After 80s, the couple sold milk tea and started a listed company.

Successful listing does not mean that you can sit back and relax. How to make the brand develop for a long time after listing is the beginning of the test.

This article was originally published by Hongcan.com (ID: hongcan18), by Jian Yuhao; Editor: Jing Xue.

On April 23rd, Chabaidao (2555.HK) was officially listed on the main board of the Hong Kong Stock Exchange. However, the performance on the first day of listing was not ideal. On the morning of 23rd, Chabaidao opened at HK$ 15.74 per share, which was lower than the issue price of HK$ 17.5. At the close, Chabaidao recorded HK$ 12.80 per share, with a market value of only HK$ 18.914 billion. In intraday trading, the share price of Chabaidao once fell to HK$ 10.80/share.

Time goes back to a week ago. On April 15, the first day of the public offering of Chabaidao, it attracted attention because the public offering did not achieve full subscription. In addition, at that time, Chabaidao did not introduce cornerstone investors. Many investors have said that if a company with a valuation of tens of billions does not introduce cornerstone investors, it may mean that the valuation of this enterprise is too expensive, or institutional investors are not optimistic about the future profit prospects of the enterprise.

Although it was successfully listed, there are different opinions in the industry about "the second share of new tea". On the one hand, the successful listing is a milestone achievement for Chabaidao. However, in the eyes of some people in the industry, listing is not once and for all. In the increasingly competitive new tea circuit, there are still many uncertainties in the future development of Chabaidao.

After 01.80, the couple sold milk tea with a net worth of over 14 billion.

According to public reports, the founder of Chabaidao, Wang Xiaolong, and his wife, Liu Yuhong, were both born in the 1980s. Wang Xiaolong was a senior tea artist and his wife was a tea lover. Because they have accumulated rich tea knowledge and practical experience in their past work and life, they started the entrepreneurial experience of a tea shop.

In 2008, near Wenjiang No.2 Middle School in Chengdu, Sichuan, the first Chabaidao opened. This store, which is less than 20 square meters, is mainly for students with low spending power, and mainly sells powdered milk tea in the form of foreign belts.

At that time, compared with the hot demand of portable brewing milk tea, the existing tea was still in its infancy. The emergence of "Tea Hundred Ways" just fills this blank. With good products and affordable prices, it has successfully attracted the attention of students’ consumer groups. The blank of the market itself, coupled with the advantages of site selection, enabled Wang and his wife to successfully earn the first bucket of gold. A year later, they opened a second branch on the campus of Southwestern University of Finance and Economics (Liulin Campus).

In 2010, the trademark "Tea Hundred Roads" was officially registered. In the same year, two major desktop milk tea brands, Diandian and coco, successively entered the mainland for development. In the following years, a number of existing tea brands such as Xicha, Lujiao Lane and Naixue Tea began to rise, and new Chinese tea officially entered the stage of branding and chain development.

△ Image source: Chabaidao official little red book

In 2016, Chabaidao opened its franchise in Chengdu for the first time, upgraded its stores and started its brand operation. This year, the number of stores in Chabaidao exceeded 100.

Generally speaking, the development speed of Tea Hundred Roads in the early stage is not fast, and the sense of existence is not strong.

It was not until 2018 that this situation began to change. This year, Chabaidao began to aim at the whole country, which opened the expansion of the whole country, and the rapid growth of Chabaidao began to enter the investor’s field of vision.

In May and June, 2023, Chabaidao successively received two rounds of financing totaling 970 million yuan, which was led by Lanxin Asia, followed by many well-known investment institutions such as Zhengxin Valley, Grassroots Zhiben, CICC and Tomato Capital, with a post-investment valuation of 17.6 billion yuan.

According to the latest prospectus information of Chabaidao, Wang Hao and Liu Yuhong hold about 81.75% of the shares of Chabaidao. According to the valuation of 18 billion, their net worth has reached about 14.5 billion yuan. Wang Hao and Liu Yuhong also made the Hurun Report in 2023 and became the new "dark horse" in the rich list in 2023.

02.99% of the revenue depends on franchisees, and the pressure on the supply chain is not small.

Looking back on the development of Tea Hundred Roads, we can see that joining in business is an important driving force for the rapid development of Tea Hundred Roads.

According to the prospectus, as of December 31st, 2023, Chabaidao has opened 8,016 stores in China, covering 31 provinces and cities across the country, achieving comprehensive coverage of all provinces and county-level cities in China. Among them, the proportion of franchise stores accounted for 99%.

On the surface, it seems that Chabaidao is a direct consumer-oriented business, but in fact, Chabaidao is similar to Mixue Ice City, and it is also a supply chain company wearing a milk tea coat. Selling goods and equipment to franchisees is the core business of Chabaidao.

