On January 28th, the Emergency Management Department of Henan Province released typical cases of production safety accidents in 2020 in the whole province, and sorted out and analyzed 10 production safety accidents, so as to promote all localities, departments and enterprises to learn the lessons from accidents, be prepared for danger in times of peace, sound the alarm bell and compact their safety responsibilities.

It is understood that in 2020, all levels, departments and relevant units in the province will co-ordinate safety precautions and COVID-19 epidemic prevention and control, achieving a "three declines" in the total number of accidents, deaths and major accidents, and no serious accidents occurred throughout the year.

01

Xinyang Pingqiao District Fuxin Mining Co., Ltd. "3 13" was a major water leakage accident.

At 3: 20 on March 13, 2020, a water seepage accident occurred in the second mining area of fluorite mine in Dashiling integrated mining area of Fuxin Mining Co., Ltd., Pingqiao District, Xinyang City, causing 7 deaths and a direct economic loss of 9.37 million yuan.

Direct cause: illegal blasting operation in Fuxin mining industry caused a large amount of water in goaf to break into roadway, causing water seepage.

The main lessons are as follows: First, Fuxin Mining Co., Ltd. carried out cross-border mining, failed to carry out construction and production as designed, failed to install many safety facilities as required, and built some roadways without design; The daily safety management is chaotic, and the regulations on hidden danger investigation, taking classes to go down the well, water prevention and control, safety training and holding certificates are not implemented, and underground projects are contracted out in violation of regulations. Second, the storage and use of blasting equipment of Pingqiao District Civil Explosive Equipment Franchise Co., Ltd. did not meet the requirements, and Henan Xiangtai Safety Evaluation Co., Ltd. issued an evaluation report of "meeting the safety production conditions" when the infrastructure project did not meet the design and the safety facilities were not perfect. Third, the district mine management office failed to check the acceptance of resumption of work and production, and neglected illegal mining and cross-border mining; The district emergency bureau urged the investigation and management of hidden dangers to be ineffective; The Minggang Branch of the Municipal Public Security Bureau did not find that civil explosives were not recycled, used or stored according to regulations; Xingji Town Government’s safety supervision power is weak, and there are blind spots in its work. The district committee and district government are ineffective in supervising and guiding the management of mineral resources exploitation and safety production.

02

The "4 18" major suffocation accident occurred in Shenghefu construction site in Yuanyang County, Xinxiang City.

At 17: 00 on April 18th, 2020, when the earthwork was dumped at the construction site of Shenghefu in Yuanyang County, an earthwork was buried and suffocated, resulting in the death of four children and a direct economic loss of 4.85 million yuan.

Direct cause: the construction unit dumped earthwork and buried four children without command, causing an accident.

The main lessons: First, the safety rules and regulations of the construction unit Qunying Company are not perfect, education and training are not in place, full-time security officers are not equipped as required, and safety protection facilities and warning signs are not set on the job site; The site management of Zhongfu Company, the construction unit, was chaotic, and it borrowed the qualification for construction, dismembered the contracted project in violation of regulations, and organized the construction without obtaining the construction permit and safety and quality supervision procedures. Second, the county urban management bureau did not find that the unlicensed construction behavior of enterprises was not stopped and investigated. The Housing and Construction Bureau only issued a rectification notice for the unlicensed construction behavior and failed to hand it over according to the regulations, resulting in the illegal behavior not being stopped and investigated in time. Third, the public opinion control and on-site control of relevant departments are weak, which has a great negative impact.

03

The "5 28" major poisoning and suffocation accident occurred in the rainwater connection project of Rongxiao Road in Xinxiang City.

At 19: 13 on May 28, 2020, a hydrogen sulfide poisoning suffocation accident occurred in the manhole of the rainwater connection project at the intersection of Dongming Avenue and Rongxiao East Road in Xinxiang, causing three deaths and direct economic losses of 3.62 million yuan.

Direct cause: the construction unit violated the rules and regulations, and the workers did not take effective protective measures, which led to poisoning and suffocation, and the consequences of blind rescue expanded.

Main lessons: First, the specification of "ventilation first, then detection, then operation" was not implemented, isolated respiratory protective equipment was not equipped as required, safety ropes were not used as required, and casualties were enlarged due to blind rescue. Second, the construction unit Xinjian Company has no construction qualification and no safety production license to undertake labor service operations in violation of regulations, and the on-site management is chaotic, education and training are not in place, and the downhole personnel are not qualified for operation; Xinxiang Municipal Company, the construction unit, subcontracted the engineering labor service operations to units that did not have the qualification for subcontracting, and the safety management system was not perfect, and education and training were not in place. Third, the Municipal Bureau of Housing and Urban-Rural Development "blacked out" the supervision of subordinate units’ projects, and did not conscientiously perform the duties of inspection and inspection of construction projects.

