The commission owed is over 1 billion! Well-known real estate agents issued a document, naming Evergrande and Baoneng

Intermediaries are an important part of the real estate market. Due to the changes in the real estate market in recent years, incidents of intermediaries "asking for salaries" from developers have also occurred from time to time.

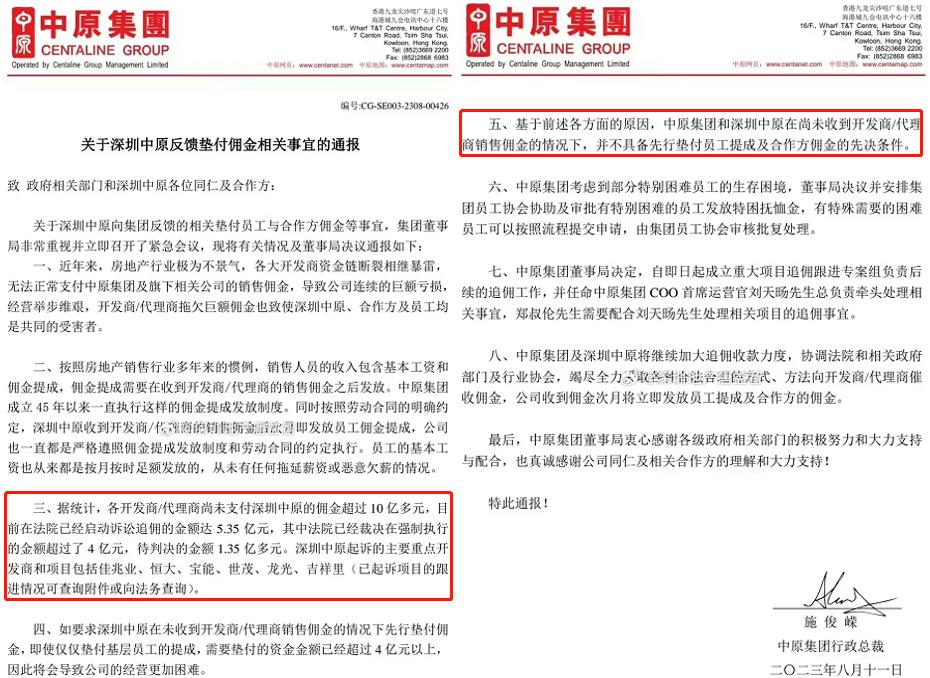

Recently, a document titled "Notice on Matters Related to Shenzhen Zhongyuan Feedback Commission Advance" circulated on the Internet, in which the information that "each developer/agent has not paid Shenzhen Zhongyuan’s commission exceeds 1 billion" attracted attention.

Well-known intermediaries post for commissions

The signature of the online document is "Shi Junrong, CEO of Zhongyuan Group", and the time is August 11, 2023.

According to the document, in recent years, the real estate industry has been sluggish, and developers’ capital chains have been broken and thunderous, unable to pay the sales commissions of Zhongyuan Group and its related companies normally, resulting in consecutive huge losses and difficult operations.

According to First Finance, insiders of Zhongyuan Group confirmed the authenticity of the above documents to First Finance.

"According to the practice of the real estate sales industry for many years, the income of sales personnel includes basic salary and commission, and the commission needs to be paid after receiving the sales commission from the developer/agent." The above-mentioned commission payment system has been implemented by Zhongyuan Group since its establishment 45 years ago, and the basic salary part of employees has always been paid in full on time every month, and there has never been any delay in salary or malicious arrears of salary.

Regarding the commissions not received by employees, the above-mentioned document states that if Shenzhen Zhongyuan is required to advance the commission without receiving the sales commission from the developer/agent, even if only the commission of the grassroots employees is advanced, the amount of funds that need to be advanced has exceeded 400 million yuan, which will make the company’s operation more difficult. For the reasons mentioned above, Zhongyuan Group and Shenzhen Zhongyuan do not have the prerequisites for advance payment of employee commissions and partner commissions without receiving the sales commission from the developer/agent. However, considering the living difficulties of some particularly difficult employees, the board of directors of Zhongyuan Group has decided to issue special hardship pensions to employees with special difficulties. Employees with special needs can submit applications according to the process, and the group employee association will review and approve them.

Involving Evergrande, Baoneng, etc

According to public information, Shenzhen Zhongyuan belongs to Zhongyuan Group, which was established in 1978 and is a large-scale comprehensive real estate service enterprise mainly engaged in real estate agency business, including property management, measurement and valuation, mortgage agency, asset management, data integration, and investment immigration.

