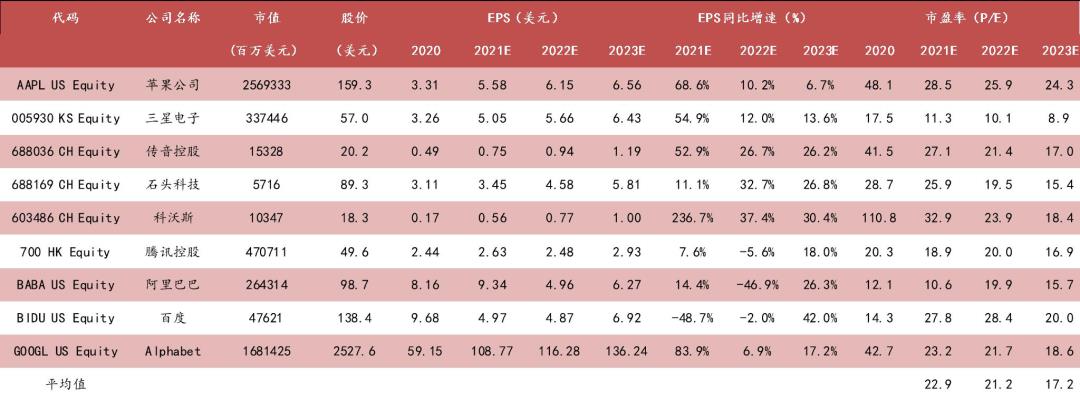

In terms of valuation, we selected nine comparable companies at home and abroad, among which Samsung, Apple and Chuanyin are well-known smart phone companies at home and abroad, Roborock and Cobos are intelligent hardware companies, and Tencent, Ali, Baidu and Google are typical Internet companies at home and abroad. We use P/E to value Xiaomi Group. According to the current average price-earnings ratio of 21.2 times that of comparable companies in 2022E, the target price of Xiaomi Group is HK$ 23.09. The target price is 78% higher than the current share price of HK$ 12.94, so we give Xiaomi Group a buy rating for the first time.

Chart 40: Comparison of Valuation of Related Comparable Companies

Note: Data as of March 8, 2022.

Source: Bloomberg, Zheshang International

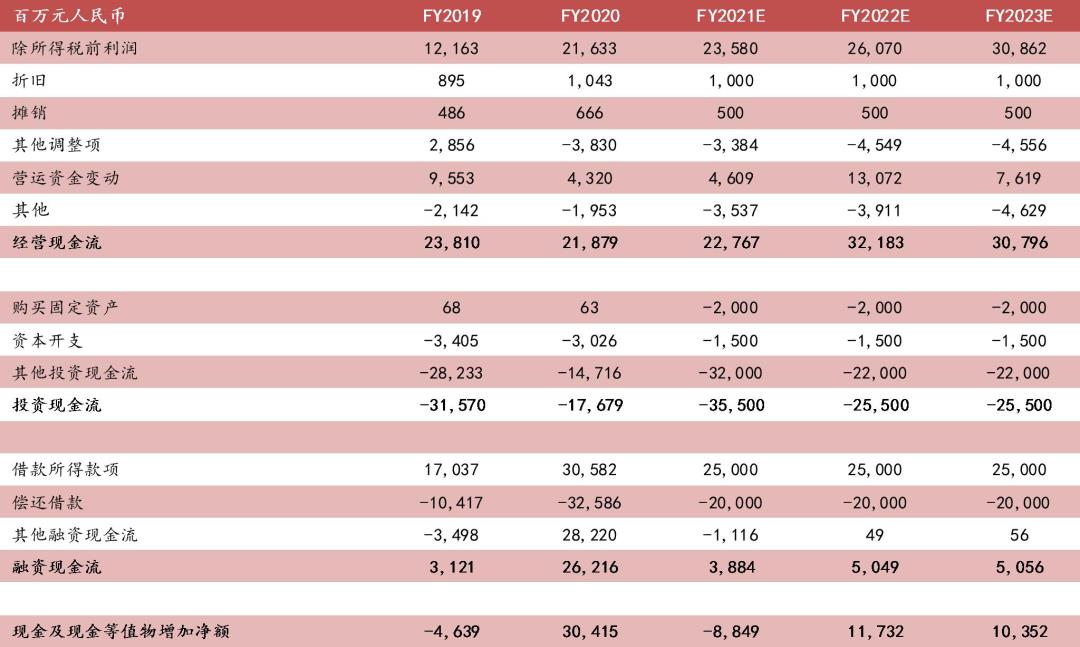

6. Financial statements

Chart 41: Income Statement

Source: Company Financial Report, Zheshang International Forecast.

Chart 42: Balance Sheet

Source: Company Financial Report, Zheshang International Forecast.

Chart 43: Cash Flow Statement

Source: Company Financial Report, Zheshang International Forecast.

This article comes from "Zheshang International Financial Holdings Co., Ltd." WeChat WeChat official account; Zhitong Finance Editor: Wenwen.