04

The "June 22nd" explosion accident of Min ‘an Blasting Service Co., Ltd. in Luanchuan County, Luoyang City.

At 14: 49 on June 22, 2020, after the blasting operation of Guoxiang marble mine in Luanchuan County, the remaining explosives were stored in an abandoned cave in Heigou Formation, Bailu Village, Luanchuan Township, Luanchuan County, and exploded, causing the mountain to collapse, resulting in two deaths and one missing, with a direct economic loss of 11.59 million yuan.

Direct cause: explosion caused by illegal storage of explosives and improper operation by operators.

The main lessons: First, Luanchuan Min ‘an Blasting Service Co., Ltd. illegally set up temporary explosive storage points in caves with unsafe conditions in the mining area, and arranged unqualified personnel to carry civil explosives. Lack of safety management system, illegal attachment of blasting operators, chaotic management of explosives, and unclear collection and flow of explosives; Luanchuan Guoxiang Marble Mine Co., Ltd. was lax in safety management, used personnel without blasting license to operate, and failed to return the remaining explosives after blasting as required. Second, the county public security bureau failed to crack down on the unlicensed production, operation, transportation, trading and use of explosives, neglected the supervision of the qualifications of blasting workers, and the examination and approval of explosives was unreasonable; The county science and technology bureau failed to perform its supervision and management duties according to the government division of labor; The county emergency bureau failed to perform its duties of supervision and inspection in time.

05

The "June 27" drainage reconstruction project of Huanglong industrial cluster in Xiangfu District, Kaifeng City was seriously poisoned and suffocated.

At 14: 25 on June 27th, 2020, a poisoning and suffocation accident occurred in the rainwater integrated pumping station of the drainage reconstruction project in Huanglong Industrial Cluster, Xiangfu District, Kaifeng City, resulting in three deaths and direct economic losses of 2.25 million yuan.

Direct cause: the construction unit violated the rules and regulations, did not take effective protective measures to cause accidents, and blindly rescued the consequences.

Main lessons: First, the operators failed to detect and ventilate, failed to equip with isolated respiratory protective equipment and use safety ropes as required, and failed to take protective measures for blind rescue. Second, Henan Lin Run Construction Engineering Co., Ltd. has no full-time safety officer, and the qualifications of the project manager and safety officer of the office located in different places (Kaifeng) are illegally linked, failing to perform on-site duties, and the safety management organization is nominal and the safety management is lacking. Third, the District Housing and Construction Bureau failed to supervise and guide enterprises as required, and the Huanglong Industrial Cluster in Xiangfu District lacked inspection and supervision over the safety work of its subordinate departments.

06

The "7 18" suffocation accident of Min Nong Noodle Products Co., Ltd. in Wuzhi County, Jiaozuo City.

At 18: 00 on July 18th, 2020, a production worker fell into a starch settling tank in Jiaozuo Bennong Noodle Products Co., Ltd., Zhangcaiyuan Village, Zhandian Town, Wuzhi County, killing six people.

Direct cause: an employee fell into a material tank for poisoning and suffocation due to illegal operation, and the consequences were enlarged due to blind rescue.

The main lessons: First, Jiaozuo Bennong Noodle Products Co., Ltd. did not produce illegally without permission, did not organize hidden dangers investigation, lacked safety management system and safety training, and did not carry out the instructions of relevant departments to stop production without authorization. Second, Zhangcaiyuan Village illegally rents non-construction land; The county market supervision bureau failed to implement the responsibilities of "three controls and three musts", failed to carry out "cracking down on illegal activities", failed to seriously verify the situation of unlicensed production enterprises found in inspections, and failed to report and report according to regulations; County Natural Resources Bureau failed to supervise the illegal use of land. Third, there are a large number of hidden dangers and violations of laws and regulations in "small, scattered and chaotic" enterprises, and the conditions for safe production are seriously insufficient. Most of them are labor-intensive enterprises, which are easy to cause mass deaths and injuries.

07

The "July 30" fire accident occurred in Ruyi mattress curtain wholesale store in Luyi County, Zhoukou City.

At 05: 30 on July 30, 2020, a fire accident occurred in Ruyi Mattress Curtain Wholesale Store in Gaoji Township, Luyi County. The fire area was about 176 square meters, causing five deaths and direct property losses of 209,000 yuan.

Direct cause: The electrical circuit fault ignited the color steel board house and the surrounding combustible materials to produce toxic gas, which led to the poisoning and suffocation of the illegal residents.