The company’s official website shows that currently, Zhongyuan Group has more than 55,000 employees, 2,500 directly-operated floor shops, and has established branches in 60 cities around the world, with business reaching hundreds of cities. It has become a pioneer and leader in the real estate agency industry.

According to the Shanghai Securities News, Shenzhen Zhongyuan is the abbreviation of Zhongyuan Real Estate Agency (Shenzhen) Co., Ltd. It is a large professional real estate agency company in Shenzhen. Since 2001, the number and sales volume of real estate agents in the secondary market have accounted for the main share of the Shenzhen real estate market.

Shenzhen Zhongyuan provides research services for government land investment, full consultation planning and sales agency services for developers, and residential, office, shop, factory rental and sales brokerage services, as well as mortgage, appraisal and other services for customers in Shenzhen and Hong Kong.

The above-mentioned document states that in recent years, the real estate industry has been sluggish, and the capital chains of major developers have been broken one after another. They have been unable to pay the sales commissions of Zhongyuan Group and its related companies normally, resulting in consecutive huge losses and difficult operations.According to statistics, the developers/agents have not paid Shenzhen Zhongyuan commission more than 1 billionThe court has initiated a lawsuit to pursue the amount of 535 million yuan.Where the court has ruled that the amount of enforcement exceeded 400 millionThe amount to be judged 135 million multiple.

At present, the main developers and projects sued by Shenzhen Zhongyuan include Kaisa, Hengda, Baoneng, Shimao, Longguang, and Jixiangli. The above-mentioned real estate developers who have been sued recently are also subject to various news.

According to First Finance, Bai Wenxi, vice chairperson of China Enterprise Capital Alliance and chief economist of IPG China, told First Finance that from the perspective of creditor repayment order, the payment of intermediary sales commission should be classified as ordinary creditor’s rights, and the general supplier is in the same sequence, and the repayment order is after the senior debt rights with secured mortgage and other credit enhancement conditions, and before preference share.

Bai Wenxi said that in the process of chasing commissions, real estate intermediaries can seize as many of the other party’s effective assets and key current accounts as possible by means of pre-litigation preservation, and then fully negotiate with the other party to achieve maximum reconciliation as much as possible, so as to recover claims as soon as possible.

Shenzhen second-hand housingDeal size shrinks

A massive loss of employees

Data from the Shenzhen Real Estate Intermediaries Association shows that since 2020, the transaction volume of second-hand houses in Shenzhen has continued to decline. From 2020 to 2022, the number of second-hand houses signed online in Shenzhen (the number of sales and purchase contracts initiated on the Shenzhen real estate information platform, and the number of non-final transactions) was 120,295, 44,375, and 26,853, respectively. The number of second-hand houses recorded in the first half of this year was 20,852, only a fraction of the peak in 2020.

On July 12 this year, data disclosed by the Shenzhen Real Estate Intermediaries Association revealed that the average monthly turnover of second-hand real estate agents in Shenzhen in the first half of this year was 0.09 units per person, translating to an intermediary who could only sell 1.08 units a year.

In recent years, the scale of second-hand housing transactions in Shenzhen has shrunk, leading to a large loss of employees.

"At the peak of the market, there were more than 60,000 star-rated intermediaries (real-name registration practitioners) in Shenzhen, but now there are only more than 20,000 people left, and the industry is struggling to survive," said a relevant person from the Shenzhen Fangfang Association. In addition, the "newcomer rate" of Shenzhen’s intermediary industry in the first half of this year was about 21.6%. In 2020, when the market is hot, 49.3% of practitioners are newcomers.

The Shenzhen Real Estate Intermediaries Association pointed out that the first-quarter "phased Xiaoyangchun" market in Shenzhen’s second-hand housing market came to an abrupt end after entering April. Even from the second quarter, the monthly transaction volume continued to drop, and returned to the embarrassing situation of less than 3,000 units per month during the annual epidemic. In the final analysis, after the market bottomed out, market confidence has not been completely restored. After entering the second half of the year, with the accumulation of new housing sales pressure, the white-hot competition for second-hand housing and the weakening of market expectations for policies, in the absence of any support to stabilize expectations, it may be difficult for the market to reproduce a similar "phased Xiaoyangchun" market in the first quarter in the near future.

edit|Sun Zhicheng, Yi QijiangProofreading |Zhao Qing

The daily economic news is comprehensive from Securities Times, China Business News, Shanghai Securities News, etc