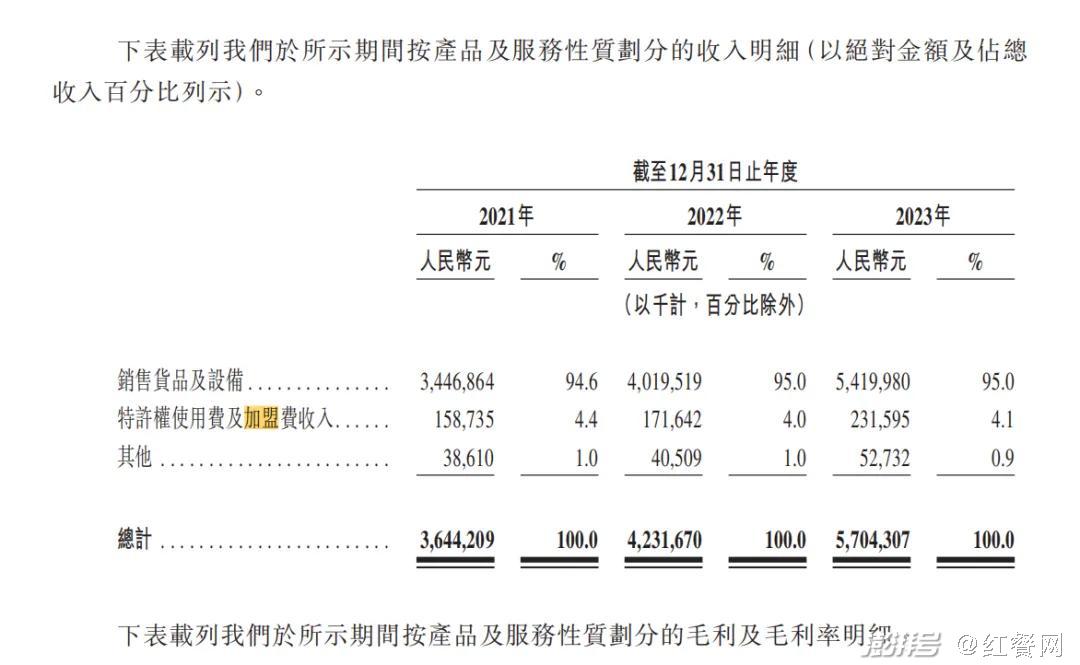

According to the prospectus, from 2021 to 2023, Chabaidao achieved revenues of 3.625 billion yuan, 4.197 billion yuan and 5.659 billion yuan through franchise stores, accounting for more than 99% of the total revenue; Among them, the income from selling goods and equipment to franchise stores accounts for about 95%, and the gross profit margin of this business is also maintained at about 32%.

△ Chart source: screenshot of Cha Baidao prospectus

The core of this business model, similar to S2B2C, is to reduce the operating costs of franchisees and improve the overall profitability through the advantages of supply chain and standardized processes.

However, unlike the self-built supply chain of Mixue Ice City, Chabaidao mainly relies on third-party suppliers and other business partners to provide raw materials and services for it.

According to the prospectus, in 2023, the procurement ratio of Chabaidao from its top five external suppliers (including dairy products, sugar, juice and other ingredients, packaging materials, etc.) was as high as 36.6%.

△ Chart source: screenshot of Cha Baidao prospectus

Perhaps it is also realized that there is no small risk in relying on third-party suppliers. Therefore, in the past several rounds of financing, Cha Baidao has repeatedly mentioned that the funds raised are mainly used to improve the overall operational capability and strengthen the supply chain capability.

At present, Chabaidao has established a supply chain center covering every key link of supply chain management from product development, procurement, logistics to after-sales service and quality control. At the same time, Sichuan Tea Co., Ltd. was established to provide brand logistics and distribution services.

In addition, Chabaidao and Bawang Chaji jointly established Sichuan Chabenyuan New Materials Technology Co., Ltd.. The company’s business scope includes research and development of new materials technology, manufacturing of bio-based materials, standardization services, sales and manufacturing of plastic products, sales of packaging materials and products, and import and export of goods.

It is worth noting that in addition to the continuous strengthening of the supply chain, Chabaidao has been actively exploring overseas markets and coffee tracks in the past two years.

In December 2023, Chabaidao opened the first store of coffee sub-brand "Coffee Ash" in Chengdu, and entered the coffee track for the first time.

In January 2024, Chabaidao officially went to sea, and the first overseas store was selected in Gangnam-gu, Seoul, South Korea. Later, stores were opened in Seoul Hongda and Seoul Yau Pavilion. As of April 20, 2024, the number of Chabaidao stores in Korea has reached three.

At present, it remains to be seen whether Chabaidao has explored the new amount in terms of going to sea and coffee business.

03. Queue for listing, and the 2024 New Tea Listing Competition started.

In fact, in addition to the hundreds of teas, there are many tea brands waiting in line for listing.

In January this year, Mi Xue Bing Cheng and Gu Ming submitted prospectuses to the Hong Kong Stock Exchange at the same time. Subsequently, on February 14th, Auntie Shanghai, a tea brand, submitted a prospectus to the Hong Kong Stock Exchange. The co-sponsors were CITIC Securities, haitong international and Dongzheng International.

△ Image source: Red Meal Network photo

On April 11th, the Hong Kong Economic Daily also reported that Bawang Tea Ji would go public in the United States as soon as the middle of this year, raising between 200 million and 300 million US dollars (a contract of 1.57 billion to 2.35 billion Hong Kong dollars).

Why do new tea brands start to get together and go public? In this regard, there are many views in the industry that whoever can take the lead in successful IPO will seize the opportunity among the tea drinks that are "rolled out of the sky".

In particular, tea brands need a lot of financial support to cope with the competition in the current tea track such as "joining war", "sinking war" and "price war".

In the past year, in addition to hundreds of teas, brands such as Guming and Auntie in Shanghai have also announced the sprint of 10,000 stores. In order to achieve this goal first, brands often need more funds to spread the store network. With the cooling of the new consumer investment market, the attention of the primary market to the new tea market has obviously declined. Therefore, listing has become a new way for new tea drinkers to obtain funds.

But the success of listing does not mean that the brand can sit back and relax. Take Chabaidao as an example, it and most new tea brands are in the mid-range price range of 10-20 yuan, including the above-mentioned Guming, Shanghai Auntie and Bawang Tea Ji, which are already waiting in line for listing.

There are many competitors, and the homogenization of new tea itself has become more and more serious. It is conceivable that these new tea brands in the middle price zone will still face a lot of competitive pressure in the future.