The main lessons: First, Ruyi Mattress Curtain Wholesale Store violated the rules of "three-in-one" operation, illegally arranged for family members to stay in the business premises, did not set up an escape route in the store, stored a large number of flammable materials such as polyurethane sponge to block the evacuation route, and the wiring was not standardized. Second, the village Committee, the police station and the township emergency office repeatedly found that the store’s stacked goods blocked the safety exit and illegally occupied people, issued a rectification notice to follow up and urge the rectification to be inadequate, and failed to hand it over to the fire rescue department for investigation; The township natural resources management center and the comprehensive law enforcement office did not investigate and deal with the illegal construction of color steel board houses. Third, the government of the township party committee failed to establish a fire station and a 24-hour full-time and part-time emergency rescue team as required, and was not equipped with fire rescue equipment, so the emergency response was unprofessional, untimely and unscientific. Fourth, major fire hazards such as illegal "all-in-one" places and color steel board houses exist in large numbers in rural market towns.

08

"8 6" liquefied gas leakage poisoning suffocation accident in Yinji steamed bun shop, Baiyang Town, Yiyang County, Luoyang City

At 7: 00 a.m. on August 6th, liquefied gas leaked from the facade of Yinji Steamed Mofang in baiyang village District, Baiyang Town, Yiyang County, killing three people and injuring one.

The direct cause: insufficient combustion of liquefied gas in the steam engine of Zhengmofang produced carbon monoxide and accumulated, resulting in one person being poisoned and suffocated, and two people being poisoned and suffocated one after another due to improper rescue.

The main lessons: First, the operator of Yinji Steaming Workshop illegally installed a gas steam engine in the closed room where people lived, and found that the rescue was not timely after people were poisoned. Second, the town government, market supervision, gas management, public security and other departments are not in place in safety publicity and education, and the investigation of hidden dangers is not comprehensive, and the investigation and punishment of unlicensed business behavior is weak, and the law enforcement supervision of individual operators is lacking.

09

The "9.23" major road traffic accident in Yuzhou section of provincial highway S235 Xuchang City.

At 7: 56 on September 23, 2020, a road traffic accident occurred in Bailong Village, Huashi Town, Yuzhou Section of S235 Provincial Highway, killing 4 people and injuring 14 others.

Direct causes: the minibus was overloaded and did not follow the traffic rules, and the braking distance of the large truck exceeded the specified requirements due to poor braking system. The two causes interacted to cause an accident.

The main lessons: First, Dongsheng Kindergarten in Huashi Town, Yuzhou City has no personnel of safety management system and no responsibility system for hidden dangers investigation, and long-term use of non-standard school buses to pick up students; Qinyang Hongqi Automobile Transportation Co., Ltd. and Qinyang Haoyu Logistics Co., Ltd. are affiliated to operate, but their legal representatives and actual controllers are not qualified for posts, and their training records are falsified. Second, the municipal education body, public security traffic control, highways, etc. are not serious about the daily supervision of rural schools to pick up and drop off students’ vehicles, failing to find and investigate the long-term use of non-compliant school buses to pick up students and serious overcrowding, and failing to find and correct the lack of safety warning signs and unclear signs at accident intersections. Third, the problem of private cars serving as school buses in rural schools exists in large numbers, and the problem of coordinated supervision by departments is prominent.

10

"11 20" major road traffic accident in Huaibin County, Xinyang City

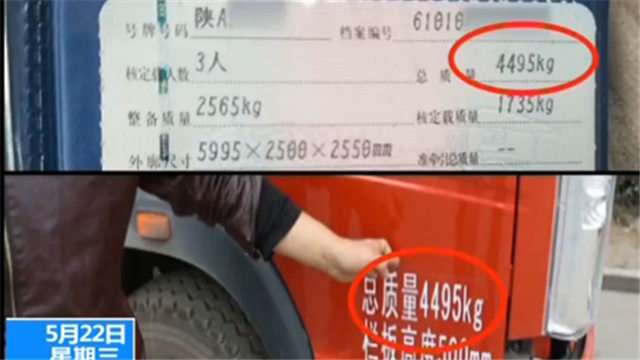

At 5 o’clock on November 20, 2020, Xie Songsong drove the heavy dump truck KQ3062 from Anhui to the 930KM+750M section along the National Highway 220, and rushed into the funeral crowd in Wutong Village, Zhangzhuang Township, killing 9 people and injuring 4 others.

Direct cause: The driver drives a truck with substandard braking system, speeding, and fails to observe the road surface and take improper measures, resulting in an accident.

The main lessons: First, the rules and regulations of Anhui Fuyang Songbai Logistics Co., Ltd. are not perfect, the driver safety education and vehicle maintenance records are falsified, and the important links of safety management are missing. Second, Fuyang yingdong district Highway Transportation Management Office, Fuyang Traffic Police Detachment No.3 Brigade and Huaibin County Traffic Police Brigade failed to perform their duties of safety supervision, and failed to investigate and deal with illegal acts of accident enterprises in time. Third, the Party Committee and Government of Zhangzhuang Township in Huaibin County failed to effectively carry out road traffic safety publicity, and failed to find and stop the behavior of burying coffins after cremation, burning a lot of paper, affecting traffic sight and occupying roads illegally. (Text/Yin Xinyu)